Microsoft’s impressive cloud revenue growth in Q4 contrasts sharply with CEO Satya Nadella’s vague and insufficient updates on its embattled security business.

Earnings Call

Despite Microsoft’s strong financial performance, CEO Satya Nadella’s inadequate focus on addressing security issues during the Q4 earnings call is a significant missed opportunity.

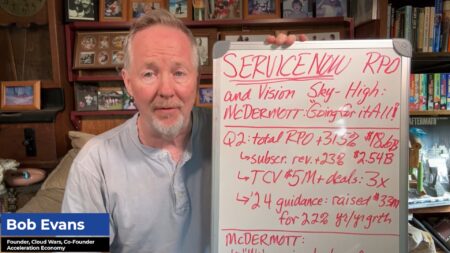

ServiceNow’s impressive Q2 results are a reflection of CEO Bill McDermott’s ambitious vision for industry-wide transformation through AI and digitization platforms.

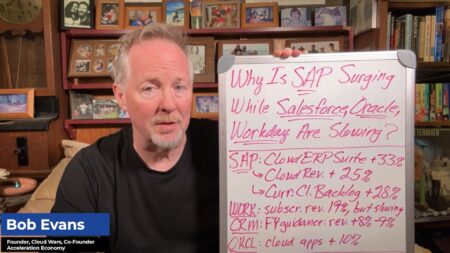

SAP reports strong Q2 growth driven by high demand for Business AI solutions and cloud migrations, significantly outperforming competitors

SAP’s strong Q2 performance stands out as it maintains robust growth while competitors face a slowdown in demand.

Google Cloud’s strategic fusion of AI innovation and robust cloud services has propelled it to market-leading growth.

Google Cloud’s latest quarterly results reveal its accelerating growth, impact of its partnership with Oracle, and major advancements in AI and cybersecurity.

SAP’s Cloud ERP Suite and Business AI capabilities have driven record Q2 growth, setting the company apart from rivals with impressive revenue increases and strong customer demand.

SAP has surpassed Salesforce in market cap, signaling greater public confidence in its growth potential amid the GenAI Revolution.

AWS is expected to achieve or exceed a 17.2% growth rate in Q2, driven by robust demand for GenAI and its other AI services including Bedrock and SageMaker.

Amazon Bedrock’s rapid adoption by tens of thousands of businesses for generative AI applications underscores AWS’s significant momentum.

AWS’s growth in the cloud computing market includes success with its AI service Bedrock, boasting tens of thousands of customers, and demonstrates its competitive edge against Microsoft with a strong security focus.

Oracle and Microsoft have expanded their multi-cloud partnership, offering Oracle’s Autonomous Database on Azure, allowing customers to accelerate the shutdown of outdated data centers and benefit from streamlined cloud migration.

In a market facing delayed purchases, SAP’s Cloud ERP Suite excelled with 31% growth in Q1, the highest among major enterprise-apps vendors.

Larry Ellison asserts Oracle will revolutionize cloud services by creating both the world’s largest AI data centers and ultra-compact, portable cloud data centers for individual customers, even on ships and submarines.

A discussion of Oracle’s impressive Q4 growth, its aggressive expansion plans, and Larry Ellison’s bold vision for the future of AI and data centers.

Oracle’s rapid cloud infrastructure growth, driven by high demand for AI services and a lucrative multi-cloud partnership with Google Cloud, is constrained by its ability to expand data center capacity,

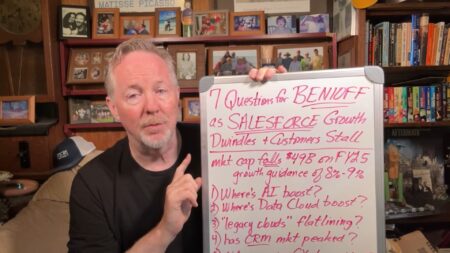

Salesforce’s Q1 revenue growth hit 11%, but a forecast of 8-9% fiscal-year growth caused a sharp market cap drop due to concerns over declining customer spending and future growth challenges.

Challenges and opportunities emerge as Salesforce shifts focus from growth to profitability. This transition marks a significant evolution and raises a number of strategic questions.

The AI revolution in enterprise applications, led by SAP and Salesforce, hinges on leveraging their extensive data repositories to enhance customer outcomes.