In an interview with Oracle VP Jenny Tsai-Smith, discussions revolve around the upcoming Oracle Cloud World event, highlighting topics such as AI integration, Exadata advancements, and a focus on developers’ needs.

Cloud Wars Archive

IT services provider Kyndryl and Microsoft are joining forces to develop new generative AI use cases for customers. Kyndryl also detailed better-than-expected financial results.

An update on the Cloud Confidence Index, with Amazon, Google, and SAP leading the index higher.

AWS fell to #3 on the Cloud Wars Top 10, as supply chain innovations and corporate strength are not enough to facilitate growth to combat cloud competitors.

The Cloud Confidence Index uses market caps of top 10 cloud companies as a proxy for business leaders’ confidence in their growth, reflecting customer demand and technology trends. The index is up slightly.

In a candid conversation, Christian Anschuetz highlights the value of curiosity, courage, and overcoming fear as essential factors for personal and professional growth.

With copilots for GitHub, Windows 365, Windows 11, and Dynamics 365, Microsoft is taking a multi-pronged approach to help customers drive productivity with generative AI.

Oracle’s explosive growth, dispersed data centers, industry partnerships, and dynamic CEO have made it the hottest cloud vendor today.

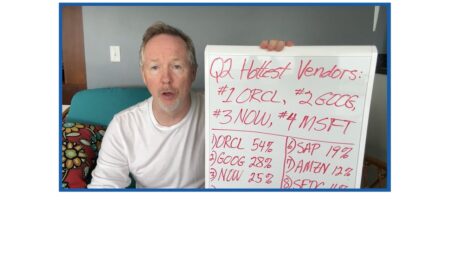

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

SAP CEO Christian Klein’s vision and execution powered a cloud transformation that lands it at #5 on the Cloud Wars Top 10.

The four fastest growing cloud vendors’ financial results indicate an upturn in customer spending and preparation for the generative AI revolution.

New data cites process intelligence, the output of process mining software, as a powerful tool to combat the macroeconomic and supply chain factors that are pressuring businesses.

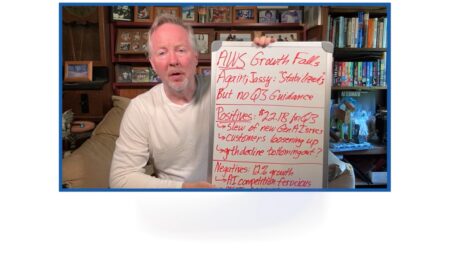

Despite AWS’s impressive scale and achievements, its rivals are gaining ground in other software-centered segments of the cloud. AWS may face challenges in the Cloud Wars going forward.

ServiceNow’s investments in generative AI, willingness to work with competitors’ products, and dynamic CEO are some of the reasons the company leaped from #10 to #6 in the Cloud Wars Top 10 rankings.

Amazon Web Services (AWS) experienced a decline in its growth rate for the seventh straight quarter amid fierce competition from Microsoft, Google Cloud, and Oracle.

Christopher Lochhead joins Bob Evans to discuss the types of workers who will thrive as AI explodes in popularity.

Private generative AI tools like Moody’s Copilot give employees easy access to current, relevant data in a digital sandbox that’s protected from public AI tools.

Workday strives to make ERP implementations simpler for customers and has strong endorsements to show for its customer-centric approach. The company ranks #7 on the Cloud Wars Top 10.

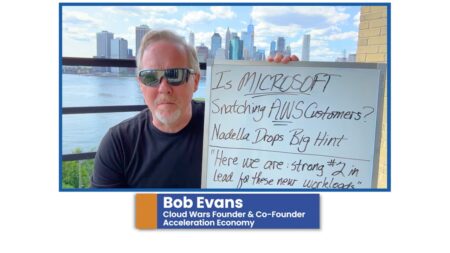

Microsoft’s strong fiscal Q4 performance can be attributed to its generative AI portfolio and the defection of some AWS customers to Azure.

Microsoft is experiencing significant growth in the cloud infrastructure market, particularly in AI workloads, potentially taking market share from AWS, which has seen a decline in its growth rate.