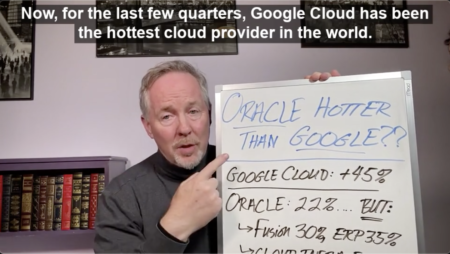

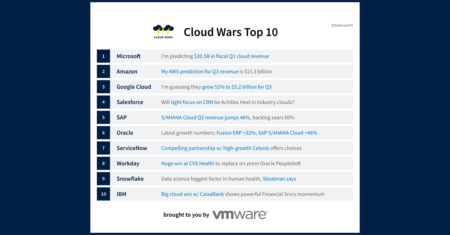

Two keys: thousands of Oracle ERP customers are moving to the cloud + Fusion ERP applications are merging with industry-specific capabilities

Cloud Revenue

On its Q2 earnings call, Oracle shared some massive numbers around the company’s Fusion apps and a renewed focus on Industry Cloud.

In light of Oracle’s Q2 performance, can a case be made that Oracle is an even hotter cloud provider than Google Cloud?

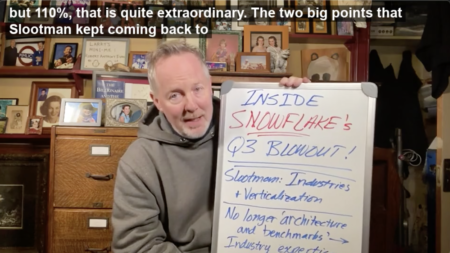

CEO Frank Slootman says that the driving factor behind Snowflake’s huge Q3 performance was the direct-to-consumer craze sweeping the world.

Some important lessons to take away from the recent blowout Q3 for Snowflake, in which the cloud data company’s revenue grew 110%

ServiceNow has gone pretty unchallenged in the “digital workflow” area—but Marc Benioff seems poised to change that with Salesforce + Slack.

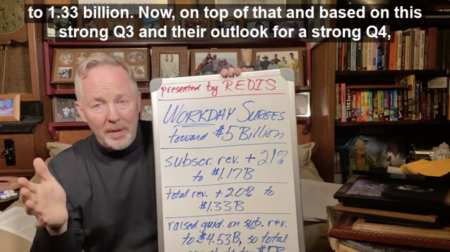

Based on its Q3 earnings, Workday appears on its way to blow past $5 billion in fiscal-year revenue under CEO Aneel Bhusri.

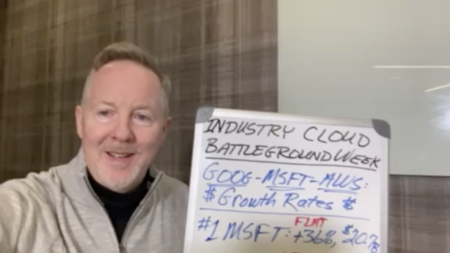

With each provider growing at at least 36% in Q3, Cloud Wars leaders Microsoft, Amazon and Google Cloud all had great cloud revenue results.

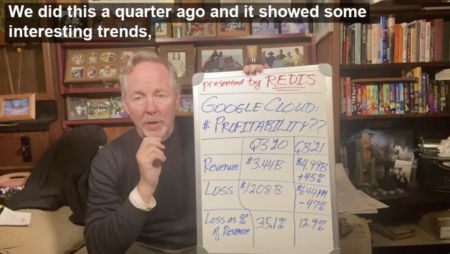

Google Cloud will likely hit profitability in 3 or 4 quarters from now, though there are a few complex trends within their revenue numbers.

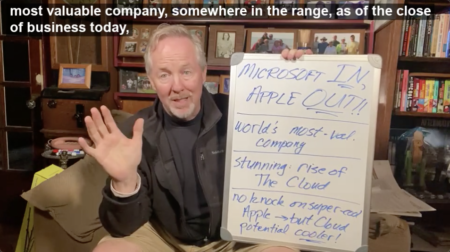

A look at how Microsoft overtook Apple as the world’s most valuable company with its current cloud growth and projections for the future.

On the Amazon earnings call last week, CFO Brian Olsavsky called out machine learning as the primary catalyst behind the AWS surge.

On the Oct. 26 earnings call for Alphabet, CEO Sundar Pichai said that a focus on industry-specific solutions is driving Google Cloud growth.

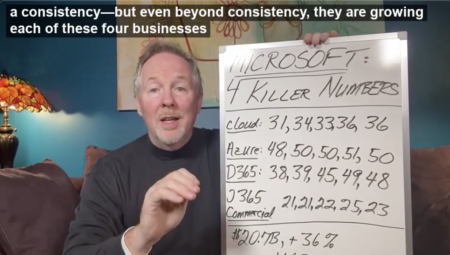

Competing with Microsoft cloud is not for the faint of heart. Amazon & Google should be paying very close attention to MSFT’s latest numbers.

One of the mind-boggling things about Microsoft Cloud businesses is that both its revenue AND growth rates rose in Q1 (as per usual).

Despite having revenue only 1/75th the size of IBM’s, data-cloud disruptor Snowflake has vaulted past IBM to #9 in the Cloud Wars Top 10.

SAP CEO Christian Klein took notable shots against archrivals Workday and Oracle in framing SAP’s growing cloud momentum in Q3.

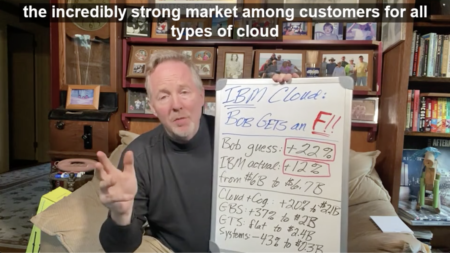

I really flubbed my prediction for IBM Q3 cloud revenue growth. Let’s look at what’s going on within IBM Cloud’s various business units.

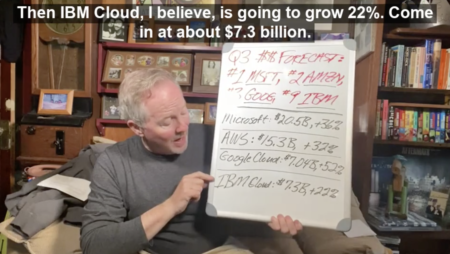

I’m predicting the following Q3 cloud revenue figures: Microsoft $20.5 billion, Amazon $15.3B, Google $5.2B, and IBM $7.3B.

Bob Evans predicts that we’ll see $50 billion in Q3 cloud revenue from just 4 vendors, Microsoft, Amazon AWS, Google Cloud & IBM.

My reaction to “Cloud’s trillion-dollar prize is up for grabs,” a McKinsey article from this year w/ some fascinating cloud research.