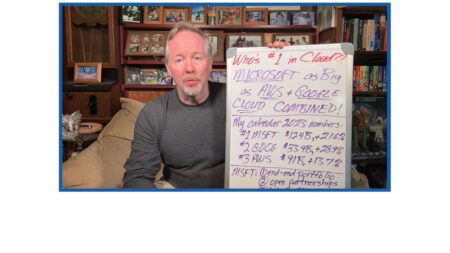

Microsoft’s cloud business is projected to generate as much revenue in 2023 as both AWS and Google Cloud combined, highlighting its dominance in addressing customer needs and pioneering in technology.

Search Results: partners (2391)

Microsoft’s cloud success vs. AWS and Google Cloud is driven by its end-to-end portfolio, strategic partnerships, AI initiatives, and impressive scale.

IBM Consulting, Microsoft target a range of generative AI use cases — including procurement and healthcare — with new services running on Azure OpenAI.

Intel’s visionary approach to AI spans devices and power levels, promoting an open ecosystem, offering opportunities for diverse product differentiation and innovation.

Involving non-technical managers in the buying process helps ensure that technology purchasing decisions have a direct impact on business growth and productivity.

AptEdge is using generative AI to turn the challenge of data and knowledge sprawl into an advantage when it comes to serving customers.

AI Index Report episode 6: Zscaler develops new tools for IT and security teams; Protect AI secures funding for AI security tools; and Inworld builds a platform to create AI non-player characters, or NPCs.

Its growth rate has declined over 18 months, but AWS remains a dominant cloud infrastructure force and customers benefit from its scale, focus on innovation, and generative AI strategy.

Organizations that can meet their customers’ need throughout all stages of the relationship are more likely to achieve important financial objectives — from lowering customer acquisition costs to increasing average value contract sizes to boosting profitability.

Its end-to-end view of the cloud combined with its early embrace of generative AI and massive scale, keep Microsoft in the top spot on the Cloud Wars Top 10.

Professional services firms can take advantage of artificial intelligence (AI) to gain useful insights and minimize transaction risks.

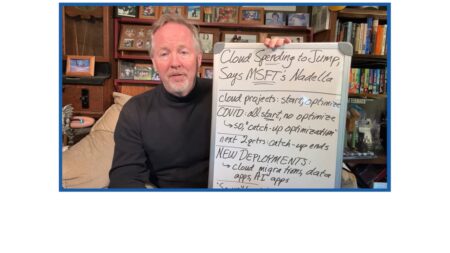

Cloud investments are poised for a rebound as Microsoft’s recent Q4 results, and commentary from company leaders, indicate.

Despite its smaller size, Google Cloud leapfrogged AWS in the Cloud Wars Top 10. Innovation, CEO vision, and generative AI tools are some of the reasons for its rise.

In an interview with Oracle VP Jenny Tsai-Smith, discussions revolve around the upcoming Oracle Cloud World event, highlighting topics such as AI integration, Exadata advancements, and a focus on developers’ needs.

IT services provider Kyndryl and Microsoft are joining forces to develop new generative AI use cases for customers. Kyndryl also detailed better-than-expected financial results.

AWS unveils a game-changing Cyber Insurance Program to address common challenges in the cyber insurance market, offering quick quotes, multiple insurer options, and use of AWS services for streamlined assessments.

Oracle’s explosive growth, dispersed data centers, industry partnerships, and dynamic CEO have made it the hottest cloud vendor today.

Building on its success with process mining, the airline Lufthansa built a custom application in house and plans an expansion of its use cases to include procurement functions.

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

SAP CEO Christian Klein’s vision and execution powered a cloud transformation that lands it at #5 on the Cloud Wars Top 10.