During Oracle CloudWorld, Clay Magouyrk presented a keynote that emphasized the positive dramatic changes generative AI has on the cloud.

Search Results: cloud infrastructure (1498)

A recent Microsoft and Oracle partnership dispels multi-cloud FUD, co-locating OCI in Azure to eliminate latency and enable cross-commitment usage.

A Partners Ecosystem Digital Summit highlighting how Chronosphere and Google Cloud deliver unique value to customers modernizing their infrastructure.

A look at the groundbreaking multi-cloud partnership between Oracle and Microsoft and its potential benefits for customers.

Despite a significant drop in market capitalization, Oracle’s cloud business continues to thrive, with strong customer confidence and robust Q1 cloud revenue growth.

Oracle remains fast-growing with an anticipated Q1 cloud revenue growth of at least 29%, even without the boost from its Cerner acquisition.

As new challenges arise, API providers need to understand the importance of cloud hosting choices and rising expectations for reliability.

IAC VP Paul Scribano emphasizes the importance of treating both employees and end users as customers, enhancing their experiences, and achieving remarkable productivity improvements through OCI migration.

Learn how Specialized Bicycle Components achieved tech-driven growth and innovation through its Oracle partnership.

Google Cloud emerges as the preferred choice for over 70% of generative AI startups due to its advanced AI capabilities, reliable infrastructure, and open-source commitment.

Discover how Oracle technology drives growth, innovation, and enhanced experiences at IAC, as discussed by VP Paul Scribano, ahead of the Oracle CloudWorld event.

There are some key factors that CFOs must evaluate when managing cloud spend as they invest in cloud migration.

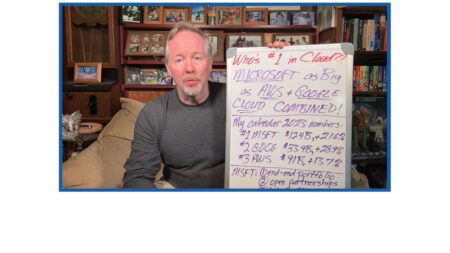

Microsoft’s cloud business is projected to generate as much revenue in 2023 as both AWS and Google Cloud combined, highlighting its dominance in addressing customer needs and pioneering in technology.

Microsoft’s cloud success vs. AWS and Google Cloud is driven by its end-to-end portfolio, strategic partnerships, AI initiatives, and impressive scale.

Its end-to-end view of the cloud combined with its early embrace of generative AI and massive scale, keep Microsoft in the top spot on the Cloud Wars Top 10.

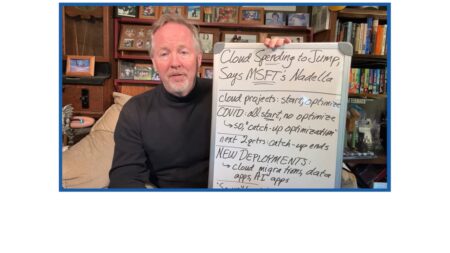

Cloud investments are poised for a rebound as Microsoft’s recent Q4 results, and commentary from company leaders, indicate.

AWS fell to #3 on the Cloud Wars Top 10, as supply chain innovations and corporate strength are not enough to facilitate growth to combat cloud competitors.

Oracle’s explosive growth, dispersed data centers, industry partnerships, and dynamic CEO have made it the hottest cloud vendor today.

Oracle maintains its position as the world’s hottest major cloud vendor with 54% growth in Q2, followed by Google Cloud at 28% and ServiceNow at 25%.

When migrating financial software to cloud infrastructure, make sure you’re getting the cost savings, operating efficiencies, and transparency you expect.