I wonder if Amazon cloud chief Andy Jassy knows—and takes any comfort from—the history of Bum Phillips?

In the NFL during the 1970’s, Bum was the brash and colorful head coach of some fabulous Houston Oilers teams that could well have won a Super Bowl ring or two had it not been their misfortune to be in the same division as the Pittsburgh Steelers, who during that decade won 4 Super Bowl championships in 6 years, frequently meeting and beating Houston in the playoffs.

Late in that decade, in the aftermath of yet another close but crushing playoff defeat at the hands of the Steelers, a reporter asked the highly quotable Bum what he’d like his tombstone to say.

Bum immediately replied, “He woulda lived a whole lot longer if’n he hadn’t been in the same dang division as the Pittsburgh Steelers.”

Amazon’s Jassy has created a remarkable record of achievement in his 13-year run atop Amazon Web Services, which has become by far the most-profitable business unit in the far-flung Amazon empire. For example:

- Without question, Jassy’s the category king for creating the public-cloud IaaS business and making it a massive, round-the-world phenomenon.

- He and his team have convinced more than 1,000,000 customers to use Amazon’s cloud services.

- He’s begun pushing the company beyond its IaaS roots and into PaaS, the middle layer of the cloud that connects infrastructure to applications.

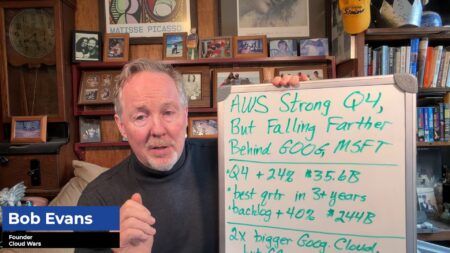

- Even as Amazon begins to approach $20 billion in annual enterprise-cloud revenue, Jassy’s still got his team delivering hypergrowth results: for the quarter ending Dec. 31, the AWS unit posted an outstanding revenue jump of 45% to $5.1 billion.

But—enter the ghost of Bum Phillips from stage left—for that same 3-month period, Microsoft’s commercial cloud business grew an even more impressive 56% to an even bigger $5.3 billion. (And it must be noted that IBM’s cloud business topped both Microsoft and Amazon during that same period, growing 30% to $5.5 billion.)

Extending the revenue comparison to the full calendar year, Microsoft’s enterprise-cloud business came in at $18.6 billion, Amazon’s at $17.5 billion, and IBM’s at $17.0 billion.

Undaunted—as indeed he needs to be—by Microsoft’s ability to top his own company’s outstanding performance, Jassy told CNBC’s Jon Fortt a few months ago that he has no doubt about Amazon’s ability to become the #1 player in the cloud.

Fortt writes, “I asked him if he thinks Amazon Web Services could become the biggest enterprise cloud company on the planet,” and then offers this reply from Jassy: “I do think it’s possible,” he says. “It has the chance, I think, to be a really large business. And I think that if we are able to accomplish the right type of customer experience and continue to build what customers ask us over time, as the market moves more and more toward cloud, I think we have the chance to be the largest enterprise company in the world.”

Now, perhaps I’m parsing the language too rigorously, but since we’re talking about two of the world’s largest, most valuable, and most influential companies, the language Jassy uses here is very important.

So when Fortt specifically asks Jassy about the possibility of AWS becoming the “biggest enterprise cloud company on the planet,” it’s very interesting to note that Jassy’s reply makes no mention of “cloud”—Jassy says, “…we have the chance to be the largest enterprise company in the world.”

A mere linguistic slip? Possibly.

Or was it an indication that Amazon expects AWS to eventually become larger than Microsoft?

Either way, the first hurdle for Amazon to overcome on its journey is to beat Microsoft in cloud revenue—and my premise is that if that achievement isn’t disclosed to the world on Thursday, April 26, when both Microsoft and Amazon post their calendar-Q1 financial results, then Microsoft will forever remain ahead of Amazon in the cloud unless Amazon makes a major cloud acquisition.

Here’s why I believe Microsoft’s cloud supremacy over Amazon is about to become permanent, and that belief boils down to Software, Strategy and Seasonality.

- Software: Yes, Amazon’s been building some great software prowess to complement its dominant Infrastructure business, but whereas it helped create the IaaS space and understands it as well or better than anyone, Amazon is way behind Microsoft in understanding and internalizing enterprise-grade software down to the DNA level. And as the IaaS business continues to be waged on ever-declining prices and brute-force computing, the PaaS and SaaS layers of the cloud are all about enterprise software, and play very directly into Microsoft’s 45-year history in that space. For more detail on this, please check out two in-depth pieces I’ve written on this ultimate difference-maker: Why Amazon Won’t Catch #1 Microsoft In The Cloud: Because It’s All About Software, and an earlier piece called Sorry, Amazon, But Microsoft Is the World’s #1 Cloud Vendor—Here’s Why.

- Strategy: At Microsoft, that begins with CEO Satya Nadella and his total overhaul of the company in his four years at the helm. Having run Microsoft’s enterprise-cloud business before becoming CEO, Nadella understands its potential better than anyone and has turned Azure and the cloud business from just another of Microsoft’s many fragmented LOBs focused on bitter in-fighting for resources and recognition to a unifying force through which Microsoft expresses its customer-centered innovation in:

- AI, which Nadella has expanded dramatically and now includes well over 5,000 computer scientists and software engineers;

- IoT, which Nadella frams as the Intelligent Edge fused with the Intelligent Cloud;

- Hybrid cloud: CFO Amy Hood says she really doesn’t care if customers buy cloud solutions or on-premises solutions because, after all, with Microsoft it’s all one big interconnected architecture;

- Microsoft 365, which allows CIOs and other leaders to see their IT investments as interconnected elements within a unified “digital estate”;

- Helping customers migrate their largest and most mission-critical SAP workloads to the Azure Cloud;

- Azure Stack, specifically designed to allow CIOs to seamlessly blend their on-premises systems with their cloud services; and

- Blockchain, where the combination of Microsoft’s deep knowledge of its corporate customers plus its end-to-end software expertise is a powerful strategic capability.

To understand Microsoft’s cloud strategy in greater detail, you might wish to look at Why Microsoft Is Ruling The Cloud, IBM Is Matching Amazon And Google Is $15 Billion Behind and also at How Microsoft Is Revolutionizing The Cloud: Satya Nadella’s Strategy To Blow Past $20 Billion.

- Seasonality: While not as weighty as the first two factors, this one nevertheless indicates that time is definitely not on Amazon’s side—primarily because Microsoft’s commercial-cloud business is simply growing faster than Amazon’s but also for a more-specific reason. Amazon’s fiscal year aligns with the calendar year, and since most companies put everything they have into delivering their best possible performance in closing the year, the excellent $5.1 billion it posted in Q4 pretty much represents the very best Amazon can deliver. But Microsoft’s fiscal year ends June 30, meaning that this week its results will be for its fiscal Q3, with extra-effort Q4 results coming in mid-July. So while Amazon’s chances for somehow closing the cloud gap with Microsoft this quarter are slim, those chances will get even smaller for the April 1—June 30 period as Microsoft looks to close the year with a boom.

Let me close with one more line from Bum Phillips because it surely applies today to our little comparison here of Microsoft and Amazon. Asked if his star running back, Earl Campbell, was in a class of his own, Bum said, “Well if’n he ain’t, it sure don’t take long t’call the roll.”

As fate would have it, one of Amazon’s classmates here in 2018 is Microsoft. And no matter how good Amazon’s grades are, I believe Microsoft will be the star pupil for a long time to come.

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!