In the high-octane world of cloud computing, rankings of service providers have become a staple of industry analysis. A top-to-bottom order of companies based on revenue, market share, or even perceived influence seems a natural way to analyze the complex cloud market.

But for channel partners, there are shortcomings in this model. I’d like to explain them and how the Acceleration Economy Cloud Wars Top 10 delivers stronger insights to inform partnering decisions.

The traditional ranking approach involves assessing companies based on a universal set of criteria. This overlooks the inherent diversity in customer needs including industry and geographical context. Channel partners operating in niche industries or emerging markets may find more value in a cloud provider that isn’t at the top of the rankings but offers customized solutions suited to their specific needs.

Enter Acceleration Economy and the Cloud Wars Top 10 — developed through a 360-degree analysis about what is best for customers, as well as their ecosystem partners and the industry. That’s refreshing!

Below, I lay out some of the current issues with the majority of industry rankings and explain how the Cloud Wars Top 10 can be better suited to the needs of channel partners.

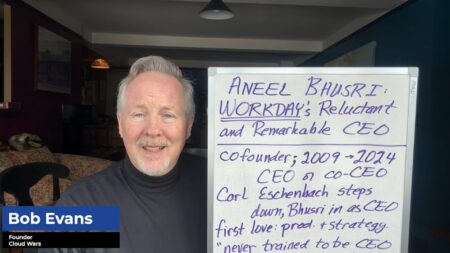

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.

Definition of market leaders: Many current rankings emphasize (to a fault) the leading or largest players, which can distort the perception of other innovative companies bringing unique and potentially more suitable offerings to the market or particular segments of the market. In reality, what defines a leader or winner varies widely once a partner lens is placed on the rankings.

Our Cloud Wars Top 10 analysis at Acceleration Economy looks more broadly at customer centricity and use cases, the cloud platforms, customer benefits from ecosystem strategies, and growth as well as the financial strengths of the top providers. Our approach ensures channel partners have the best of the best to pick from.

Overemphasis on financial indicators: A common ranking methodology relies heavily, at times too heavily, on financial performance, market share, and other financial metrics. While these are essential indicators of a company’s overall health, they don’t always do the best job of reflecting technology innovation, quality of service, customer satisfaction, or other important measures that factor into the Cloud Wars Top 10. Our approach will sometimes result in changes within the ranking.

Neglecting the Importance of partner programs: Other analysts’ rankings rarely consider the quality of a cloud provider’s partners ecosystem. These programs can significantly affect a channel partner’s ability to deliver value to its customers. Some cloud providers with lower overall rankings by the bigger analyst firms may offer superior partner programs.

Not reflecting the ever-evolving nature of the cloud market: With the cloud industry in a constant state of flux, a static ranking based on a snapshot in time can quickly become outdated, failing to reflect the current reality. Channel partners must keep their finger on the pulse of the market rather than relying solely on potentially outdated rankings. Our Cloud Wars Top 10 ranking ensures that evolution is considered as the rankings are maintained and updated.

The Cloud Wars Top 10 rankings provide a useful starting point for evaluation of cloud vendors by partners, who should also consider their end customers’ needs, vendor innovation capabilities, partner programs, and ongoing market developments.

Happy partnering!