With a slew of Q2 earnings releases about to hit, I’m expecting more hypergrowth in the cloud, especially on the part of the world’s fastest-growing cloud companies: SAP, Microsoft and Amazon.

In Q1, those three major cloud vendors posted blowout numbers as the business surges into the cloud. And there’s no reason to think SAP, Microsoft, and Amazon’s AWS unit won’t deliver more hypergrowth for Q2.

Fastest-Growing Cloud Companies: The Leaders

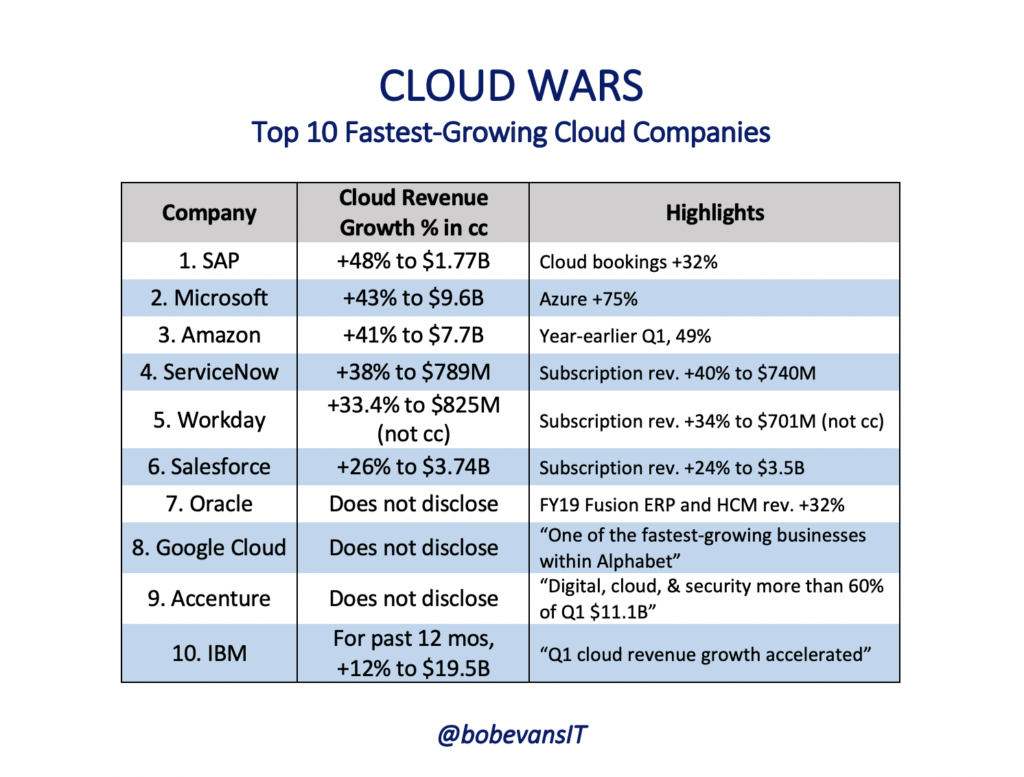

While SAP, as shown in the cloud-revenue-growth chart above, posted a gaudy rate of 48% in constant currency in Q1, it was equally impressive to see that the Cloud Wars’ two largest vendors—Microsoft and Amazon—were able to deliver hypergrowth results in spite of their huge revenue bases.

In fact, as I noted yesterday in Will Microsoft Crack $10 Billion in Q4 Cloud Revenue? Count on It!, Microsoft’s cloud business has become so large that if it were a separate business of its own—with annualized revenue of $40 billion—it would be the world’s second-largest enterprise-tech company, behind only IBM and its total revenue of about $80 billion.

And Amazon is trending to finish calendar 2019 with cloud revenue of about $35 billion. That would also put it near the top of that list.

Fastest-Growing Cloud Companies: The Rest of the Top 10

It’s worth highighting a few other notable achievements from the Cloud Wars Top 10, as mentioned in the table above:

- Salesforce’s 26% growth rate lands it in the middle of the pack, but bear in mind that its revenue base is much larger than any other vendor except Microsoft and Amazon. For calendar 2019, Salesforce has a great shot at reaching $16 billion in total revenue (its fiscal 2020 runs from Feb. 1, 2019 through Jan. 31, 2020). For some compelling insights on what Marc Benioff and Salesforce are up to, please check out Attention Workday, SAP and Oracle: Is Salesforce Jumping into HCM? and Salesforce’s New Strategy: All-In on ‘Customer 360,’ Powered by MuleSoft.

- ServiceNow continues to be an exceptional growth story and should end the year with total revenue of close to $3.5 billion. (To get a sense of where all that growth’s coming from, please see ServiceNow Set to Unveil ‘Killer App’ as Market Cap Surpasses $50 Billion and ServiceNow’s Breakthrough Strategy: Create ‘Systems of Action’.)

- Workday’s expanding product line is establishing it as much more than a leading supplier of HCM applications. It, too, should generate total revenue for calendar 2019 of very close to $3.5 billion. (For more on that, please check out Workday’s Path to a $1-Billion Quarter: 10 Key Insights and Inside Workday: Digital-Transformation Boom Triggers New Opportunities.)

- Oracle’s beginning to see some intriguing revenue traction from its revolutionary Autonomous Database, as outlined in Oracle’s Blowout Q4: Autonomous Database Looks Like a Huge Success and How Oracle Is Becoming a Cloud Powerhouse: Larry Ellison’s All-In Bet on Autonomous Database.

Disclosure: at the time of this writing, SAP, Oracle, Google Cloud and IBM were clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!