I’m confident SAP will post Q3 cloud-revenue growth of at least 20% next week not because 20% is a nice round number but because if SAP wants to stay on track with its 3-year strategic plan and maintain credibility in a wickedly competitive market, it must do better than the 19% growth rate it posted for Q2.

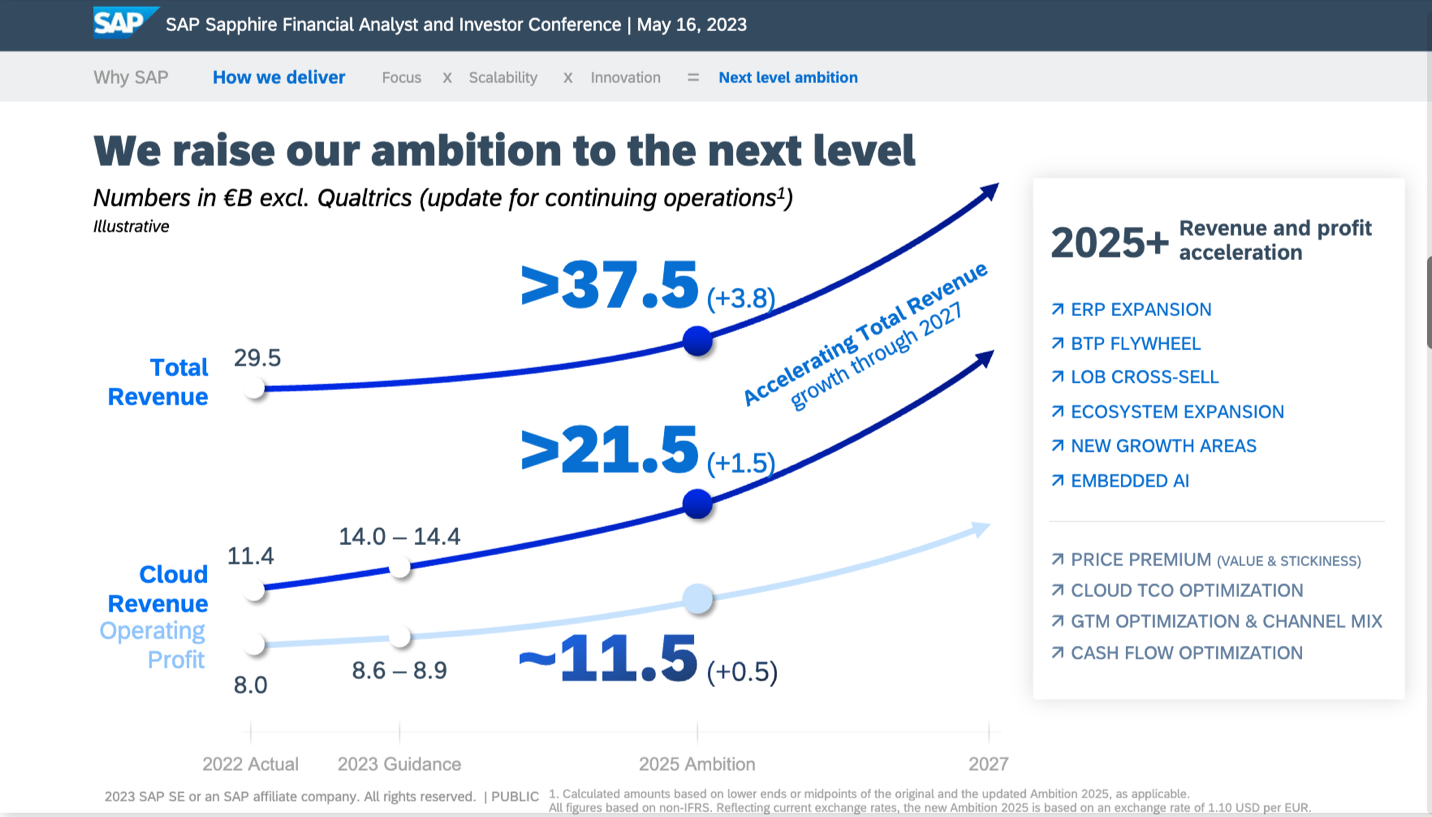

Between now and the end of 2025, SAP has projected that its cloud business will grow at about 23% compounded annually, with 2025 cloud revenue expected to be about $23.7 billion as shown in the chart below:

While the cloud growth rate of 19% looks significantly better when viewed through the lens of constant currency, which bumps it up to 22%, those numbers are down significantly from last year when SAP’s cloud business was growing close to or even above 30%.

But here’s why I’m bullish on SAP prospects in the cloud starting with the Q3 results that will come out on Oct. 18:

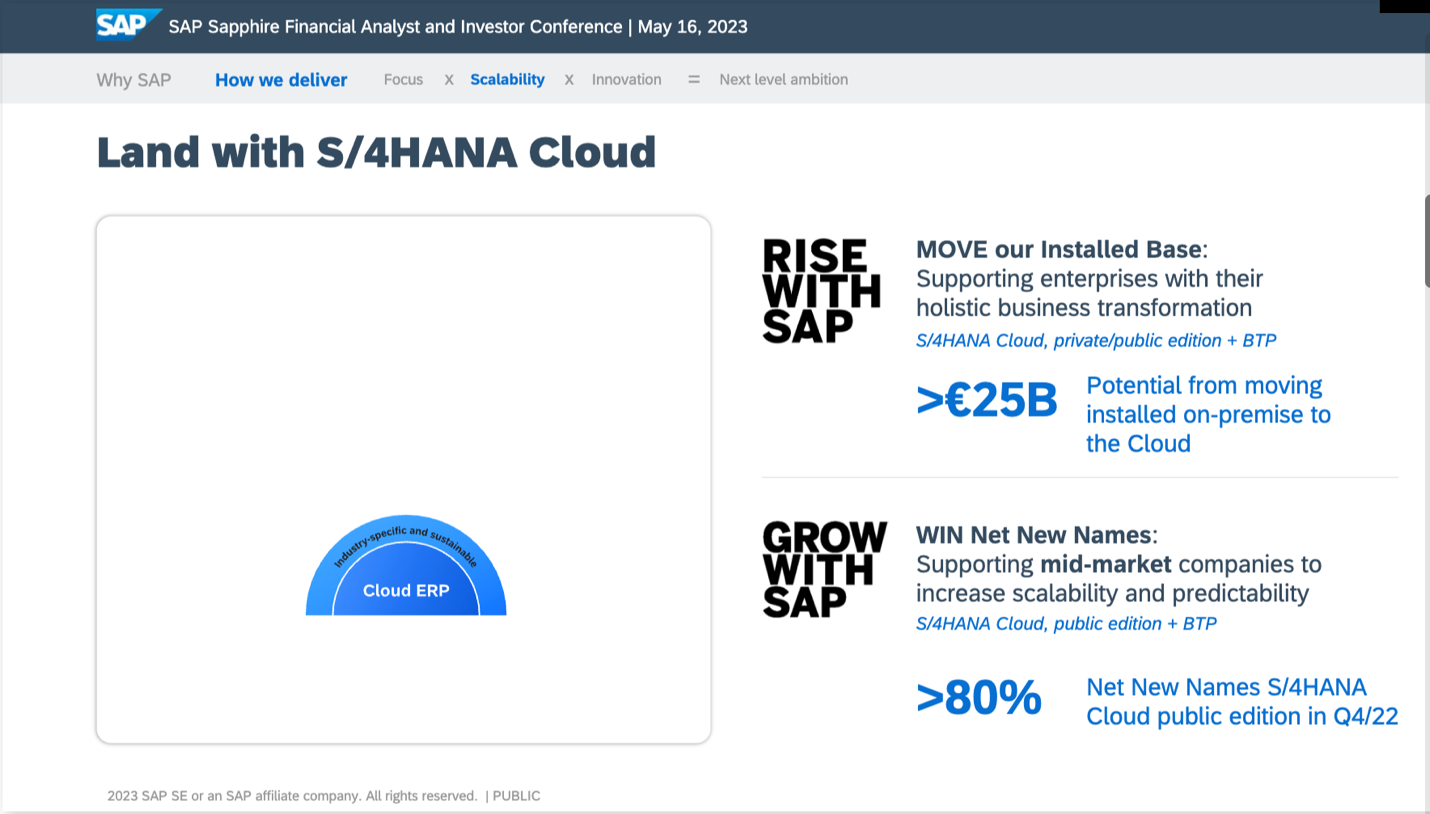

- SAP has about 25,000 on-prem customers who are only beginning their transition to the cloud.

- In the SAP slide below, the company says those 25,000 on-prem customers represent a potential incremental of $27.5 billion, or about $1.1 million per customer.

- And I’ll bet that at least 20,000 of those 25,000 businesses are more than aware that the only chance they have for surviving in the relentless digital economy is to move to the cloud — and to do so much sooner rather than later.

To convince those customers to make that move and begin creating their digital futures, SAP has an outstanding leader in executive board member Scott Russell, global head of customer success. In years past, he would have been known as “head of global field operations” — but in today’s customer-centric world built on the cloud, that internally focused traditional title has given way to the new externally oriented descriptor.

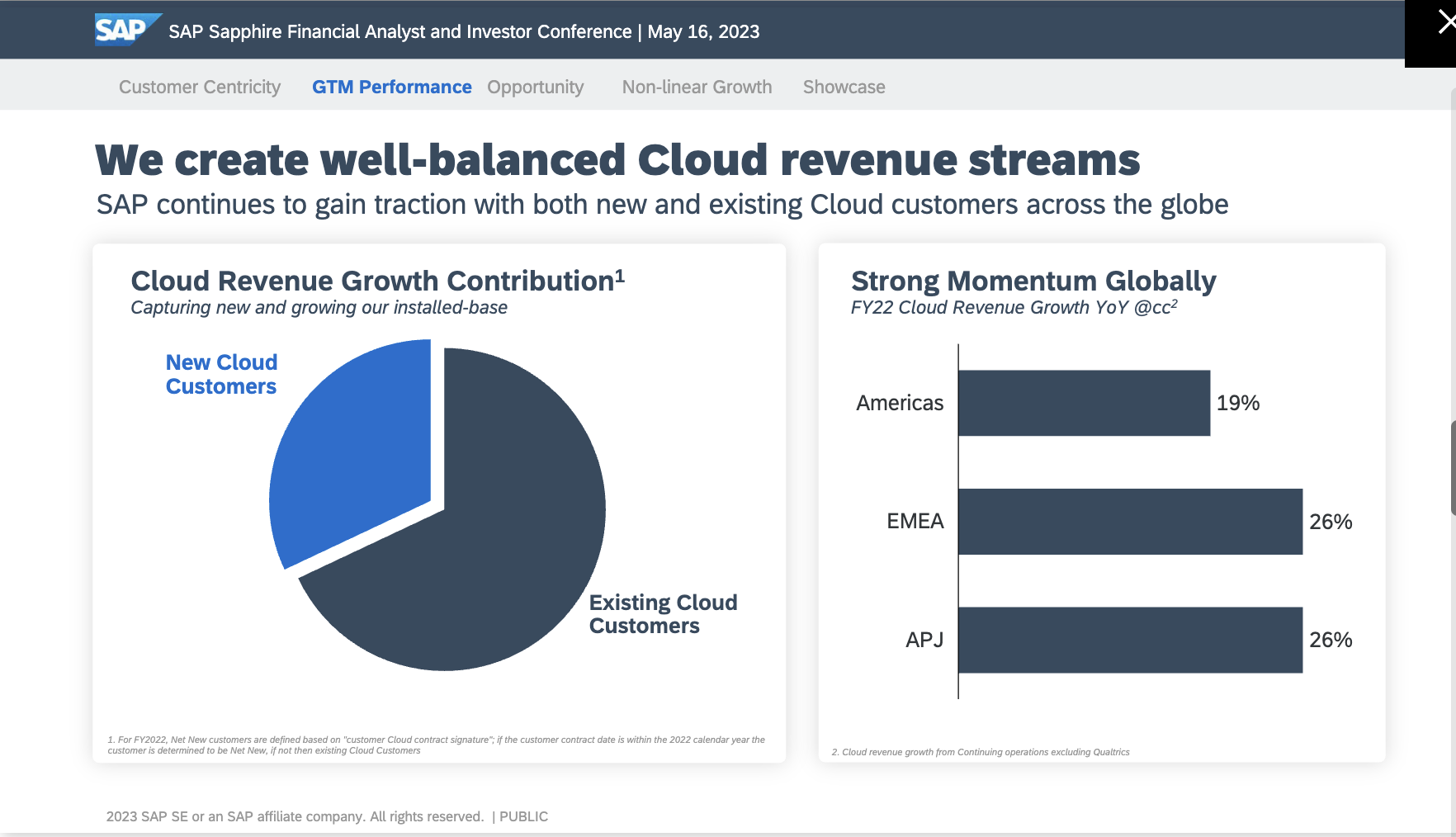

And here’s a slide shared by Russell at the company’s Financial Analyst Meeting a few months ago that reflects the other and equally vital segment of SAP’s growth strategy: landing net new customers while also converting on-prem customers.

While SAP did not offer specific revenue figures or percentages for the pie chart on the left, that looks to be about a 30-70 split, with 30% of the cloud-revenue growth contribution coming from new cloud customers. That’s a very healthy new business for SAP, which for the first 46 of its 51 years was focused almost exclusively on the large global corporations that made it the world leader in enterprise apps.

Final Thoughts and My Q3 Prediction

While SAP faces intense competition from Oracle, Salesforce, and Workday, I believe Q3 will mark a significant turning point in SAP’s cloud-centric future marked by the combination of (a) a big chunk of those 25,000 traditional customers beginning to move aggressively into the cloud and (b) SAP continuing to win the hearts, minds, and wallets of companies it has not done business with before.

In that context, my prediction for SAP’s Q3 cloud performance is that revenue will be up 23% to $4.45 billion.