Intensifying its efforts to convert its 25,000 on-premises customers to the cloud, SAP has added new pricing and product layers to its highly successful RISE go-to-market offering as it hopes to convince those 25,000 to choose RISE as the guiding force in their business and technology transformations.

If most of those 25,000 on-prem customers do choose to stick with SAP as their primary supplier of cloud ERP and related applications and services, SAP will be able to capitalize on what it has estimated to be a $27.5-billion opportunity.

SAP has long believed that its technology is the best match for customers, but in the past three years it has complemented that product component with its customer-centric RISE program, which is designed to:

- simplify the mechanics of undertaking this highly strategic technology shift that will underpin an even larger-scale and more-significant business transformation;

- accelerate the customer’s migration by sharing massive amounts of data and best-practices SAP has accumulated with customers in every industry and every region of the world; and

- connect those customers with complementary SAP products and services such as the Business Technology Platform, industry solutions, and Business Network.

Building on that foundation that has led SAP CEO Christian Klein to call RISE “the heart of our strategy” and “one of the most successful offerings ever” in SAP’s storied 50-year history, SAP has created three tiered versions of RISE to give customers a range of choices to evaluate. Before I get to those details, though, it’s vital to acknowledge the strategic significance of these new offerings in the context of their ability to convince those 25,000 on-prem customers to stick with SAP as they move to the cloud.

Those customers have no doubt been enticed aggressively by SAP’s enterprise-apps competitors— notably Oracle, Workday, Salesforce, and Microsoft — to move away from SAP for everything from ERP to HCM and CX.

And, as SAP shared a few months ago in a presentation to financial analysts, those 25,000 customers represent potential incremental cloud revenue of about $27.5 billion. Here’s the SAP slide that lays out what’s at play, as spelled out in the top-right corner:

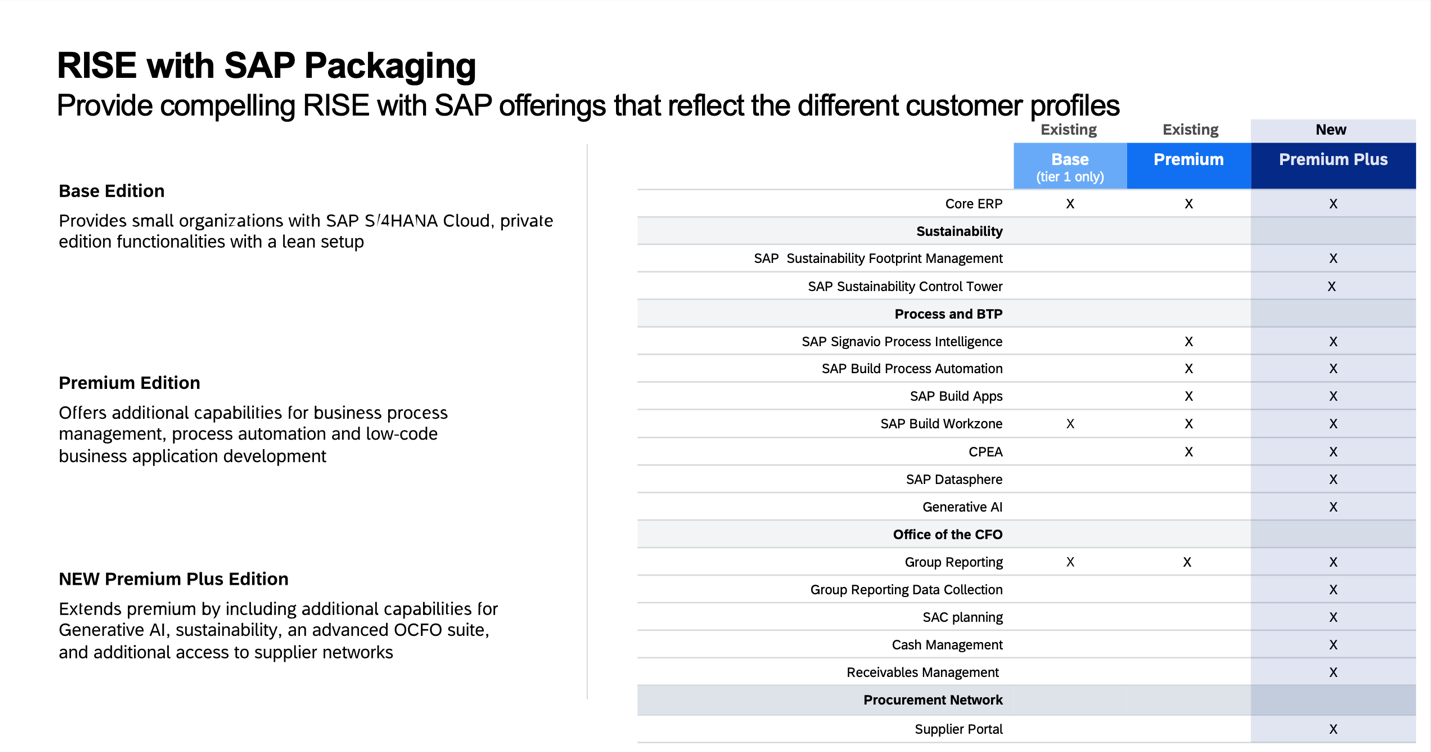

The new three-tiered approach with RISE is highlighted by what SAP is calling its “Premium Plus” package that combines “AI technology with sustainability and advanced finance solutions to help business innovate faster, make more-informed decisions, and unlock the value of enterprise data,” wrote Eric van Rossum, chief marketing and solutions officer for Cloud ERP, in a blog post.

Under the new program, “customers can choose which package best drives business results for them, including a new premium plus package” that can “maximize the impact of AI across business processes,” van Rossum wrote.

The chart below breaks out what’s included in each of the new RISE tiers, and there’s no question that SAP has bundled its highest-potential new offerings in the Premium Plus version.

But just as beauty is defined within the eye of the beholder, high potential is defined by the enterprise-app customer — and while some might pay just about any price for the latest in generative artificial intelligence (GenAI) capabilities, others will be enticed by a relatively low price.

Here’s the comparative breakout across Base Edition, Premium Edition, and Premium Plus Edition:

Final Thought

As I discussed earlier this week in “SAP Q3 Preview: Why Cloud Growth Must Return to 20% or More,” SAP CEO Klein has led a remarkable turnaround over the past three-and-a-half years, particularly since he took office as sole CEO just as the COVID pandemic was beginning to wreck the global economy.

Klein has been totally unwavering in his commitment to transform SAP into not just a cloud company but a world-class cloud innovator. The RISE program has had his fingerprints on it from its onset in early 2021, and this new set of customer options extends SAP’s innovative go-to-market approaches that are built around what individual customers want and need to be successful, rather than being centered on the stuff the cloud vendor is eager to sell.

And with a potential cloud windfall of $27.5 billion out there, this is the perfect time for SAP to double down on its unique RISE program — and I think the new Premium Plus Edition is going to be a big winner because it offers what business leaders need to take their companies into the AI-powered digital future.

Gain insight into the way Bob Evans builds and updates the Cloud Wars Top 10 ranking, as well as how C-suite executives use the list to inform strategic cloud purchase decisions. That’s available exclusively through the Acceleration Economy Cloud Wars Top 10 Course.