As Salesforce’s blowout Q2 sent its share price to record heights and pushed future guidance higher, the company’s ongoing and thorough domination of the CRM field—against some very worthy competitors—continues to define Marc Benioff’s company.

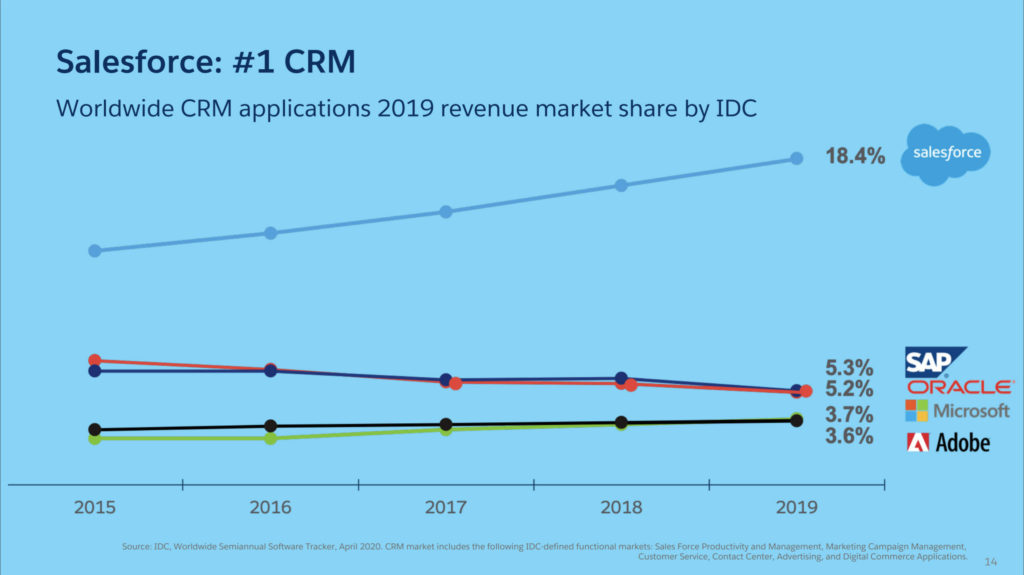

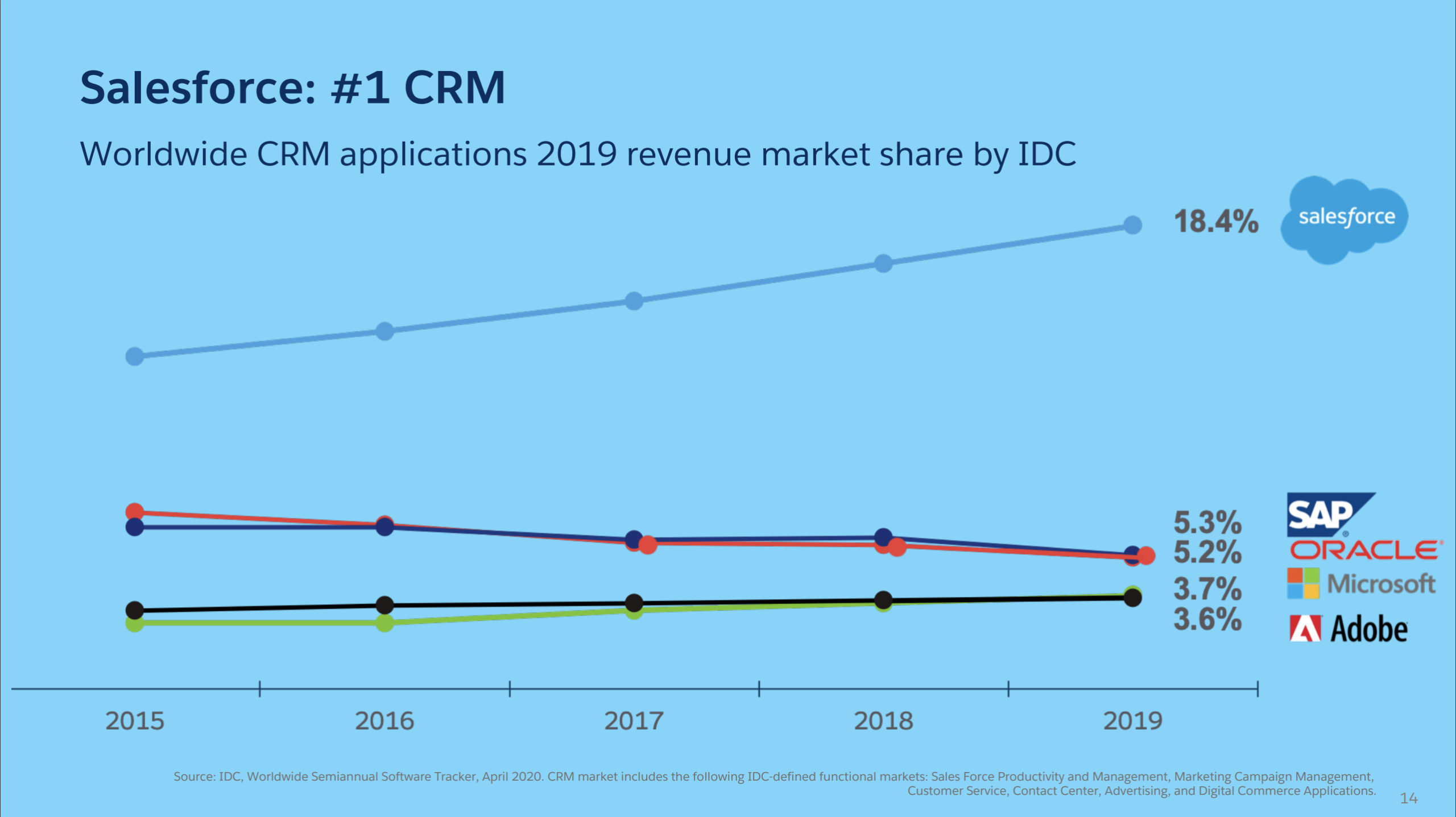

In the earnings presentation released yesterday afternoon with its blockbuster results, Salesforce included a 2019 CRM revenue market-share chart from IDC showing that Salesforce’s slice is bigger than that of SAP, Oracle, Microsoft and Adobe combined. (Quick reminder that we wrote a similar article to this one last year: Salesforce 2018 CRM Market Share Topped SAP, Oracle and Adobe—Combined! But Salesforce’s achievement is even more impressive, because this year Cloud Wars #1 Microsoft is added into the group it is outperforming.)

Salesforce claimed an 18.4% share for 2019, according to IDC, while those other four outstanding companies generated a combined portion totaling 17.8%. (This is slide #14 in the Q2 earnings presentation.)

I’ll offer more analysis of Salesforce’s Q2 numbers later this week, but here are a couple of quick takeaways:

- Bear in mind that even as its suite of CRM apps continues to be the overwhelming favorite in the marketplace, inside the company itself, none of those businesses is big enough to be the Big Dog. That distinction belongs to “Platform and Other,” whose Q2 revenue was up 60% to $1.5 billion, making it the largest business unit inside a company synonymous with SaaS apps. Lagging behind Platform and Other were ServiceCloud, up 20% to $1.3 billion, and Sales Cloud, up 13% also to $1.3 billion. You can read more about that stunning shift in the Salesforce hierarchy at Salesforce Shocker: Its #1 Revenue Business Is “Platform and Other”;

- Following the after-hours spike in its share price, Salesforce now has a market cap ($194.7 billion) significantly bigger than Oracle’s ($172.1 billion) and almost as large as SAP’s ($197.2 billion). You can read more on that at Why SAP Is Beating Salesforce and Oracle in the Market-Cap Wars.

RECOMMENDED READING

Why SAP Is Beating Salesforce and Oracle in the Market-Cap Wars

Salesforce Q2 Earnings Call: Marc Benioff Will Focus on These 5 Things

Salesforce Shocker: Its #1 Revenue Business Is “Platform and Other”

How Larry Ellison Is Shuffling Top Execs to Spark Next-Gen Oracle Cloud

Cloud Revenue: Microsoft Bigger than Amazon + Google, 2X Bigger than IBM

Cloud Wars: Why Microsoft Is #1, Amazon #2, Salesforce #3, Google #4

Will Salesforce Be First Cloud Apps Vendor to Top $5 Billion in a Quarter?

Subscribe to the Cloud Wars Newsletter for in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive and it’s great!