Fresh on the heels of two massive cloud deals with Vodafone and Juniper valued at about $875 million, IBM today said it has deepened its long-time strategic partnership with global bank BNP Paribas in a deal that one analyst believes could be valued at $2 billion.

This additional big new win for IBM Cloud will enable BNP Paribas to accelerate “the digitization of the bank” and development of new digital applications, services, and capabilities, IBM said in a press release.

Because BNP Paribas and its 200,000 employees do business in 73 countries, its move to the cloud—particularly via hybrid cloud and multi-cloud approaches—requires the bank to meet incredibly complex requirements around data residency, data privacy, and other regulatory and governance issues.

And in landing this deal with one of Europe’s largest banks, IBM is showcasing its unique strengths in the cloud that few if any of its competitors can match:

- deep vertical-market expertise in how the global banking industry works;

- end-to-end understanding of enterprise software to interconnect private clouds with public clouds with on-premises systems, plus data management;

- the increasingly essential expertise in all facets of global cybersecurity and privacy;

- and the ability to adapt all of its wide-ranging offerings—services, hardware, software and more—to be configured to the client’s specific, unique and exacting needs.

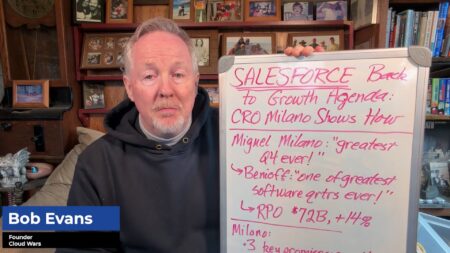

Analyst Charles King of Pund-IT, Inc. offered this perspective in an email exchange: “In the beginning, most cloud service providers aligned themselves with evangelists—Salesforce’s Marc Benioff is a good example—who claimed that cloud would eventually subsume traditional IT.

“Over time, it became increasingly apparent that cloud-centric IT was not the be-all/end-all that many assumed—instead, organizations were using cloud to support specific use cases and applications, and seeking ways to better leverage cloud in their IT strategies,” King said.

And then King made a point that I have been harping on for the past year or more: that the modern enterprise cloud will be defined by what customers want and need, and not by some wonky 4-letter acronyms or NIST definitions.

“IBM never really bought the cloud-evangelist line, and instead listened to what their customers were saying,” King said.

“So, the company offered cloud-based services that were geared to the needs of enterprise clients, and also worked on orchestration and service-management tools and open-source projects that customers could use to align their on-premises and cloud data/workloads. As a result, the company was well-prepared when hybrid cloud gathered momentum.”

King also addressed the issue of IBM’s unique qualifications for this sweeping deal with BNP Paribas, the value of which he believes “would come in at around or somewhat above $2 billion.”

“While about three quarters of the bank’s near-200k employees are located in Europe, its presence in in 73 countries defines BNP Paribas as a large global enterprise that needs a significant, broadly deployed cloud infrastructure,” King said.

“Additionally, while banking is among the world’s most highly regulated industries, those rules and requirements can vary significantly between countries and regions, meaning that BNP Paribas needs cloud services that can comply with regulations whatever the location. IBM is obviously ready and able to support PNB Paribas’s needs.”

In the press release outlining the deal, IBM said BNP Paribas will not use the public cloud to store customer data or as production environments using sensitive information. Rather, the IBM Cloud will help the bank accelerate operations and innovation, and improve the reliability and performance of its IT environment and security.

Disclosure: At the time of this writing, IBM is a client of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************