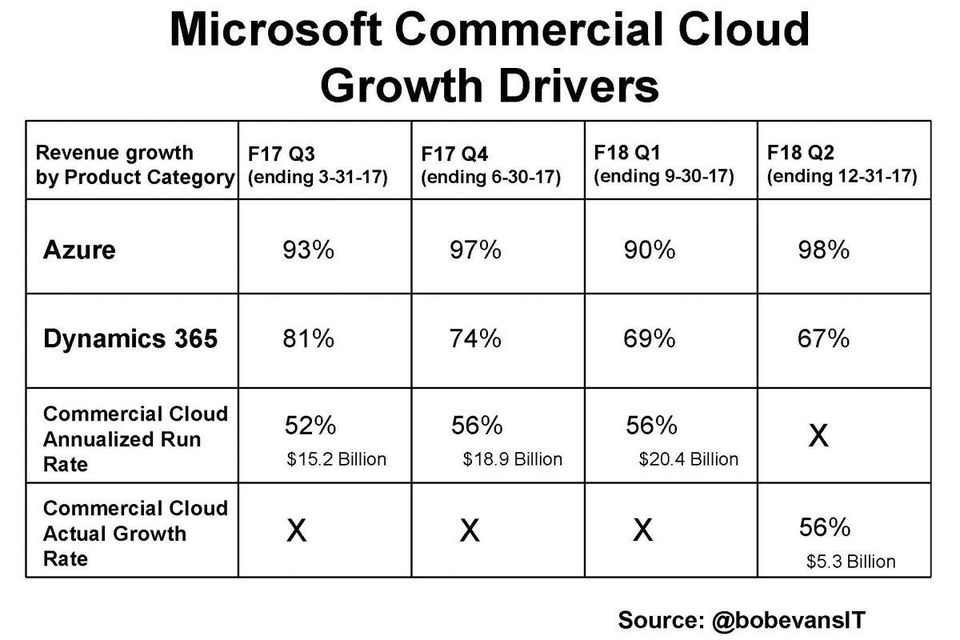

In the wake of Microsoft’s 56% commercial-cloud revenue growth in its just-completed quarter, some recent public comments from executive vice-president and CFO Amy Hood offer remarkable insights into why everything in Redmond seems to be humming along beautifully these days.

The comments from Hood, who’s been with Microsoft for 15 years and was CFO of the Office group before being promoted to her current role in the corporate C-suite, touch on the company’s culture to its operating philosophy to its M&A strategy to its evolving hyperfocus on customer success to its recent and massive overhaul of the sales organization.

And taken as a whole, Hood’s perspectives reveal a great deal about how the world’s leading enterprise-cloud company thinks, plans, imagines and executes.

For example:

- Microsoft’s created a legion of highly technical salespeople who become embedded at customer locations to get cloud projects up and running, showcase Azure capabilities that address undiscovered customer needs, and place unprecedented focus on ongoing customer success and Azure consumption. Hood’s description of their technical skills is a classic.

- The $26-billion acquisition of LinkedIn almost two years ago has been widely lauded as a strategic masterstroke by Microsoft—but Hood says it’s turning out to be an even “more strategic asset than we expected.”

- While cloud services are the core of Microsoft’s current growth and its future business, Hood says that when it comes to customers choosing to either invest more in on-premises products or to shift budget dollars to cloud services, “I am really indifferent as long as it meets the customer need.”

- Customer success has become an obsession with Microsoft’s sprawling cloud business and the new way sales teams are compensated because “ultimately in a consumption-based business, customer success is all that matters.”

In addition to her participation with CEO Satya Nadella on Microsoft’s fiscal-2018 Q2 earnings call on Jan. 31, several weeks before that Hood was the featured speaker at a tech-industry investors conference hosted by Wells Fargo.

The evidence of Hood’s stature as one of the industry’s—if not the world’s—top CFOs is reflected not only in Microsoft’s superb financial performance but also in her penetrating and unique insights into the company’s customers, strategy, competitors and operations.

So I’ve pored over the transcripts of those two events and have pulled out for your reading pleasure Hood’s thoughts on 10 strategic issues of significance to Microsoft and its customers—and the entire tech industry. (Within quoted excerpts of Hood’s comments, I’ve occasionally highlighted particularly meaningful passages in bold-italic text.)

-

New-Age Salespeople: Capable Of Writing Shippable Microsoft Code

Responding to a question asked at the Dec. 5 Wells Fargo investors conference about the sweeping sales reorganization that began in July 2017, Hood said, “It’s not just the terrific engineering work that we’ve done in product value, it’s also the investments that we’ve made to put resources in some of these larger accounts to continue to add new workloads that are only possible in the cloud, and with these added resources, we’re seeing the revenue get recaptured in that way….

“And what we did was really fundamentally change how we go to market for all customer types. At the high end that’s meant adding a lot of resources that are technical. And when I say technical I mean you would probably not see the distinction between them and someone that works in Redmond writing lines of code that’s shippable. They are fully capable of implementing and doing most project startup costs—costs meaning efforts—they’re capable of getting projects off the ground, and they’re capable of demoing all deep Azure functionality.

“That type of person was not someone that we, frankly, had at Microsoft and used in that way. We tended to use that type of person, that type of talent, in either our service business, our consulting arm, or obviously in one of our engineering teams.

“So that large investment is meant fundamentally to be about consumption and that’s how people are paid. They’re not paid on selling a contract of Azure—so not on bookings—but rather as customers are successful, meaning they get projects up and running, the meter starts spinning on Azure, and that’s when they get rewarded.

And this infusion of huge numbers of salespeople with the technical chops to write “shippable code” is only part of the sales-team revolution at Microsoft over the past several months–the company’s spurring its sales force to work more closely with partners to drive more cloud revenue as outlined in my recent article Microsoft Unleashes New Cloud Growth Via Go-To-Market Program Including Customers As Partners.

-

Customer Success More Essential Than Ever Before

“The one thing I care differently about this year than I think in the past is, we’re really focused on Azure consumption as opposed to just the billing cycle, which is an important distinction. You always recognize revenue based on consumption—you don’t get to recognize revenue just for selling something. And so really focusing on that motion with customers to make sure they’re successful is a really important pivot that we’ve taken….

“And so if you think about the lifecycle of making a customer successful, you absolutely start there: you’d invest with technology expertise to help them on their journey; you’d pick the right projects that matter to them; you’d show ROI through hands-on effort to get projects up to speed. And then you would see our person and them be rewarded with a successful outcome.

“So that’s why I’m pretty wedded to the concept that this is a different way that we should be rewarding our people, because it’s more cleanly aligned structurally to customer success. And ultimately in a consumption-based business, customer success is all that matters, because it builds on itself over time.”

-

In midst of “once-in-a-lifetime opportunity”

Asked if recent changes in federal-government policy about corporate taxation will make Microsoft more aggressive in acquiring companies, Hood said, “I would say that when we’ve seen an opportunity to invest, we have not really waited for tax reform to do that. Our opportunity—the total addressable market—really, the once in a lifetime opportunity—is the technical transition and digital transformation that’s occurring now.”

-

Hybrid At The Center of Everything

During her prepared remarks on the January 31 earnings call, Hood cited rising interest in hybrid clouds among macro growth trends—”positive IT spend signals, a strengthening commercial PC market, and growing customer demand for hybrid cloud services”—and said it would help “our commercial business to remain strong as we drive annuity growth, expand our installed base and execute well on renewals.”

And during her Q&A at the December investors conference, Hood offered this broad perspective on the unfolding manner by which corporations are finding the optimal mixes of cloud and traditional technologies:

“I think in many ways for us the bigger question was how quickly the transition on the customer side would happen. We felt pretty confident we could execute for Azure and be competitive and have an interesting story, a differentiated one, including the fact that we were committed to hybrid from the beginning in our architecture.

“So for us I think it was more a pacing of the market, and I do think things have gone pretty quickly on the customer side in terms of, even, you heard John talk about how important this is at Wells Fargo. There’s hundreds and hundreds of those stories, and I think the pacing has probably been the bigger surprise. And I feel very good about our execution, obviously, but it’s as much about a market opportunity as it is about our execution…..

“The distinction with Azure is that I actually think what you’re seeing for us and for others you’re is both on-prem growth and the cloud growth as people decide how they want to run their infrastructure, including the investments they’ve made over the past. To us that looks like, particularly for SQL and even for Windows, continued license growth even through this “transition” because it’s not a transition. This is really just people continuing to add investment to their technology bucket of spend to digitize whatever process that is, whether it’s a business process, a marketing environment, you can kind of go on down the list.

“For me, we bring people back to that singular KPI because I really am indifferent as long as it meets the customer need for their infrastructure and platform if they buy on-prem licenses or buy Azure stuff.

-

IoT: “It’s A Worldview Rather Than A Specific Product”

To give more context to Hood’s comments on this subject, here’s a quick comment from CEO Satya Nadella about Microsoft’s IoT strategy from the January 31 earnings call: “To thrive in a world with millions of intelligent end points, every company needs an IoT strategy. Microsoft is giving customers comprehensive solutions to help them realize the promise of a connected world of devices and things:

- Azure IoT Central is the first global-scale SaaS offering that enables customers to build intelligent, secure, enterprise-grade IoT apps in hours.

- Azure Event Grid simplifies creation of event-driven IoT solutions across millions of end points.

- Azure IoT Edge enables customers to run serverless computing and machine learning models at the edge.

“Chevron is using Azure IoT to harness massive amounts of data from its oil fields to accelerate deployment of new, intelligent solutions for oil exploration and to manage thousands of oil wells worldwide, increasing revenue and improving safety and reliability of their operations. Kohler is building connected, voice-activated products powered by Azure IoT.”

And here’s Hood on the broad subject of how Microsoft thinks about IoT: “Well, you say on most of the end points what people still want is a secure, manageable end point, especially if it’s going to collect any amount of sensing data. Do you want to be able to update it? How secure do you want it to be? That story for us is both a Windows 10 story as well as an Azure IoT story around the connectivity of those devices back to a data source….

“When I think about IoT or any endpoint, and when you say edge, think about it in the broadest term—which is the right way to interpret it—whether it’s a PC, whether it’s a phone, whether it’s a sensor, or frankly whether it’s the edge of your network, I would say that compute needs to reside where it needs to reside for the application to work its best. Azure Stack has it right, because Azure Stack is another way of talking about having an edge. And so for us it’s a worldview more than I think it’s any specific product—it’s that all products should make it possible for you to run compute and assess data and capture data and then analyze data no matter the environment.”

-

LinkedIn’s Soaring Strategic Value

During the Q&A session of last month’s earnings call, Hood said LinkedIn is “performing better than we expected and I think today we would even say it’s a more-strategic asset than we even maybe thought a year ago in terms of the power of it to add to our graph and our understanding.”

Asked how deeply Microsoft would attempt to integrate LinkedIn into the Redmond organization and culture, Hood offered this perspective: “I think what you’ll have to get used to a little bit on this one is you’ll start to see integrations in the experiences themselves, whether it’s going into Word and seeing LinkedIn integration on resume building, whether it’s Sales Navigator integration with CRM solutions for more social selling, whether it’s maybe incremental HR efforts by LinkedIn to sell more to their existing customer base. I think you’ll see it as we both have really functioning, thoughtful sales teams that I’m really fine bumping into each other a little bit, because they work actually just fine that way.

“So instead of trying to jam two sales forces together and disrupt basically customer momentum, we’ve made an active choice to not do that in this situation.”

-

Microsoft 365: How did it come about?

“So if you think about modern security and modern management, people tend to think about Office and Windows quite separately…. And so we finally said, well, why don’t we sell the thing that customers actually ask us about, which is, wait, what’s the most secure environment to have, and we would say, well, that’s Windows 10 and Office 365, and that combination when deployed together is more secure than any component. And so we’ve started to call that thing Microsoft 365.”

What’s extraordinary about Hood’s story is that it would have been impossible in the pre-Nadella Microsoft, where internal turf wars and internal silos often precluded—intentionally or not—the type of customer-centric innovation and rapid transformations Hood describes. The “one Microsoft” culture that Nadella has infused across the organization has reinvigorated the company on a scale that’s hard to fathom, and is one of the primary reasons I’ve chosen Nadella as the #1 CEO Of The Year in the Cloud Wars.

-

Azure multi-year commitments growing, profitability rising rapidly

A terribly flawed prejudice tossed about by critics of Microsoft’s cloud business is that it’s mostly cloud versions of Office with a little bit of “real” cloud thrown in. But back here in Planet Earth, reality reveals a very different story as highlighted in this earnings-call comment from Hood: “Commercial unearned revenue came in slightly higher than expected, at more than $20.2 billion, from growth in multi-year customer commitments to Azure. Commercial cloud revenue was $5.3 billion, growing 56% year-over-year, with broad-based growth across geographic markets and customer segments. Gross margin increased by 7 points to 55 percent, in line with seasonal trends. We improved gross-margin percentage in each cloud service, and Azure again saw the most significant margin improvement this quarter.

-

Dazzling Customers Versus Cutting Costs.

“I tell people all the time that most of the efficiency work we do now is focused on making a better customer outcome, whether it’s how many commerce systems do you need in a company so that it recognizes you when you call, or how many different customer interfaces? Or how modern should your build-environment be for engineers? All of those things matter, because the customer—whether it’s an internal employee or whether it’s an external customer who makes us money—benefits when we do thoughtful, efficient work, as opposed to saying, oh, I see costs to cut. It’s just not a good frame for a successful company….

“I don’t feel constrained in any way—as long as we continue to execute—to spend thoughtfully. We have to. The industry is aggressive. We need to be aggressive. We’ve got a good worldview. We’re executing well. The team is good. And when you feel all those things, the last thing you want to be is not aggressive.

-

“Strategic Patience and Execution Urgency”

“I am a deep believer in strategic patience, but execution urgency. So if you believe in those two things you can both understand where you’re going, invest patiently, invest in the right things, watch them pay off, but if you’re not doing well then let’s fix it. I mean that’s not hard. And that’s just fun stuff for me….

“It’s a good way to think because confusing the two is super-important. If you actually have a really thoughtful, strategic plan and you’re executing poorly, that can be interpreted inside the company as a bad strategy. Then you change course, and it wastes time, it wastes cycles, and more importantly it wastes the energy of your people.

“And the opposite could also be true: you could have a bad strategy and good execution, and then you just say, oh, oh no, I’m right; just let me fix this thing. That takes too much time. You’re very far away from where you need to be positioned as a company. And they both really can be damaging.

“And so I spend a lot of time with teams thinking about making sure we’re distinguishing between the two. It ultimately makes you much faster and much better positioned for customer success.”

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!