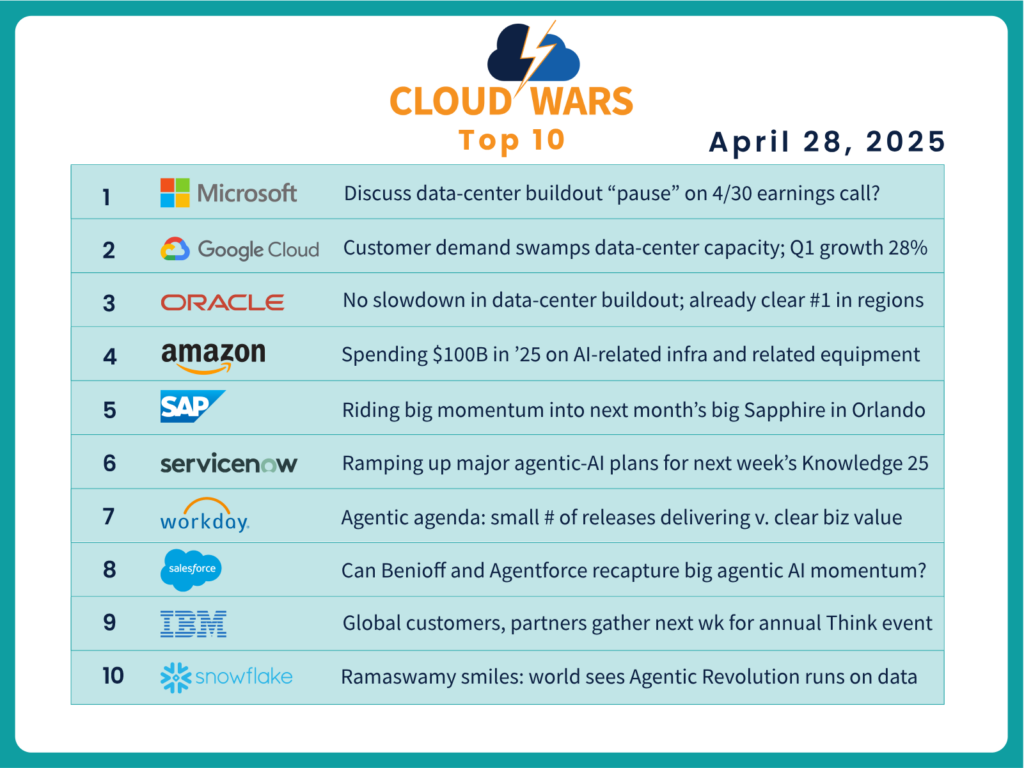

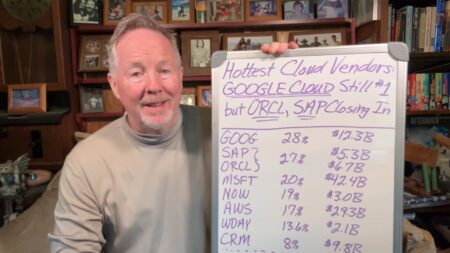

With customer demand outpacing Google Cloud’s ability to add data center capacity, Google Cloud’s Q1 growth slipped to 28% as parent Alphabet prepares to spend $75 billion this year to meet the surging appetite for AI and cloud data centers.

On Alphabet’s Q1 earnings call last week, CFO Anat Ashkenazi said Q1 is the second straight quarter in which Google Cloud was unable to meet surging customer demand because of constrained data center capacity.

“I’ve stated on the Q4 call that we exited the year in cloud specifically with more customer demand than we had capacity, and that was the case this quarter as well,” Ashkenazi said.

“So we want to make sure we ramp up to support customer needs and customer demands. Having said that, we’re investing in long term, and we’re investing in innovation — that’s the essence of our business.”

And Alphabet intends to address that imbalance between supply and demand by pumping $75 billion — think of that as almost $1.5 billion per week, or more than $200 million every single day of this year — into the expansion of its cloud infrastructure CapEx.

“We’re still planning to invest approximately $75 billion in CapEx this year because we do see a tremendous opportunity ahead of us across the organization, whether it’s to support Google services, Google Cloud, and Google DeepMind,” Ashkenazi said.

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

But, even with an investment of that magnitude, the additional capacity won’t come fully into play until Q4, which means that Google Cloud — the world’s fastest-growing major cloud vendor — is likely to see some additional turbulence in its growth rate throughout 2025.

“In cloud, we’re in a tight demand/supply environment, and since revenues are correlated with the timing of deployment of new capacity, we could see variability in cloud revenue growth rates depending on capacity deployment each quarter,” Ashkenazi said on the earnings call.

“We expect relatively higher capacity deployment towards the end of 2025.”

Despite the shortfall in capacity, Google Cloud Q1 revenue grew 28.1% to $12.26 billion, putting the world’s fastest-growing major cloud vendor on an annualized run rate of more than $49 billion.

This marks the second straight quarter that insufficient data center supply has stifled Google Cloud’s quarterly growth rate. If we look at quarterly growth numbers for the past six quarters, it’s clear that Thomas Kurian’s company’s steep growth trajectory hit a wall two quarters ago:

| Financial Metric | Q3 ’23 | Q4 ’23 | Q1 ’24 | Q2 ’24 | Q3 ’24 | Q4 ’24 | Q1 ’25 |

|---|---|---|---|---|---|---|---|

| Growth Rate | 22.5% | 25.7% | 28.4% | 28.8% | 35.0% | 30.0% | 28.0% |

| Revenue | $8.41B | $9.2B | $9.6B | $10.35B | $11.35B | $12.0B | $12.26B |

One more number: a couple of years ago, some self-proclaimed experts were screaming that unless Google Cloud became profitable instantly, parent Alphabet would certainly shut the business down. Those claims were absolutely absurd then and in hindsight today they’re even more ludicrous given Google Cloud’s operating-income numbers, which for Q1 were up 142% to $2.18 billion, a massive spike over the $900 million figure for Q1 of 2024.

Final Thought

Of the various problems that a high-growth business can confront, having customers want more of the stuff you’re selling than you can possibly deliver is the kind of problem that’s not so terrible. But, the Google Cloud story stands in contrast to a recent statement by Microsoft head of data center operations Noelle Walsh to the effect that “we are slowing or pausing some early-stage projects.” At the same time, she said, Microsoft is also planning to invest $80 billion on data center buildouts this year, so perhaps the adjustment is simply temporary.

Well, these are wildly complex and expensive businesses and are certainly not for the faint of heart. But, I would say that anyone who wants to bet against the AI Revolution — and all the extraordinary technological developments and investments that are the fundamental components of that revolution — is going to end up on the losing side.