The profound power shift at the top of the cloud and AI industry came into stark relief last week as AWS posted its best quarter in more than three years but nevertheless continued to fall farther behind new category leader Google Cloud, whose 48% Q4 growth rate doubled the 24% posted by AWS.

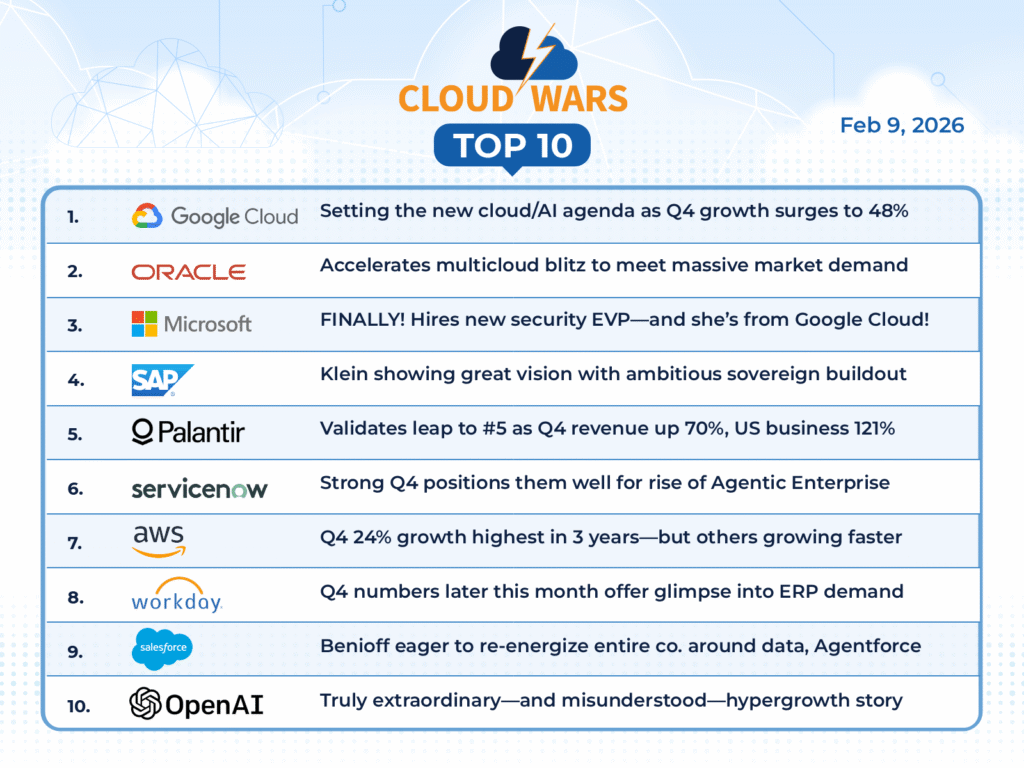

As a consequence of those and other recent dramatically different market performances from the four hyperscalers, last month I announced a big shakeup in my weekly Cloud Wars Top 10 weekly rankings, as Google Cloud powered into the #1 spot, Oracle jumped up to #2, Microsoft fell to #3, and AWS tumbled from #4 to #7.

Following the release of Amazon’s Q4 results late last week, today I’m going to explore AWS and its current spot in the market from two perspectives:

- AWS itself: the very good Q4 results posted by AWS along with some of its high-speed product rollouts and momentum; and

- AWS versus its competitors: a quick comparison of how those AWS Q4 numbers stack up against those of Google Cloud, Microsoft, and Oracle.

AWS Q4 Highlights

- There’s no question that AWS delivered a very strong fourth quarter as shown via these major highlights:

- Q4 revenue grew 24% to $35.6 billion

- that’s AWS’s highest growth rate in more than 3 years

- growth rate accelerated in every quarter in 2025

- backlog jumped 40% to $244 billion

- Q4 quarter-over-quarter increased by $2.6 billion

- Q4 year-over-year increased by $7 billion

- custom-chip revenue now at $10-billion run rate

- continues to be very profitable

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

AWS Q4 versus Competitors’ Q4

But as I’ve noted a few times recently, AWS does not operate in a vacuum — instead, it’s a major player in the greatest growth market the world has ever known, which I would also nominate for consideration as the most-competitive market the world has ever known. (There’s no question about the first descriptor, but the second one is still a work in progress.)

As such, the results delivered by AWS must be viewed in the context of how its competitors are performing. And it is precisely on that basis that I’m claiming that AWS is — in spite of its solid Q4 results — losing ground to rivals Google Cloud, Oracle, and Microsoft.

1. Q4 cloud growth rates: Google Cloud 48% (not a typo), Microsoft 26%, AWS 24% (Oracle Q3 ends Feb. 28 — most-recent growth rate was 34%)

**In any other market in the world, AWS’s 24% growth to quarterly revenue of $35.6 billion would be astonishing, otherworldly, unbeatable. BUT — this is not any other market — this is the biggest and fastest-growing and most-expensive sector the world’s ever known — and possibly the most competitive as well. So, compared to the growth rates of its competitors, AWS’s 24% is not so special. Consider: AWS’s Q4 revenue is exactly twice as big as Google Cloud’s, but Google Cloud’s 48% growth rate is exactly twice as big as AWS’s — which metric better indicates which company’s better positioned for the future AI Economy?

2. Q4 cloud revenue:

- Google Cloud: $17.7 billion

- Microsoft: $51.5 billion

- AWS: $35.6 billion

**Yes, AWS is 100% bigger than Google Cloud, but Microsoft Cloud is 45% bigger than AWS — and Microsoft Cloud is growing significantly faster than AWS, and has been doing so for the past few years.

3. Growth rates across the past four quarters, starting with most-recent:

- Google Cloud: 48%, 34%, 32%, 28%

- Microsoft: 26%, 26%, 27%, 20%

- AWS: 24%, 20%, 17.5%, 17%

**Again, nice numbers for AWS, and impressive year-long acceleration. BUT: if you had to pick one of those sets of numbers as the horse you wanted to ride into the AI future, which one would it be?

4. Incremental quarter-over-quarter revenue:

- Google Cloud: $2.5 billion

- Microsoft: $2.4 billion

- AWS: $2.6 billion

**Nice clean win here for AWS, particularly over Microsoft. BUT: Since AWS is 100% bigger than Google Cloud, shouldn’t we expect its incremental Q4 revenue to be much larger — perhaps on the scale of 100% larger — than that of Google Cloud? And if it’s not bigger by that much — and it is certainly not — then we have to ask why is that the case? To me, the answer is that Google Cloud is winning a disproportionately large share of current/future business because it is winning the battle of tomorrow, not those of yesterday.

Amazon CEO Andy Jassy’s Clumsy Spin

On last week’s Amazon Q4 earnings call, CEO Andy Jassy said this: “As a reminder, it’s very different having 24% year-over-year growth on a $142 billion annualized run rate than to have a higher percentage growth on a meaningfully smaller base which is the case with our competitors.”

That flimsy rationale conjured up in my head this long-ago but potent observation from Monday Night Football commentator Dandy Don Meredith: “If if’s and but’s were candy and nuts, we’d all have a Merry Christmas!”

So if we were somehow still back in 2018, AWS would still be King of the Cloud — but we’re not, and it’s not.

And if Google Cloud were not growing 2X as fast as an even rejuvenated AWS, then AWS would still be the King of the Cloud. But Google Cloud is growing 48%, and AWS is not still King of the Cloud.

Jassy wants to be able to deploy his growth-rate-versus-base-size discrepancy on a selective basis: he wants to use it to downplay the fact that AWS is getting scorched by Google Cloud, but he wants to ignore it when it comes to Microsoft, which is not only much bigger than AWS but is also growing more rapidly and has been for years.

Final Thought

I don’t blame Jassy for trying to position AWS’s very good quarter in the best possible light — that’s his job. But the cold, rational numbers tell us that while AWS is performing very well, that performance is nowhere near the best in its class.

And that is why Google Cloud is moved to #1 from #2, and it’s why Microsoft fell from #1 to #3, and it’s why AWS tumbled from #4 to #7.

There’s a new leader at the front of the pack because customers are much more focused on how tech vendors can help them build their AI future than on what they did for them in the fast-receding past.