In a striking example of just how big the enterprise cloud has become and how rapidly it’s growing, Google Cloud Platform’s disclosure of an impressive $4-billion forward-looking annualized revenue run rate leaves GCP about $15 billion behindthe parallel metrics for Cloud Wars leaders Microsoft, Amazon and IBM.

For calendar 2017, the seven biggest enterprise-cloud vendors—Microsoft, Amazon, IBM, Salesforce, Oracle, SAP and Google—posted cloud revenue of $76.3 billion, as compiled from those companies’ publicly available earnings results.

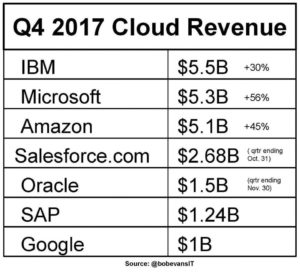

The Big 3 in that group—Microsoft ($18.6 billion), Amazon ($17.5 billion) and IBM ($17.0 billion)—combined for calendar-2017 cloud revenue of $53.1 billion, and the enterprise-cloud businesses for each of those three companies appear to be accelerating rapidly going into 2018 as this graphic reveals:

In the middle of the pack, Salesforce.com posted revenue of $9.92 billion for the 12 months ended Oct. 31, and that’s as close to an approximation for calendar 2017 as is available. But with Salesforce continuing to grow rapidly, let’s be a little crazy and say its calendar 2017 revenue is a cool $10 billion.

Oracle, SAP and Google combined for more than $13 billion in cloud revenue in 2017, but I can’t be more precise than that because while Oracle came in at $5.6 billion (for the 12 months ending Nov. 30) and SAP at $4.7 billion, Google didn’t release a specific full-year revenue figure for its cloud business. Some analysts are pegging the full-year number at around $3 billion.

So let’s take a look at what some of those numbers mean:

- IBM is a huge winner on multiple fronts, particularly in the revelation that its cloud business is only 3% smaller than Amazon’s and within 10% of market leader Microsoft.

- Another big win for IBM: surprise surprise, but look at which cloud vendor posted the biggest revenue in Q4? IBM takes that crown with $5.5 billion, spurred by a 30% year-over-year growth rate, while Microsoft came in at $5.3 billion on a staggering 56% growth rate and Amazon at $5.1 billion on stellar 45% growth.

- The narrative—and it is dead wrong—repeated relentlessly and tirelessly by many in the media and amplified by some analysts that Amazon is the runaway winner in the cloud is baseless, sloppy and terribly misleading. In the IaaS space exclusively, yes indeed, Amazon’s AWS unit is the big cheese. But as the publicly available numbers shown throughout this article and within the embedded graphics reveal, Microsoft is the overall leader in the enterprise cloud, Amazon sits below Microsoft in revenue, and IBM is just barely behind Amazon. It’s time for that long-running string of extremely fake news that “Amazon rules the cloud” to come to an end.

- Reports that long-time enterprise-software powerhouses Oracle and SAP are lost in the clouds is also pure rubbish. Both companies are generating broad and deep growth for their cloud businesses, both are investing heavily in hybrid-cloud technologies to allow customers to continue to get maximum value out of their existing on-premises software in close collaboration with their new cloud services, and both companies are also investing heavily in customer-success programs essential to credibility in the cloud.

- Google Cloud Platform’s achievement of $1 billion in Q4 revenue is outstanding—but it’s also a clear indication that Google, for all of its astonishing technological and financial resources, has not until recently taken this market seriously. While the longtime media trope has been that SAP and Oracle have been “late to the cloud,” these numbers reveal that if any of the major cloud vendors truly deserves to have to wear a T for tardy, it is Google. Now that Diane Greene and company have things on track, it will be most interesting to see how GCP fares in the Cloud Wars in 2018 and beyond.

So, let me conclude with a couple of thoughts on each of these leading enterprise-cloud vendors as they jointly escalate the Cloud Wars here in early 2018 to the very great benefit of business customers.

Microsoft is all about the hybrid cloud, and it’s a subject that CEO Satya Nadella returns to relentlessly, citing his company’s success in the cloud as being due to aggressively creating and deploying what Nadella calls the company’s “architectural advantage,” wherein Microsoft strives to let customers smoothly blend together on-premises technology, cloud technology and hybrid technology. In the end, Nadella said, it is Microsoft’s job to make it easy for customers to move across all three with grace and speed, and to be able to exploit the full power of AI in that mega-environment to yield increasingly valuable data. That’s why Nadella is my runaway pick for CEO Of The Year.

Amazon is doing terrific work on many fronts, and were it not for Microsoft above it and IBM just behind it, Amazon would deserve all the hosannas the media loves to lavish upon its cloud business. But reality often intrudes on rickety narratives, and if Amazon wants to remain a top-tier cloud powerhouse, it must increase its presence in the higher-value realms of PaaS and SaaS.

IBM has not only created an “as a service” cloud business approaching $10 billion, but it has also exploited with great success its “power of incumbency” among the world’s largest corporations by offering hardware, software and consulting services to help those customers convert their legacy systems into cloud or cloud-compatible environments. That’s become a $7-billion business for IBM with some outstanding customer use cases. On the other end, IBM’s close coupling of cloud plus AI/cognitive via Watson has been brilliant.

Salesforce continues to be unique (as if a company run by Marc Benioff could be anything else), innovative, and fast-growing. Having hit $10 billion, Benioff is hell-bent on getting to $20 billion in just a few years, but he and his company will have to continue finding new revenue categories, notably in the platform area.

Oracle has a fast-growing SaaS business accounting for about 75% of its total cloud revenue, but chairman Larry Ellison has said many times that he believes Oracle’s PaaS business will become even bigger than its SaaS business, particularly as the database-as-a-service offering gains momentum among customers. Ellison also believes Oracle’s advanced IaaS technology can snatch huge chunks of share from Amazon.

SAP‘s power of incumbency is centered on being and having been the world’s leading supplier of enterprise applications for many, many years, giving it a great opportunity to help those trusting customers pivot as much of that on-premises technology as possible over to the cloud. SAP’s still working through some of that massive end-to-end transformation to the cloud, and when that process is complete it will be an even more formidable competitor than it is now.

Google is, well, Google, and it’s got not only tons of technical chops and tons of money to invest but also, at long last, a concerted sense of purpose and will toward becoming a very serious player in the enterprise cloud. It’s starting from pretty far back in the pack, but never count out a company whose name has become a verb.

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!