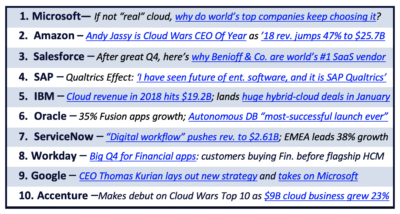

The first quarter is drawing to a close. 2019 is shaping up to be an explosive year for the world’s top cloud-computing vendors. So here’s a question for each company in my Cloud Wars Top 10 ranking.

#1 Microsoft.

Executives within both Microsoft and SAP have been saying that huge global corporations are moving mission-critical production SAP workloads to the Azure cloud at an astonishing rate. As that trend continues, can Microsoft continue to crank up Azure’s performance, reliability and security? Can it do so in the face of the most-demanding workloads the business world can generate?

#2 Amazon.

I’ve been intrigued by AWS’s nod to the surging demand for hybrid-computing solutions that cut across its home turf in the cloud as well as the on-premises landscape—where AWS has zero presence. Will AWS’s proposed hybrid solution—called “Outposts” to underscore the Amazon’s view that on-premises is an outlier and an aberration—gain anywhere close to the trust and commitment that its phenomenally successful public- and private-cloud services have generated?

#3 Salesforce.

For the past decade, Salesforce has defined, dominated, and owned the customer-facing world of CRM. But now one of the competitors that Marc Benioff has belittled over much of that time—SAP—is looking to redefine the customer-facing game with an impressive set of assets. Does Salesforce have enough gravitational attraction with its customers—and enough snazzy new products in the labs—to withstand the coming offensive from SAP?

#4 SAP.

Its $5.2-billion cloud business is growing at close to 40%. The revamped C/4HANA customer-experience suite is tapping into operational data to drive deeper insights. And its new Qualtrics experience-management unit is showing fabulous new levels of innovation and value. SAP seems ready to fulfill the potential CEO Bill McDermott has talked about for the past 18 months. Can the company convince business leaders that its unique combination of X’s and O’s—experience data and operational data—is the formula for success in the digital economy?

#5 IBM.

IBM looks to become the vendor that can help companies productively and elegantly weave together hybrid-computing and multi-cloud environments. Will its $33-billion acquisition of Red Hat give it the acceleration needed to become the leader in a field that Microsoft, SAP, Accenture, Oracle and others are gunning for?

*******************

RECOMMENDED READING FROM CLOUD WARS:The World’s Top 5 Cloud-Computing Suppliers

Amazon Versus Oracle: The Battle for Cloud Database Leadership

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)*********************

#6 Oracle.

This one’s simple: Can Oracle convince the companies currently running millions of traditional Oracle databases around the world to convert big chunks of those installations over to Larry Ellison’s Autonomous Database? As Ellison himself has said, the answer to that question will dictate the company’s future.

#7 ServiceNow.

I’m going to a bit sideways on this one: Can the fast-growing and hugely successful ServiceNow remain independent throughout 2019? Or will one of the big players in the Cloud Wars snap it up to gain a strong—or perhaps stronger—foothold in the booming market for enterprise SaaS applications?

#8 Workday.

Will Workday’s fledgling ERP business, which encompasses its fast-growing Financials suite, be able to reach breakaway velocity in 2019? Can it give Workday a second powerful growth driver to complement its flagship HCM business?

#9 Google Cloud.

New CEO Thomas Kurian recently offered some broad-brush looks at the strategic approach he’s driving inside this company whose commercial success to date has not matched its technological prowess. At Google Cloud’s upcoming Next customer conference in early April, will Kurian and his team be able to deliver a vision compelling enough and distinctive enough to trigger significant new growth in the Google Cloud business?

#10 Accenture.

With $9 billion in cloud revenue in 2018, Accenture’s got an appealing mix of industry expertise, strategic vision and technological chops to become an even greater force in the booming enterprise-cloud business. Can the partner-to-everyone evolve as well into a disruptive arms merchant in 2019?

Disclosure: at the time of this writing, Microsoft, SAP, IBM, and Oracle are clients of Evans Strategic Communications LLC.

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!