With six Cloud Wars Top 10 companies reporting accelerated growth in Q3 over the previous quarter, Palantir far outpaced its lusty rivals with an absolutely stunning growth rate of 63% that sets an entirely new standard for what’s possible here in the AI Revolution.

Of course, we’ll no doubt hear some complaints about how it’s “not fair” to compare and contrast Palantir’s growth arc with companies whose revenue is up to 40X larger than Palantir’s. To those whiners, I suggest they take not only a deep breath but also pride in their grasp of basic mathematics, and then focus instead on what Palantir is doing to win the confidence of and fast-growing contracts from customers across industries and across the globe. I’ll even offer a couple of destinations that can help with that strategic market enlightenment:

- WATCH: Inside Palantir: Wildly Different Value Prop for Customers — Growth!

- PODCAST: Palantir Q3 Reveals New Deal Sizes, Shorter Timelines, Bigger Ambition | Cloud Wars Live

- WATCH: Palantir Joins Cloud Wars Top 10: 48% Growth, $440-Billion Market Cap

- READ: High-Flying Palantir Soars into Cloud Wars Top 10, Replacing Snowflake

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Meanwhile, Google Cloud — which had held the #1 spot on the Cloud Wars Growth Chart for the past SIX quarters — grabs the #2 spot this time with stellar Q3 growth of 34%.

And the next three fastest-growing Cloud Wars vendors show that being half a century or so old doesn’t mean you’ve lost your stuff as Oracle (28%), SAP (27%), and Microsoft (26%) grabbed the next three spots.

All in all, six of the nine Cloud Wars Top 10 companies that break out their quarterly cloud revenue saw their growth rates increase in the most-recent quarter: Palantir, Google Cloud, Oracle, AWS, Workday, and Salesforce. You can see all the details in the table below. (IBM no longer breaks quarterly revenue — and while I have enormous respect for Arvind Krishna, what am I gonna do with a “hybrid cloud” company that doesn’t break out its cloud results??)

CLOUD WARS GROWTH CHART: Nov. 20, 2025

| Company | Latest Qtr Growth Rate | Quarterly Cloud Revenue | Previous Qtr Growth Rate |

|---|---|---|---|

| Palantir | 63% | $1.12B | 48% |

| Google Cloud | 34% | $15.2B | 32% |

| Oracle | 28% | $7.2B | 27% |

| SAP | 27% | $6.14B | 28% |

| Microsoft | 26% | $49.1B | 27% |

| ServiceNow | 21.5% | $3.3B | 22.5% |

| AWS | 20% | $33B | 17.5% |

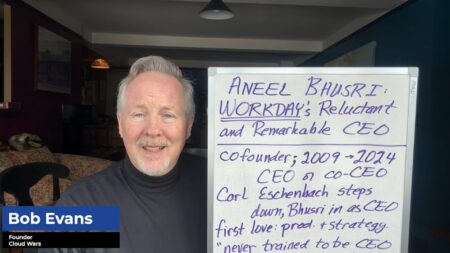

| Workday | 14% | $2.17B | 13.4% |

| Salesforce | 10% | $10.24B | 8% |

| IBM | ??? | ??? | ??? |

Final Thought

For the past seven years, I’ve been describing the Cloud Wars as the greatest growth market the world has ever known. If, after reviewing these latest Cloud Wars Growth Chart results, anyone can point to a category that can top this one in that regard, please let me know.

Ask Cloud Wars AI Agent about this analysis