Most companies are unaware of how much time and money non-standard processes consume. They also aren’t using technology to let leaders know when a standard process isn’t being followed.

Now, with process mining, they have a way to quantify the percentage of activity that follows a standard process and understand what the various iterations of the non-standard processes are. It’s easy to find process inefficiencies or breakdowns.

As a CFO, I need to think about where to apply this technology to deliver the greatest business value. To do this, it’s important to get out of the back office and start thinking about which processes touch the customer and key vendors. The ability to discover and rectify inefficiencies and optimize processes at customer touchpoints is, from my experience, the greatest benefit of the technology.

Process Mining to Safeguard Customer Satisfaction

I started looking at processes from a customer satisfaction point of view and asked, “Are we an easy company to do business with?” The answer should always be yes, and frictionless processes contribute greatly to this goal.

Here’s a situation where customer satisfaction is put at risk: If you have billing inconsistencies, you may find that only 30% of transactions go through the standard process. That means 70% of your volume must be addressed manually, which introduces the risk of human errors. Or they go through some manual processes that add time to your billing process. Both can be very frustrating for customers that you are billing. Never mind the fact that this slows down cash inflows for your company.

There’s another use case that arises when I’m dealing with financial processes under a federated business model.

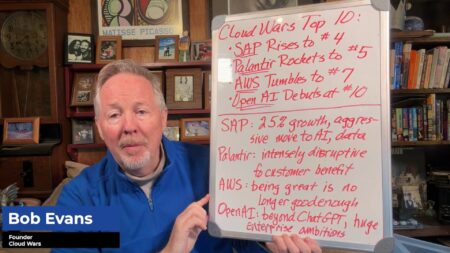

Which companies are the most important vendors in AI and hyperautomation? Check out the Acceleration Economy AI/Hyperautomation Top 10 Shortlist.

I may have three businesses that came together through acquisition, and all of them process accounts payable transactions using the processes that were developed in their companies. While I may not have the corporate culture in place to standardize those processes, I still need to know how consistent they are. Are we applying the same policies consistently across business units? Are we using those policies to make judgment calls consistently, or are we frequently making exceptions?

The ability to discover and rectify inefficiencies and optimize processes at customer touchpoints is, from my experience, the greatest benefit of process mining technology.

It’s also important to consider that if you simply apply a process mining tool to ensure you’re enforcing the letter of the law, you could find yourself in a scenario where you have created the most efficient process, but you’ve made your company very difficult to do business with by prioritizing standardization over customer experience. Finding the right balance between customer experience and process efficiency is crucial.

CFO View of Implementation Priorities

I’ve emphasized the use of process mining to evaluate the performance of customer-facing processes. That, however, isn’t necessarily the first place that many companies should start with this technology.

There really is no one ideal use case to start with when introducing process mining into your organization. That being said, one of the first processes companies have targeted for process mining is accounts payable, because it’s easier than many other processes to investigate and measure, and consistency in this function has major business benefits.

I started with accounts payable in my past, with a previous employer because that provided a good opportunity to prove the value of process mining, but you really could start with any process. From a risk tolerance point of view, it’s beneficial to start with a simple internal process, but there’s no technical reason why you can’t start with outward-facing processes that directly impact customer satisfaction.

In my current role as CFO, I’ve got people that will lead our efforts at saving money from process mining and the process efficiency it enables. However, when it touches customers, I want to be more directly involved in the use cases. I want to be able to communicate the benefits to my CXO peers. I want to be able to explain to them what it is that we’re doing and why we’re doing it, and how it will make their lives easier.

Generally, I don’t think CFOs or finance leaders have the visibility that they think they have. You may believe that you’ve got a standard process in place. You’ve centralized and automated it, but until you put in place technology that shows you very clearly the volume of transactions that go through that process and the volume that doesn’t, you don’t have an ideal level of transparency.

We saved a lot of money for my previous company using a process mining tool (using Celonis, a vendor on the Acceleration Economy Hyperautomation Top Ten Shortlist) while simplifying processes that were previously outsourced and therefore lacking in transparency. That got us to a point where we knew the judgment calls and exceptions the outsourcer was making. We were able to fix those and ultimately automate the standard process, bringing the remaining, true exception processing back in-house.

I felt more comfortable that my processes were working effectively with the knowledge that I can spot problems when they arise and ensure we are using an efficient, customer-centric approach in processes that directly impact revenue. Process mining has emerged as core technology making that possible.