Building on a long process mining track record, the BMW Group will tap GenAI to maximize usage of process mining company-wide, co-create with Celonis to ensure product features align closely with core business goals, and advance cross-company collaboration for supply chain resiliency.

BMW began using process mining in 2016 for purchasing and production use cases and it’s grown steadily to the point it now has 90 processes being analyzed, according to Dr. Patrick Lechner, head of process mining, robotic process automation, and low-code/no-code for the Munich based luxury car brand.

Production use cases include analysis of processes in the paint shop, where process mining can pinpoint opportunities to improve performance, such as how variations caused by different colors can impact cycle time.

Is your company culture ready for GenAI? Most are not. Take the Acceleration Economy Cultural Impact of GenAI executive course to learn why and define the strategic steps you can take to leverage the technology and have an “AI Mindset.”

While building out its dozens of use cases, BMW also deployed a Center of Excellence model on a centralized basis, complemented by “Centers of Competence” to tap expertise within individual departments while breaking down silos across its global operations.

Power to End Users

Like most process mining systems, Celonis has long leveraged artificial intelligence and machine learning in its platform. Process mining-oriented functions that are well suited for AI include crunching massive volumes of data, spotting patterns to determine how processes should function, and identifying discrepancies or anomalies relative to optimized processes.

Last year, Celonis detailed plans to offer GenAI functionality and the resulting natural language querying capabilities will enable BMW to expand the number of end users that have access to process mining. Celonis has said when AI is trained with standardized process knowledge and data from its Process Intelligence Graph, customers will be able to unlock maximum value from process mining.

“We can extend our user base much further than we have so far because everyone can use the tool without deeper knowledge of Process Mining,” Lechner says. “They can ask the right questions and get the answers they need. I think this will be the biggest benefit of AI from our point of view.”

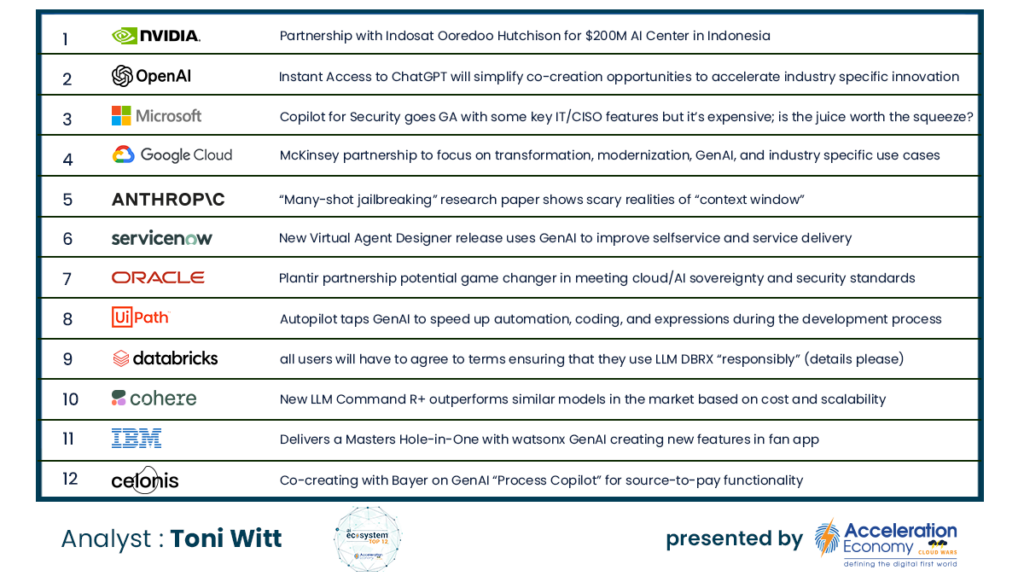

BMW expects to begin testing the Celonis Process Copilot soon after it becomes available.

Expanding the use of process mining is a positive development in view of BMW’s Center of Excellence/Center of Competence model that aims to realize maximum ROI from their investment — broader usage should lead to greater ROI — and the need to accelerate time to value.

Co-Creation and Resilient Supply Chains

BMW’s software developers will be working closely with Celonis for early access to software and to ensure upcoming process mining features meet the needs of its business. The two companies described their co-creation work as a means to effect process mining innovation inside BMW and across the automotive industry.

Lechner cites mutual benefits as the two companies embark on these initiatives. “We really want to make the software ready for usage for us at a very early stage. This is why it’s very important for us to get involved in software development,” Lechner says. “For Celonis, they get the experience from big corporates like BMW with all the requirements when it comes to security, when it comes to authentication, when it comes to scaling possibilities.”

The companies said their collaboration will focus on the integration of AI technology into production functions with a goal of improving operational transparency and accountability.

As a founding member of CatenaX, BMW has long focused on data exchange between supply chain partners in the automotive industry. The company casts its co-creation work with Celonis as supporting initiatives around data sharing and breaking down silos between companies, just as CatenaX aims to do.

“One example of many is to look at the supply chain end to end and see at an early stage if a supplier has any issues in terms of being able to supply parts well in advance,” Lechner says. “If we know there could be issues, we can react much faster. Also, the supplier can see there’s demand at BMW for this part and maybe change production accordingly.” The end result, he says, can be more resilient supply chains.

While having multiple, or many, value chain participants using process mining for visibility would be beneficial, that’s not considered a pre-requisite to effective collaboration in this context. Openness among software vendors to working with other vendors on behalf of customer business requirements is critical, Lechner says.