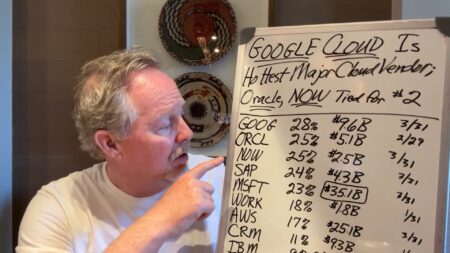

Review the updated Cloud Wars Growth Chart, led by Google Cloud which delivered the highest growth rate of the quarter.

Workday

ServiceNow CEO Bill McDermott positions the company as “the AI platform for business transformation” amidst soaring GenAI adoption.

At the Workday Innovation Summit, Bonnie Tinder and Bob Evans discuss key insights into Workday’s platform, AI initiatives, and partnership ecosystem.

From enhancing talent acquisition to activating talent management to re-skilling, HiredScore applies adds advanced AI functionality for Workday customers.

An exploration of the intricate dynamics of mergers and acquisitions within the tech sector with strategic insights into decision-making.

Generix has a strong focus on supply chain innovation, marked by strategic acquisitions and customer-focused offerings in warehouse management, transportation management, and more.

Businesses exhibit strong confidence in cloud and AI, reflected in soaring RPO and backlog figures from Workday, Snowflake, and Salesforce. Substantial long-term commitments highlight aggressive investments in these companies’ software.

NVIDIA partnership yields telco-optimized GenAI functionality, while technology acqusition delivers network management and automation for that sector.

As Workday co-founder Aneel Bhusri steps down from his CEO role to become executive chair, he’ll focus on strategic innovation while CEO Carl Eschenbach drives revenue growth.

Workday’s co-founder Aneel Bhusri transitions to executive chairman, and cites six key strategic areas, including AI integration, industry-specific solutions, and cybersecurity, as the company aims to double revenue to $15 billion.

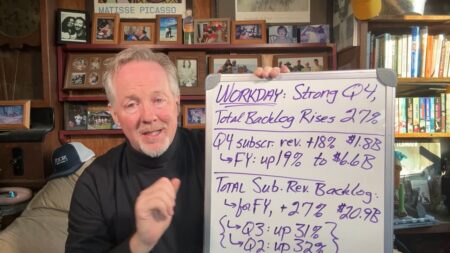

Workday’s recent strong fiscal performance includes impressive subscription revenue growth and substantial backlog.

RaceTrac VP of Accounting Merlix Reynolds reveals how Workday helped with overcoming challenges with innovation and cost management support.

Workday’s Q4 results showcase a robust fiscal performance with a 19% surge in subscription revenue, hitting $6.6 billion for fiscal 2024.

Highlighting optimistic subscription-revenue trends for Workday, decoding Salesforce’s cautiously optimistic signals for a potential growth turnaround, and expecting continued strong growth for Snowflake driven by AI and expanding data initiatives.

Merlix Reynolds discusses the remarkable impact of utilizing data and business connections in accounting, spotlighting the newfound collaboration and dependence on precise reporting within platforms like Workday.

Workday partners with services provider Insperity to deliver new HR offerings that help small and medium businesses accelerate growth.

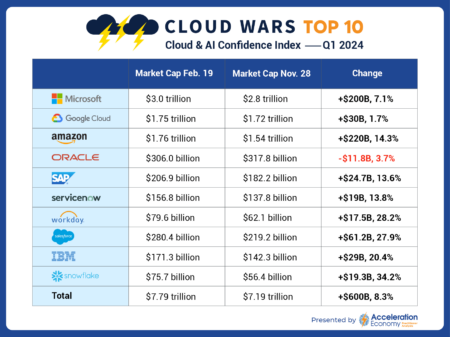

Snowflake, Workday, and Salesforce experience the greatest market cap percentage gains among the Cloud Wars Top 10. The index reflects customer confidence in these firms.

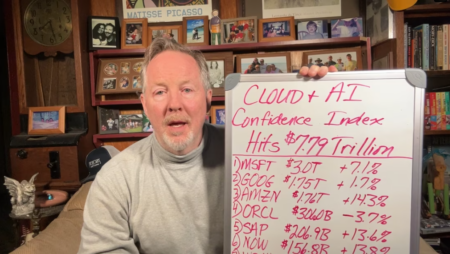

The Cloud Wars Cloud and AI Confidence Index reaches an all-time high, led by Microsoft, Google, and Amazon, which all gained well over $1 trillion in market cap.

RaceTrac utilizes Workday’s adaptable platform for quick integration of new data, effective module interaction, and prompt implementation of changes.

The elevation of Carl Eschenbach and Rob Enslin to sole CEOs of Workday and UiPath likely points to the end of the co-CEO model and important new strategic directions for both firms.