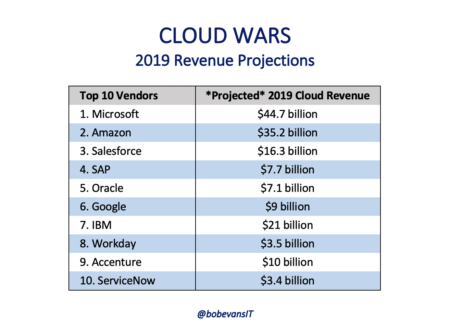

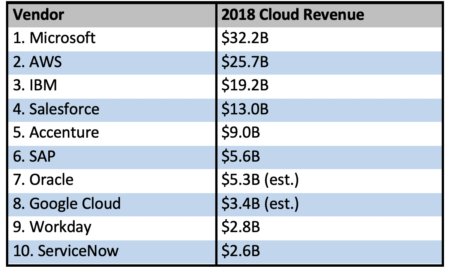

By my projections, the world’s top 10 enterprise-cloud vendors are poised to generate $158 billion in cloud revenue in calendar 2019.

Top 10

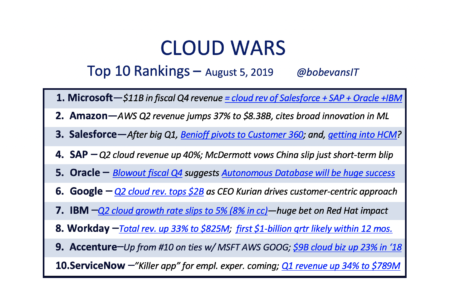

Some additional perspective on Microsoft’s monster fiscal Q4 ($11 billion in commercial-cloud revenue!), with 10 key insights from its earnings call.

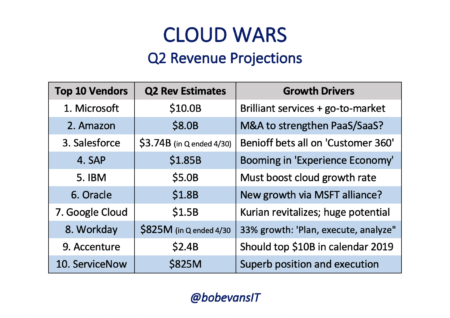

Market leader Microsoft and #2 Amazon generated HALF of the $37 billion in Q2 cloud revenue rung up by the Cloud Wars Top 10 vendors.

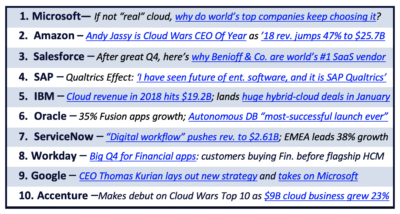

Sparked by CEO Thomas Kurian’s customer-centric leadership, Google Cloud has moved up to #6 in the Cloud Wars Top 10 on the strength of its recent $2B Q.

Microsoft just announced $11 billion quarterly cloud revenue, besting the combined totals of Salesforce, SAP, Oracle and IBM.

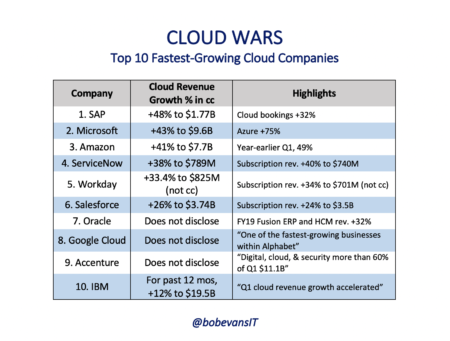

With Q2 earnings about to drop, I’m expecting more hypergrowth driven by the world’s fastest-growing cloud companies: SAP, Microsoft and Amazon.

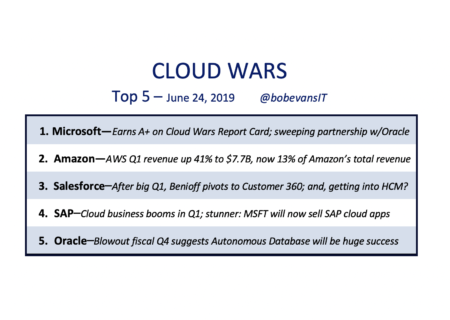

Microsoft is extremely likely to crack the $10 billion mark in quarterly cloud revenue when it posts its fiscal Q4 numbers on July 18.

On this first day of the second half of 2019, here are five Cloud Wars predictions about big trends that will define the rest of the year in the industry.

Five vendors stand out in today’s Cloud Wars: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, and a new addition to list: #5 Oracle.

A quick overview of how and why Oracle has jumped ahead of IBM in the Cloud Wars Top 10 rankings, moving from #6 to #5, as IBM growth lags behind.

My predictions: as they fuel the transformation of the global economy, the Cloud Wars Top 10 vendors will post a whopping $36 billion in Q2 cloud revenue.

As the enterprise cloud becomes without question the foundation for digital business, we’ve graded the Top 10 vendors. This is the Cloud Wars report card.

The three fastest-growing tech companies in the Top 10 each rang up revenue-growth rates of 41% to start 2019. Here’s my take on the top cloud vendors, Q1.

IBM is a major Cloud Wars player, with cloud revenue of $19.5B for the 12 months ended March 31, but its Q1 earnings release reveals a lagging growth rate.

At its Next ’19 conference, Google Cloud announced Anthos, a hybrid platform will put Microsoft and Amazon to the test and raise customer expectations.

After we shared a Cloud Wars Top 10 by revenue, some readers asked about the leading cloud vendors’ growth rates. Here’s our breakdown and analysis.

SAP on its own and Microsoft and Adobe together look to turn the CRM marketplace upside-down and position Salesforce as a behind-the-times “legacy” vendor.

As the first quarter of 2019 draws to a close, here is the one key question for each of the top 10 cloud vendors in the world.

The biggest surprise to me on the top 10 cloud vendors revenue list is Accenture, a big-time player with 2018 cloud revenue of $9 billion, up 23% from 2017.

The Cloud Wars CEO priorities offer an intriguing picture of where those companies’ customers—the world’s leading businesses—are headed.