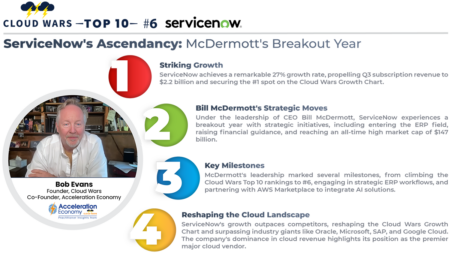

ServiceNow, led by CEO Bill McDermott, claims the top spot on the Cloud Wars Growth Chart with a 27% growth rate, outpacing competitors and achieving key milestones in a breakout year, reshaping the cloud landscape.

Snowflake

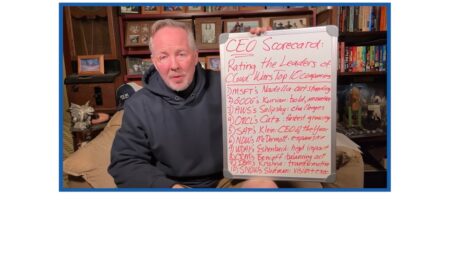

The Cloud Wars Top 10 companies, with a combined market cap exceeding $7 trillion, have experienced a range of performance in 2023, with CEOs including Microsoft’s Satya Nadella and SAP’s Christian Klein standing out.

Insights into the strategies and performances of the Cloud Wars Top 10 top CEOs, highlighting their impact on company growth, innovation, and customer-driven alliances.

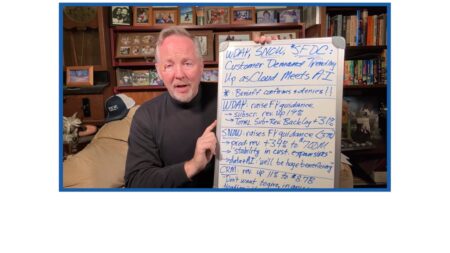

Major enterprise vendors, Workday, Snowflake, and Salesforce, collectively reveal a robust fiscal-Q3 with strengthened customer spending, notable revenue surges, and strategic positioning.

A look at Q3 earnings reports from major cloud companies (Workday, Snowflake, Salesforce), emphasizing the consistent surge in customer demand, while noting Salesforce’s CEO, Marc Benioff, skillfully balances cautious language with optimistic insights about AI and enterprise technology trends

Customer demand for AI is so high that budget considerations are not a gating factor, according to Snowflake CEO Frank Slootman.

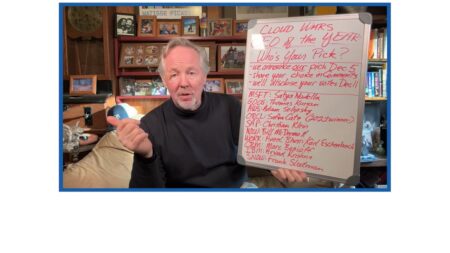

Who is the Cloud Wars CEO of the Year? A call to vote for your pick for Cloud Wars CEO of the Year.

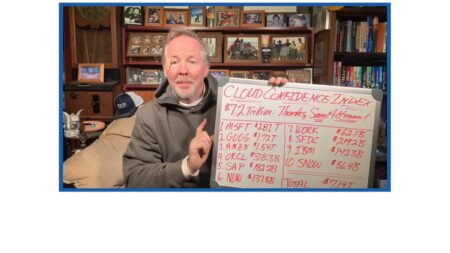

Sam Altman’s recent employment shifts between OpenAI and Microsoft triggered a remarkable $100-billion surge in the Cloud Wars Cloud Confidence Index.

The Cloud Confidence Index hits a record $7.2 trillion, reflecting heightened interest in AI-driven innovation, with Sam Altman’s brief move to Microsoft adding intrigue and cementing Microsoft’s dominance in the cloud market.

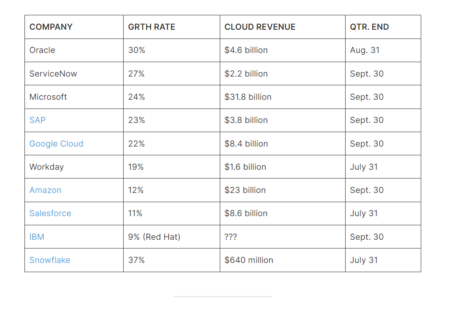

In the Cloud Wars landscape, Oracle leads with a remarkable 30% growth rate, closely followed by ServiceNow and Microsoft at 27% and 24%, respectively, with Microsoft’s FY24 Q1 standing out as an extraordinary quarter, contributing $6.1 billion in incremental cloud revenue.

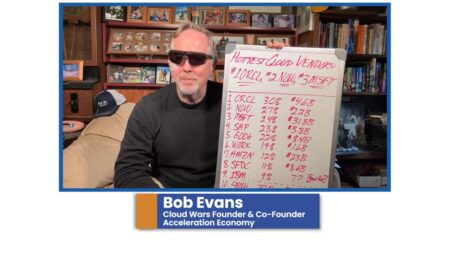

In the latest Cloud Wars Minute, Oracle leads the hottest growth companies with a 30% growth rate, hitting $4.6 billion in cloud revenue.

Q3 results show Microsoft, Google Cloud, and AWS have unique responses to evolving market dynamics, along with insight into the potential disruptor, Oracle.

With new LLM Mesh, Dataiku and several launch partners aim to make it easier to adopt generative AI while centralizing administration and enabling permission controls.

An update on the growth trends of top cloud companies, categorizing them into four groups based on their revenue growth rates.

A ranking of the cloud vendors, highlighting Oracle’s top ranking, Microsoft’s exceptional volume, and AWS’ slowing growth.

Snowflake CEO Frank Slootman notes that business customers have shifted from extreme cost-cutting measures to a more confident outlook, resulting in improved spending on data technologies and cloud-based services.

The Cloud Wars Top 10 are in the thick of quarterly financial reports. The numbers and outlook are making it clear: some investment caution is dissipating.

New partnership combines Snowflake’s data warehousing platform with Nvidia’s GPUs to help businesses build generative AI applications with their proprietary data.

The Cloud Wars Top 10 companies are projected to generate $359.4 billion in cloud revenue in 2023, despite economic challenges, with Microsoft leading at a growth rate of 21.6%, while Oracle is the fastest-growing member with a 38.8% growth rate.

Projected growth rates for the Cloud Wars Top 10 companies in 2023 showcase the sector’s resilience and rapid expansion.