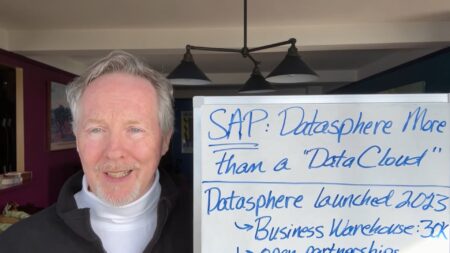

SAP intensifies focus on data with GenAI capabilities in Datasphere, refraining from “data cloud” terminology despite potential customer alignment.

Salesforce

SAP’s Datasphere platform plays a significant role in the evolving landscape of cloud technologies and data management, with implications for customer decision-making.

Oracle announces 40 AI deals totaling $1 billion and strong Q3 cloud growth at 25% to $5.1 billion as well as reveals plans for the world’s largest AI data center.

AI Ecosystem Report Ep 30: ServiceNow and Nvidia expand their existing partnership to integrate GenAI offerings; Bria secures funding for its infringement-free image generation platform; and Salesforce releases Einstein Copilot.

Salesforce introduces Einstein Copilot, a GenAI offering leveraging proprietary company data to provide contextual answers within CRM applications.

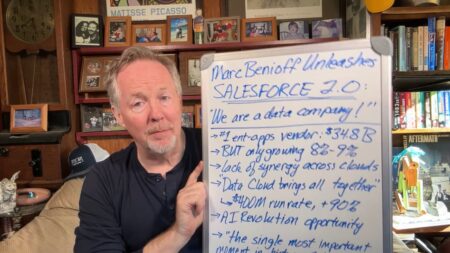

Salesforce CEO Marc Benioff declares the company’s transformation into a data company amid slowing growth projections for its core business.

Salesforce is making a strategic shift towards prioritizing higher margins over growth, which entails a new focus on its identity as a data company and addressing challenges in synergy among its legacy clouds.

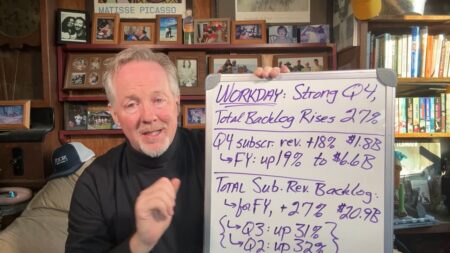

Workday’s recent strong fiscal performance includes impressive subscription revenue growth and substantial backlog.

Highlighting optimistic subscription-revenue trends for Workday, decoding Salesforce’s cautiously optimistic signals for a potential growth turnaround, and expecting continued strong growth for Snowflake driven by AI and expanding data initiatives.

The cloud software giant joins the National Institute of Standards and Technology’s US AI Safety Institute Consortium as a member of its inaugural class.

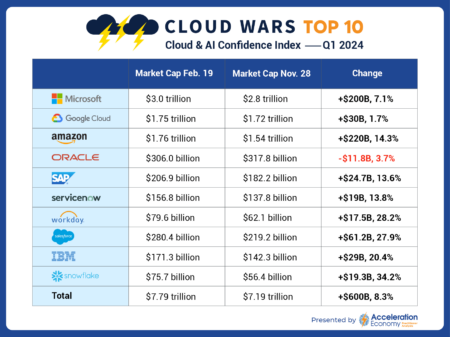

Snowflake, Workday, and Salesforce experience the greatest market cap percentage gains among the Cloud Wars Top 10. The index reflects customer confidence in these firms.

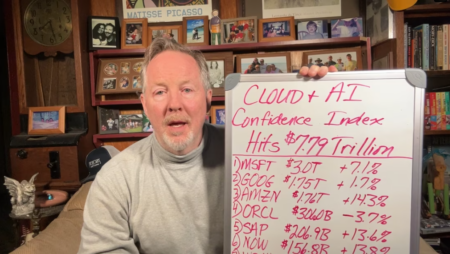

The Cloud Wars Cloud and AI Confidence Index reaches an all-time high, led by Microsoft, Google, and Amazon, which all gained well over $1 trillion in market cap.

SAP CEO Christian Klein is making a substantial commitment to Business AI, investing $1.1 billion and shifting 8,000 positions amid the GenAI Revolution.

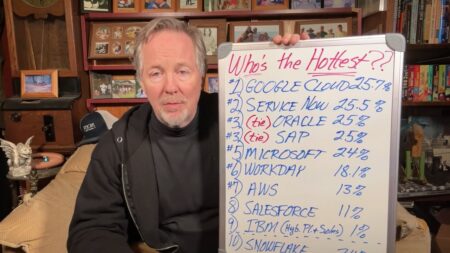

Google Cloud claims the #1 spot in the Cloud Wars growth chart with a 25.7% growth rate and $9.2 billion in revenue, amid shifting industry dynamics.

Google Cloud has a narrow lead on the Cloud Wars growth chart; Microsoft’s growth is remarkable; and the GenAI Revolution continues to impact the top cloud vendors.

A reflection on Microsoft CEO Satya Nadella’s tenure, which has seen the remarkable transformation from a ‘Cloud-First’ vision to Microsoft’s dominance in the cloud.

Siemens, Salesforce have co-created software to help manufacturers become more service-centric, upgrade customer experiences, and drive revenue growth.

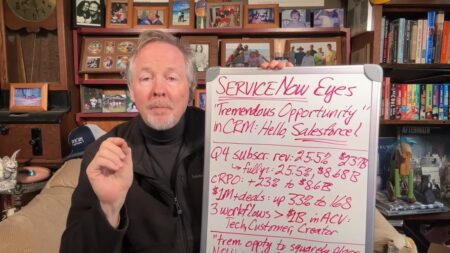

ServiceNow aims to enter the customer-relationship management (CRM) sector, with CEO Bill McDermott citing a “tremendous opportunity” to reshape CRM through AI-powered workflows.

Overview of business intelligence and reporting tools to watch delivers an explanation of key features such as AI-enhanced analytics, data visualization, and cloud functionality.

ServiceNow has had substantial subscription revenue growth and is making a strategic pivot into Customer Relationship Management (CRM).