With projected Q3 cloud revenue hitting $4.7 billion, SAP’s growth outpaces competitors Salesforce and Oracle.

revenue

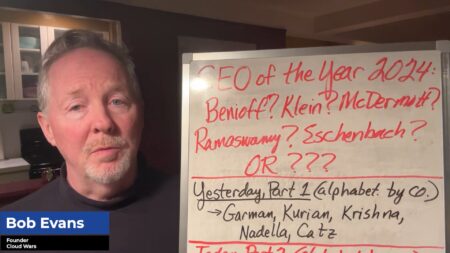

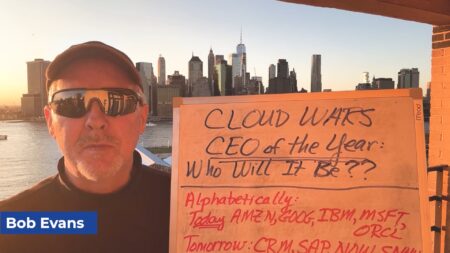

CEOs from leading cloud companies are driving innovation in AI, business transformations, and customer engagement in 2024, displaying visionary leadership and building modern partnerships.

Meet the cloud leaders pushing the boundaries of innovation, leading the way toward Cloud Wars CEO of the Year recognition.

A look at five cloud CEOs reveals their leadership and strategic successes as they are considered for the 2024 CEO of the Year award.

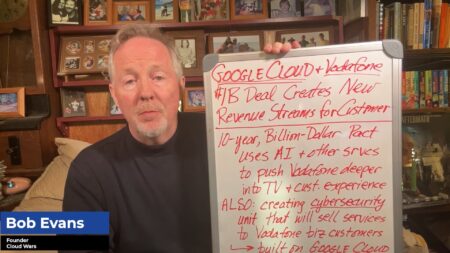

A new Google Cloud and Vodafone partnership exemplifies the power of cloud technology in enabling businesses to innovate, transform, and create new revenue streams.

Microsoft’s delay in recognizing security as a top priority has raised questions about its previous focus and fostered skepticism about its ability to create a genuine security-first culture.

Microsoft faces scrutiny over its commitment to enhancing cybersecurity, as it announces new security priorities while grappling with past failures and ongoing challenges.

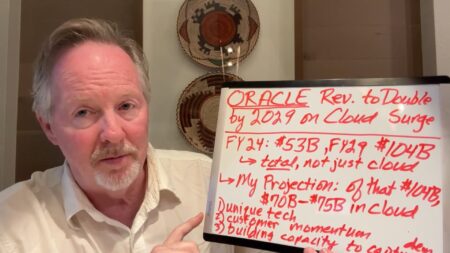

Oracle is capitalizing on its booming cloud infrastructure and strategic multicloud deals to drive substantial revenue growth and innovation across its portfolio.

Oracle is aggressively expanding its cloud infrastructure and data center capabilities, projecting significant revenue growth driven by robust demand and strategic multicloud partnerships.

Amazon’s GenAI assistant, Q, has not only showcased its advanced capabilities but also delivered remarkable financial and operational benefits.

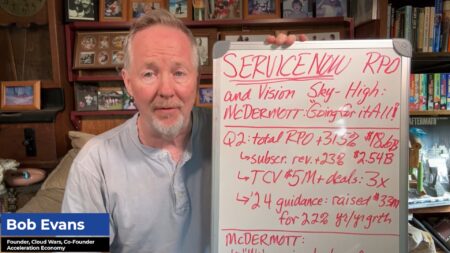

Salesforce’s growth is lagging behind faster-growing ServiceNow, raising questions about the company’s future competitiveness in the cloud and enterprise apps markets.

Marc Benioff’s comments about ServiceNow belie ServiceNow’s superior growth and market performance compared to Salesforce.

As SAP experiences its best market performance yet, the unexpected exit of key leaders prompts speculation about the company’s next move.

Microsoft’s recent cybersecurity challenges, including major Azure outages and a critical response to CEO Satya Nadella’s handling of enterprise security, are discussed.

ServiceNow’s impressive Q2 results are a reflection of CEO Bill McDermott’s ambitious vision for industry-wide transformation through AI and digitization platforms.

SAP reports strong Q2 growth driven by high demand for Business AI solutions and cloud migrations, significantly outperforming competitors

Google Cloud’s strategic fusion of AI innovation and robust cloud services has propelled it to market-leading growth.

A massive software outage impacting Microsoft customers underscores the need for IT resiliency, resources that can respond quickly when systems go down.

SAP has surpassed Salesforce in market cap, signaling greater public confidence in its growth potential amid the GenAI Revolution.

AWS is expected to achieve or exceed a 17.2% growth rate in Q2, driven by robust demand for GenAI and its other AI services including Bedrock and SageMaker.