Oracle is using its multicloud partnerships with Microsoft, Google and AWS to reignite its core database business. It aims to reach $20 billion in revenue within five years by riding the AI inference wave and offering flexible multicloud deployment.

revenue

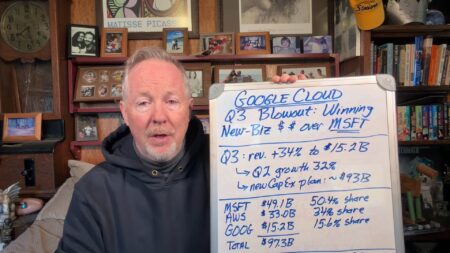

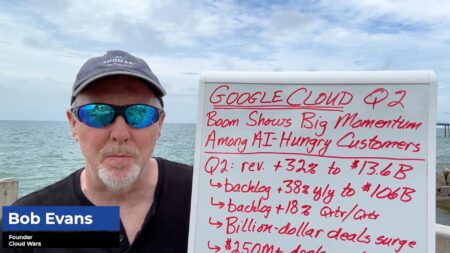

Google Cloud’s Q3 2025 saw explosive 34% growth, a $155B backlog, and more billion-dollar AI deals than the last two years combined, cementing its rise as the AI-first cloud powerhouse.

Google Cloud is growing significantly faster than Microsoft and AWS, signaling a shift in who’s winning new AI business despite trailing in total revenue.

Microsoft Azure’s Q3 share slips as Google Cloud gains momentum in new customer acquisition and market performance.

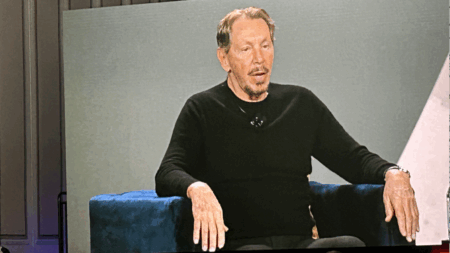

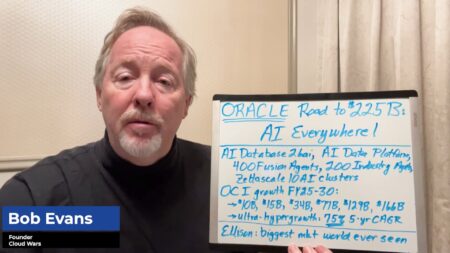

Oracle is aiming for $225B in revenue within five years by leveraging AI, multicloud, and cross-industry ecosystems to transform customers and entire industries.

Fusion AI agents, new AI databases, and massive data centers fuel Oracle’s unprecedented growth outlook.

Oracle Database proves the “Oracle Killer” crowd wrong yet again, posting surging Q1 cloud growth and unmatched AI-era positioning.

Oracle’s 359% RPO spike to $455B dwarfs competitors, narrowing revenue gaps with hyperscalers.

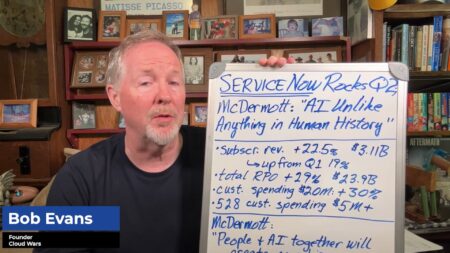

Salesforce and ServiceNow are each investing $750M in Genesys, strengthening partnerships to deliver AI-powered, orchestrated customer experiences.

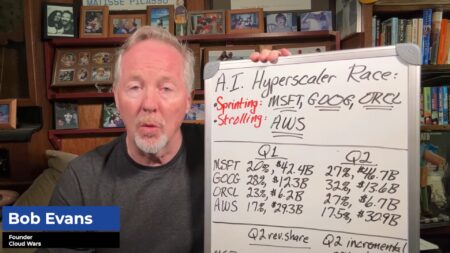

AWS’s strong Q2 results falter when compared to the accelerated AI-driven growth of Microsoft, Google Cloud, and Oracle.

Microsoft, Google Cloud, and Oracle are accelerating cloud growth and capturing more AI-driven business, while AWS lags behind in both pace and market share gains.

Microsoft just delivered the greatest quarterly financial results in the history of business — period.

In Q2, IBM showcased how AI is expanding — not replacing — its legacy products, with strong adoption of AI-assisted tools for mainframes.

ServiceNow positions itself as an AI platform, not an app or infrastructure vendor, per McDermott.

Google Cloud’s explosive Q2 growth in revenue, backlog, and AI momentum positions it as a serious contender to challenge Microsoft’s long-standing dominance in the Cloud Wars.

Google Cloud’s AI-native infrastructure and enterprise partnerships are fueling its fastest growth rate in years.

SAP’s Q2 cloud revenue rose 24% to $6B, marking a slowdown from past quarters but still outperforming major competitors like Oracle and Salesforce.

Microsoft’s 15,000 layoffs are a strategic move to retool for an AI-driven future, not just cost-cutting.

The Cloud Wars Top 10 have secured $915B in contracted future business, signaling extraordinary long-term demand for cloud and AI services.

Microsoft and ServiceNow collaborate to advance AI-powered agent-to-agent communication.