A reflection on Microsoft CEO Satya Nadella’s tenure, which has seen the remarkable transformation from a ‘Cloud-First’ vision to Microsoft’s dominance in the cloud.

IBM

Five process mining products to watch — from Abbyy, IBM, Mehrwerk, Microsoft, and ServiceNow — underscore the category’s increasing reach into automation, task mining, unstructured data, and more.

Overview of business intelligence and reporting tools to watch delivers an explanation of key features such as AI-enhanced analytics, data visualization, and cloud functionality.

IBM CEO Arvind Krishna emphasizes customer-centric innovation and co-creation, shifting from traditional selling to shared thinking, innovation, and opportunity with partners for mutual growth.

Organizations must get more technical and technology-oriented as well as stay committed to their customers’ success, IBM CEO Arvind Krishna says.

Key insights from an interview with IBM CEO Arvind Krishna on the company’s strategic shifts, customer-centric approach, experiential selling, and co-creation with clients and partners.

A look into the enduring significance of IBM mainframes, specifically COBOL’s lasting role in modern banking technology amid the rise of AI.

Innovation often comes from start-ups, but several of the biggest software firms — AWS, IBM, Microsoft — are able to prove their technology in their own complex supply chains.

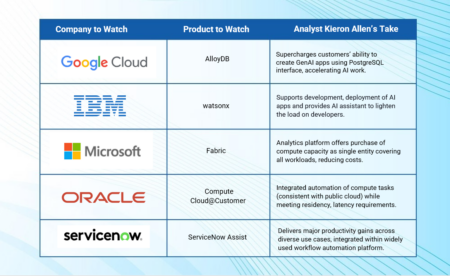

From generative AI to big data/analytics platforms to on-premise clouds, the Cloud Wars Top 10 have served up an innovative set of products to watch in 2024.

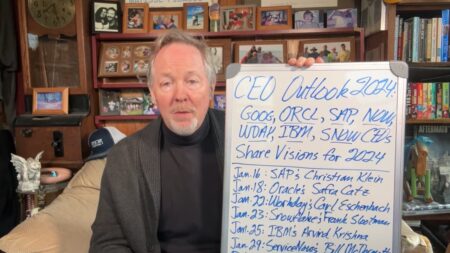

As technology and business strategies converge, the CEO Outlook 2024 series dives deep into insights from Cloud Wars Top 10 CEOs. Don’t miss the exclusive interviews, starting with SAP’s Christian Klein.

In the Cloud Wars Outlook 2024 series, CEOs from top companies including Google Cloud, Oracle, SAP, and more share insights on technology trends, culture, and strategic visions for the future.

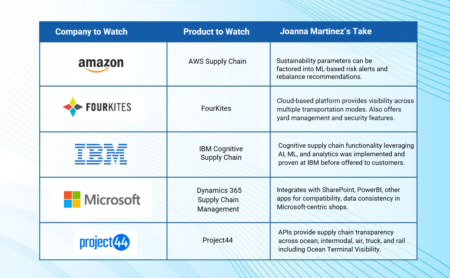

Our top products to watch this year range from applications with comprehensive supply chain functionality to transportation-focused specialty apps.

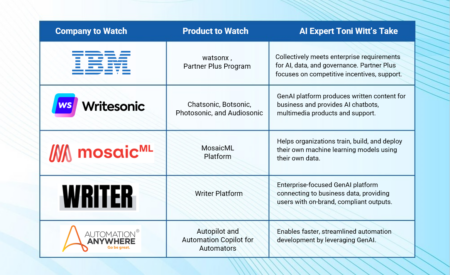

The top 5 generative AI products to watch feature platforms to build GenAI and machine learning apps, produce content, govern AI, and accelerate automation initiatives.

With its acquisition of StreamSets and webMethods, IBM enhances development speed, integration functionality for AI applications.

Cocreation partnership between AWS, IBM melds the best of their respective databases in the cloud while supporting modern AI workloads.

IBM’s Raj Datta explains how the company supports customers and drives growth with the IBM Partner Plus program.

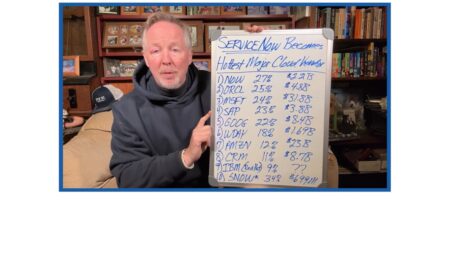

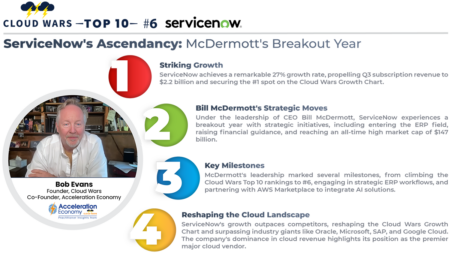

ServiceNow claims the top spot as the world’s hottest cloud vendor with a remarkable 27% growth rate, outpacing all the other Cloud Wars Top 10 companies.

ServiceNow, led by CEO Bill McDermott, claims the top spot on the Cloud Wars Growth Chart with a 27% growth rate, outpacing competitors and achieving key milestones in a breakout year, reshaping the cloud landscape.

With an expansive ecosystem strategy, IBM has once again asserted leadership around AI and its watsonx technology, taking a mature, differentiated approach.

IBM leaders share insights into the company’s evolving Partner Plus strategy, training available to partners, and go-to-market approaches optimized for AI.