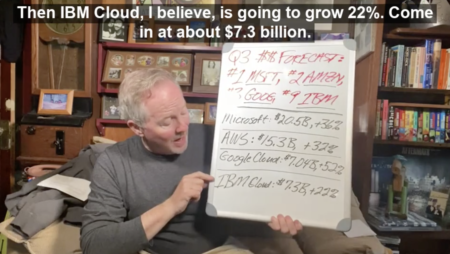

Bob Evans predicts that we’ll see $50 billion in Q3 cloud revenue from just 4 vendors, Microsoft, Amazon AWS, Google Cloud & IBM.

Google Cloud

In his keynote talk kicking off Google Cloud Next 2021, CEO Thomas Kurian noted 3 ways his company differs from archrivals Microsoft and AWS.

The market cap for Google Cloud parent Alphabet has risen 52% YTD in 2021; Salesforce up 30%; Microsoft up 27%; and Oracle up 26%.

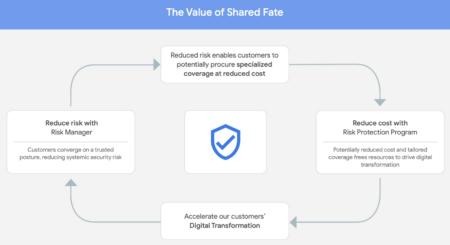

Read the Cloud Wars analysis on Tesla and its nascent car-insurance business and Google Cloud and its cybersecurity insurance business.

Recently, Google Cloud announced Supply Chain Twin technology. Bob Evans unpacks it and explores integration for other vertical industries.

In this Cloud Wars Live episode, I talk with Rob Enslin of Google Cloud about culture, his mindset regarding customers and priorities & more.

With Rob Enslin taking responsibility for tripling the size of the sales organization, Google Cloud has been on a high-growth tear.

Supply Chain Twin from Google Cloud, which fuses two extremely vital digital-business processes, gets my vote for the Product of the Year.

On the Q1 earnings call yesterday, Ellison said that Oracle Cloud has reached a $10B annualized run rate—but he didn’t stop there.

Setting a torrid pace in the greatest growth market the world has ever known, the Cloud Wars Top 10 vendors generated $60 billion in Q2 cloud revenue with #1 Microsoft, #2 Amazon, and #3 Google combining for $39 billion.

Infor has now decided in essence to bet the company on the R&D muscle of cloud-infrastructure partner Amazon.

The recent Amazon-Workday reset and Workday’s subsequent engagement with Google Cloud underscore the need for cloud-ecosystem nimbleness.

In its Q4 earnings call, Microsoft disclosed fiscal-year cloud revenue numbers: almost $70 billion on broad-based growth across its empire.

Microsoft posted cloud revenue for the quarter ended June 30 of $19.5 billion, 31% higher than the Q2 cloud revenue from Amazon AWS.

Its databases and analytics technologies are helping to drive breakneck recent growth for Google Cloud under CEO Thomas Kurian.

Delivering an astonishing Q2, Google Cloud spiked its revenue by 54% and slashed its losses by 59%. Could it be the world’s #2 cloud vendor?

Business Challenge – Staying Ahead of Demand As a leading global online marketplace, Etsy has more than 2.8 million sellers…

Technology is ever advancing and so are the cyber threats. Therefore, security is so important to your business and its…

Google Cloud lost $5.61B in calendar 2020, but through revenue hypergrowth it is rapidly narrowing its losses and building momentum.

Deutsche Bank recently disclosed a slew of innovations and goals it has already engineered as part of its 10-year deal with Google Cloud.