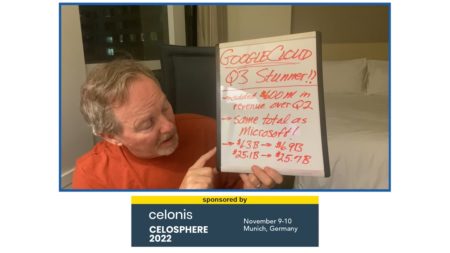

In a stunning Cloud Wars Top 10 development, Google Cloud added as much new cloud revenue as market leader Microsoft, continuing to show that its business is on an upward trajectory.

Google Cloud

In episode 23 of the Growth Swarm podcast, John, Bob, Scott, and Tony share major themes – customer centricity and partner ecosystems – that were prominent at three recent tech events.

In this Cloud Wars Moment, Bob applauds Google Cloud, which is 4x smaller than Microsoft, yet increased its cloud revenue by $6 billion and grew 37.5%.

On the heels of a cloud alliance with Microsoft, Kyndryl allies with Google Cloud, giving mainframe customers more cloud choices, as Tom Smith explains in episode 57 of the Cloud Wars Horizon Minute.

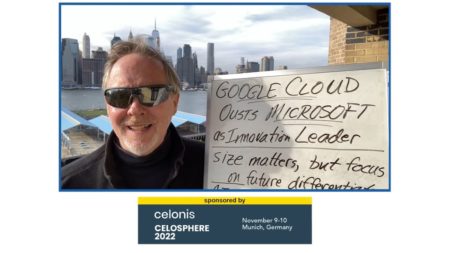

Microsoft has higher revenue, but in this article Bob Evans explains why the more upbeat, customer-centric, and innovative Google Cloud is the one to watch.

Kyndryl allies with Google Cloud to help customers move their mainframe applications to the cloud; it also deepens its Microsoft partnership.

In this episode, Bob Evans contrasts the different mindsets between the two cloud vendors, as well as highlights that Google Cloud has coming that help solidify its supremacy.

Google Cloud CEO Thomas Kurian is confident that the company is on the right track to profitability. Here’s what naysayers are getting wrong about its trajectory, writes Bob Evans.

In this Cloud Wars Minute, Bob is in New York City attending Google Cloud Next and shares some of the company’s recent big customer wins.

In this Data Revolution Minute, Pablo Moreno explains Google’s release of TensorStore, which is a framework designed to hold and process N-dimensional data. He says this is a perfect solution for training AI.

Acceleration Economy analyst and Paragon Films CIO Kenny Mullican shares data modernization tips from the tech executive’s perspective.

In this Cloud Wars Expo Moment, Hans Thalbauer discusses the need to provide supply chain professionals with visibility in order to create and implement solutions that promote business growth.

Seven reasons why Salesforce has been able to make the extraordinary journey to the pinnacle of the business apps software world.

With its impressive levels of growth, innovation, vision, and ambition, Oracle has earned its among its larger and seemingly untouchable competitors.

In this Cloud Wars Expo Moment, excerpted from the education sessions, Google Cloud’s Hans Thalbauer describes the main elements of a successful digital twin in the context of supply chains.

In this Cloud Wars Minute, Bob explains how Oracle has earned its place alongside hyperscalers Microsoft, AWS, and Google Cloud.

After the recent multi-cloud deals that Oracle made with Microsoft and AWS, will it announce a partnership with Google Cloud next? As Bob explains, the answer is likely ‘yes.’

Next month’s Oracle CloudWorld would be a great time to showcase a new agreement with Google Cloud, Bob Evans suggests.

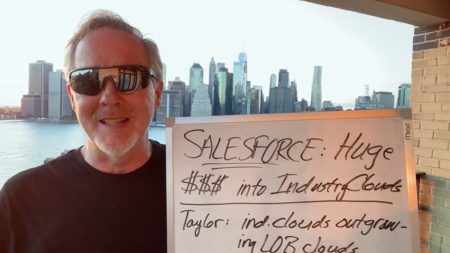

Salesforce has been heavily investing in its vertical market solutions, pushing the company to the #1 spot of the Industry Cloud Top 10.

In this Cloud Wars Minute, Bob breaks down statements made by co-CEO Bret Taylor during the Salesforce earnings call about why the company is making major investments into vertical market industry cloud solutions.