There have been changes in the Cloud Wars Cloud & AI Confidence Index; where the major cloud companies stand and what’s driving them to new heights.

Google Cloud

The Cloud and AI Confidence Index shows a 12.5% increase, with notable gains for Microsoft, Google, Oracle, and Amazon, while others face declines.

This guidebook offers insights from CISO Chris Hughes and CIO Kenny Mullican on maximizing multicloud benefits while mitigating its downsides.

Google’s Project Naptime utilizes AI to enhance vulnerability discovery and management, offering promising advancements in cybersecurity.

Partners ecosystem leader shares Workday’s latest thinking on co-creation vs. co-selling, working with hyperscalers, AI trust and how partners help customers drive results.

Alliance between AI software pioneer and Google Cloud aims to democratize access to government services for all citizens by tapping the power of GenAI.

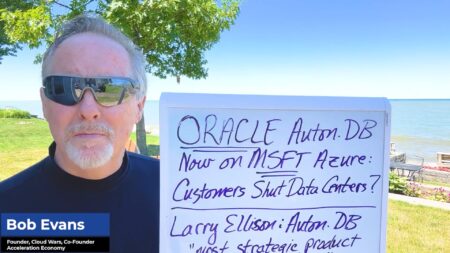

Larry Ellison’s commitment to embed GenAI across Oracle’s expansive product portfolio positions his company as a leader in the AI ecosystem, building on its history of tech innovation.

Breakthroughs in quantum computing from three Cloud Wars Top 10 firms, plus Honeywell, are opening up new frontiers in technology and industry applications.

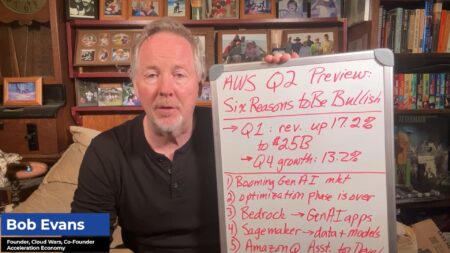

AWS is expected to achieve or exceed a 17.2% growth rate in Q2, driven by robust demand for GenAI and its other AI services including Bedrock and SageMaker.

AWS anticipates steady Q2 revenue growth driven by AI advancements and increased customer spending, according to Amazon CEO Andy Jassy.

Google Cloud partners and ISVs exec Stephen Orban discusses the ecosystem’s evolution in the AI era, how the company’s Partner Advantage increases deal sizes, and how AI is impacting cybersecurity.

AI Ecosystem Report Ep 47: Google continues updating its Gemini LLM; Axelera AI gains funds for edge computing AI chips; Sonia provides therapy services on mobile devices.

Google Cloud is dedicated to ensuring trusted AI and promoting cybersecurity vigilance throughout its partners ecosystem.

AWS’s growth in the cloud computing market includes success with its AI service Bedrock, boasting tens of thousands of customers, and demonstrates its competitive edge against Microsoft with a strong security focus.

SAP’s chief partner officer weighs in on co-creation, the AI-driven evolution of the partners ecosystem, as well as trust and cybersecurity considerations as partners engage with customers.

The expanded Oracle-Microsoft multi-cloud partnership now includes the Oracle Autonomous Database, enabling customers to accelerate their transition away from managing their own data centers.

Google Cloud’s Gemini 1.5 model significantly outperforms OpenAI’s GPT in speed, price, and context-window capacity, offering substantial benefits for enterprise applications.

A look at the fierce AI competition between Microsoft and Google Cloud, focusing on Google Cloud’s recent advancements and new product launches aimed at enterprise customers.

The AI Ecosystem Top 12 Pioneers made major advances in partnerships, language models, and productivity tools during June.

Workday explores new avenues for cloud partnerships, emphasizing innovation and customer-centric solutions in the enterprise sector.