As 2020 gets underway, and IBM prepares to release its Q4 2019 numbers, it’s perfectly clear that the #1 challenge IBM’s cloud business faces is growth.

Cloud Revenue

Taken on its own, the Microsoft $50 billion cloud business would make it one of the 3 largest enterprise-tech companies in the world.

SAP and Salesforce both held investor-day events last month, based on which I made some educated guesses as to their future cloud revenue accomplishments.

The cloud revenue for #1 Microsoft will exceed the combined total of four high-growth competitors’ cloud revenue for the quarter ended 9/30.

Q3 cloud revenue: for the 3 months ended Sept. 30, I expect that the Cloud Wars Top 10 vendors should combine for more than $40 billion.

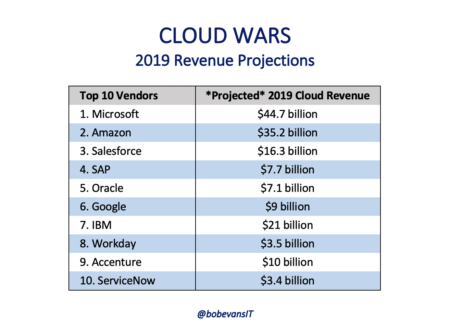

By my projections, the world’s top 10 enterprise-cloud vendors are poised to generate $158 billion in cloud revenue in calendar 2019.

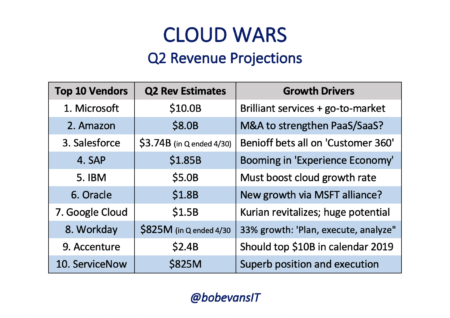

With Q2 earnings about to drop, I’m expecting more hypergrowth driven by the world’s fastest-growing cloud companies: SAP, Microsoft and Amazon.

My predictions: as they fuel the transformation of the global economy, the Cloud Wars Top 10 vendors will post a whopping $36 billion in Q2 cloud revenue.

On ServiceNow Q1 earnings call, the digital-workflow leader announced that it’s preparing to release a new employee-experience SaaS product. Here’s my take.

We didn’t get Google Cloud revenue numbers during the Alphabet Q1 earnings call, we did gain insights from Alphabet CEO Sundar Pichai and CFO Ruth Porat.

Toward the end of last week’s Amazon Q1 earnings call, CFO Brian Olsavsky made a point of mentioning AWS’s excellent performance. Here are my thoughts.

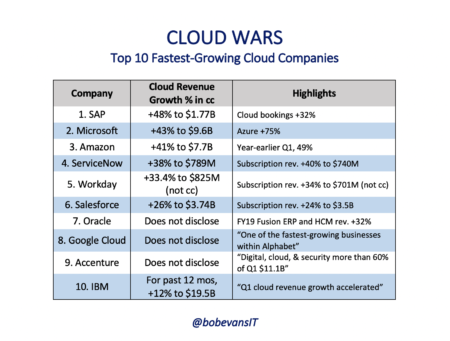

The three fastest-growing tech companies in the Top 10 each rang up revenue-growth rates of 41% to start 2019. Here’s my take on the top cloud vendors, Q1.

I pulled 10 stand-out themes from the announcement of Microsoft’s Q1 cloud revenue—which jumped 41% to $9.6 billion for the 3 months ended March 31.

SAP Q1 revenue results, announced yesterday, rocketed its stock price up 12%. Here’s my take on SAP’s transformation into a cloud-hypergrowth powerhouse.

This week, both Microsoft and Amazon will post earnings results on April 24. In this piece, I share my Q1 cloud revenue predictions and analysis.

What I see in IBM’s Q1 2019 earnings announcement: a smart new approach, making clear to the world that IBM intends to be a cloud-first company.

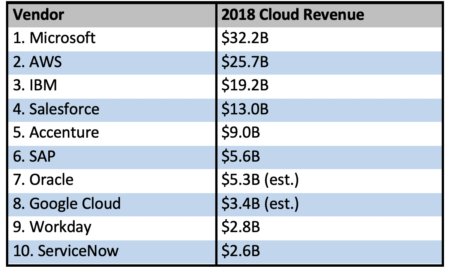

IBM is a major Cloud Wars player, with cloud revenue of $19.5B for the 12 months ended March 31, but its Q1 earnings release reveals a lagging growth rate.

After we shared a Cloud Wars Top 10 by revenue, some readers asked about the leading cloud vendors’ growth rates. Here’s our breakdown and analysis.

The biggest surprise to me on the top 10 cloud vendors revenue list is Accenture, a big-time player with 2018 cloud revenue of $9 billion, up 23% from 2017.

The Salesforce Q4 2018 earnings call revealed that the company is somehow managing to scale up an scale out in multiple dimensions simultaneously.