Despite AWS’s impressive scale and achievements, its rivals are gaining ground in other software-centered segments of the cloud. AWS may face challenges in the Cloud Wars going forward.

AWS

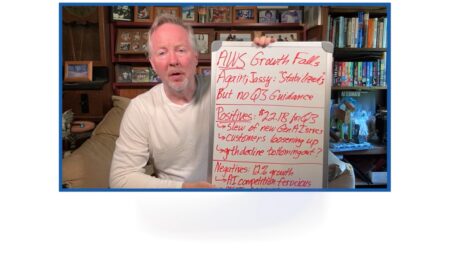

Amazon Web Services (AWS) experienced a decline in its growth rate for the seventh straight quarter amid fierce competition from Microsoft, Google Cloud, and Oracle.

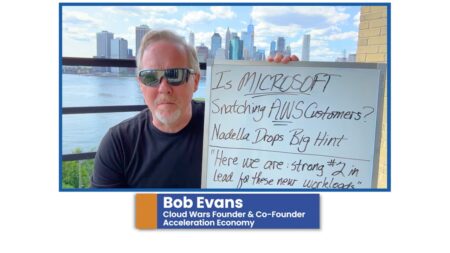

Microsoft’s strong fiscal Q4 performance can be attributed to its generative AI portfolio and the defection of some AWS customers to Azure.

Microsoft is experiencing significant growth in the cloud infrastructure market, particularly in AI workloads, potentially taking market share from AWS, which has seen a decline in its growth rate.

Amazon Security Lake capability enables organizations to centralize security data from various environments into a single purpose-built data lake.

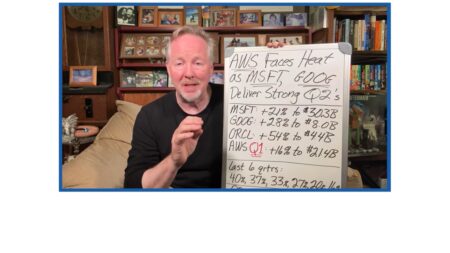

AI capabilities, generative AI customer count, and operating profits are just three of the reasons that Google Cloud replaced AWS on the Cloud Wars Top 10 list.

Google Cloud’s latest quarterly results and strong growth validate its elevation to #2 on the Cloud Wars Top 10, while they also highlight its strength in supporting AI customers.

Approaching the release of the Q2 financial results of Amazon, AWS’ growth rate decline stands out relative to Cloud Wars Top 10 adversaries.

Google Cloud and Microsoft’s impressive Q2 growth rates suggest that AWS needs to turn up the heat to keep up in the Cloud Wars.

AI Index Report episode 3: IBM releases watsonx.ai platform for enterprises; Databricks acquires MosaicML for $1.3 billion; and Amazon announces Amazon CodeWhisperer copilot.

Bob revisits the Cloud Wars Top 10 rankings as the latest growth rates of Oracle might move it up the ranks past Amazon’s AWS.

Per Oracle CEO Larry Ellison, Oracle MySQL HeatWave runs 1,000x faster than competitor AWS’ Aurora database, writes Bob Evans.

Oracle founder and chairman Larry Ellison stated on the company’s most recent earnings call that its MySQL Heatwave database is 1,000x faster than AWS Aurora.

Couchbase responds to customers’ pain points with new developer, deployment, and data modernization features in its Capella cloud database service.

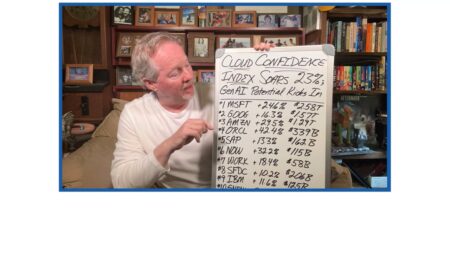

Over the last three months, the Cloud Confidence Index (overall) was up by 23.3% for a total market cap of $6.51 trillion. Bob Evans reports which companies stood out.

In the last three months, the Cloud Confidence Index grew 23%. A few of the Cloud Wars Top 10 companies stood out, and Bob Evans explains why.

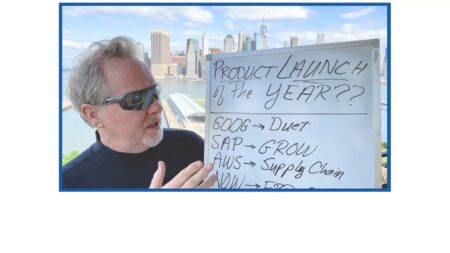

In this Cloud Wars Minute, Bob Evans reveals the product launch of the year — and you may be surprised by the results.

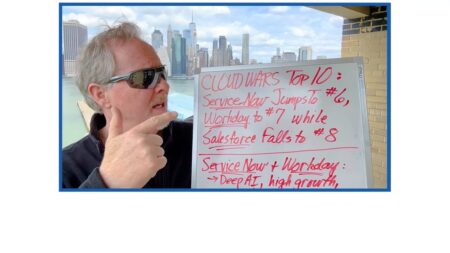

Bob Evans breaks down the latest changes to the Cloud Wars Top 10 ranking, in which ServiceNow, Workday, and Google Cloud moved up.

In the latest Cloud Wars Top 10 ranking, ServiceNow and Workday have moved up, while Salesforce has dropped.

Workday DevCon 2023 highlighted the company’s integration with AWS, machine learning, and artificial intelligence.