With the continuing uncertainty of the pandemic and the ever-present need to cut costs, now is the time to consider AP automation if you haven’t already.

Search Results: risk (1568)

Snowflake continued on its high-growth trajectory in Q4, with cloud revenue jumping 116% to $178M and overall revenue soaring 117% to $190M.

AP Automation category is going to continue growing. The question is: Have you implemented an AP Automation solution or strategy within your company?

Microsoft is preparing to compete in what could be the hottest cloud segment of 2021: industry-specific cloud solutions.

Artificial Intelligence is truly impacting the low-code/no-code landscape. But, is it a game-changer? Check out this podcast where I dive into AI and LC/NC, offer some areas to explore and leave you with options to consider.If you missed the first two episodes, be sure to check them out here:Episode 1: https://mydacfeed.com/view/video/back-it-the-low-code-no-code-evolution-part-1Episode 2: https://mydacfeed.com/view/video/back-it-low-code-vs-no-code-who-will-win-part-2Sources:Alogorithmia source: https://info.algorithmia.com/2020?utm_source=thenewstack&utm_medium=website&utm_campaign=platform OutSystems: https://www.outsystems.com/ Deloitte TruVoice: https://www2.deloitte.com/uk/en/pages/risk/solutions/truevoice.html Microsoft AI Builder: https://docs.microsoft.com/en-us/ai-builder/overview UIPath – RPA and AI: https://www.uipath.com/blog/ai-rpa-differences-when-to-use-them-together

As companies chart their path to recovery in a challenging business environment, finance departments are renewing their focus on reining in costs and positioning investments to improve controls and governance. Tax departments seeking to align with those priorities should consider one high-return move in particular: outsourcing sales and use tax returns.

The pandemic has fast-tracked many decisions around the embrace of technology. Understanding the expectations of regulators and government agencies is important to consider when implementing technology – and the risks of not considering compliance – especially for the financial services industry.

Manufacturers and distributors remove compliance risk and streamline their operations simultaneously when they automate with Avalara AvaTax.

Dealing with IRS scams can be an obstacle for taxpayers, businesses, and tax professionals during the upcoming tax season. Staying aware of the latest tax scams, which are shared publicly by the IRS each year, is important in keeping your money safe during this pandemic. Here is a brief overview of the latest IRS’s “Dirty Dozen” list of tax scams.

There’s no question that COVID-19 will continue to affect manufacturing trends in 2021. While the pandemic has had a heavy impact on the manufacturing industry in 2020, it has also positively affected manufacturers by giving them a push toward focusing their business strategies online.With this changing landscape due to COVID-19, we wanted to find out what manufacturing industry trends were going to impact manufacturers in 2021 and beyond. To do so, we commissioned independent research company, Sapio Research, to find out just that. In this blog, you’ll find the top 5 manufacturing trends to watch out for in 2021 and beyond, based on the research.For the full report on the top e-commerce challenges that are putting manufacturers’ relationships at risk in 2021 download “The Manufacturing & E-Commerce Benchmark Report.”

Not every organization is facing digital transformation from the same starting line; it is important to evaluate internally and strategize the next steps.

GNC Holdings Inc. – a global specialty retailer of health and wellness products – is making big digital strides. In this case study, learn about how GNC is leveraging personalization AI solutions and E-commerce investments to strengthen the customer experience.

AI doesn’t offer a one-size-fits-all solution for businesses, but it provides an answer for particular scenarios or problems in the workplace. In this article, understand the key factors CIOs need to consider before and during the implementation of AI technology in their business.

As ransomware attacks increase in frequency and complexity, businesses need to be on the lookout. Often, data breaches are due to basic and avoidable cybersecurity gaps. Learn how to address existing cybersecurity concerns and respond quicker and more thoroughly against these evolving threats.

SharePoint Security Sync integrates Dynamics 365 CRM & PowerApps with SharePoint to provide seamless document management and security for confidential documents stored in SharePoint. By syncing Dynamics 365 CRM security privileges with SharePoint, it helps to maintain data confidentiality and eliminate security risk while storing documents in SharePoint. It further enhances user experience in document management by providing various functions such as drag & drop, upload, download, generate link, email, and much more within Dynamics 365 CRM & PowerApps.

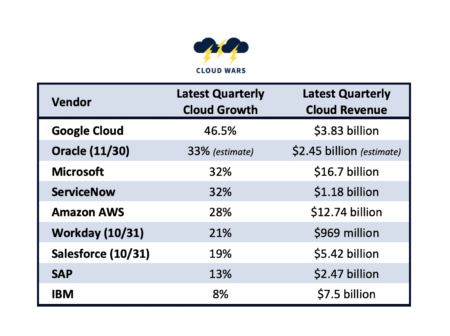

Google Cloud Q4 growth happened far more rapidly than any other cloud provider, but that’s not because the others were slacking.

“Automate your entire AP process from invoice receipt through payment.

Learn how Bottomline’s Paymode-X AP automation solution can take outdated, paper-based invoice and payment processes and convert them in a single solution that:

• Streamlines invoice workflows and improves visibility

• Centralizes all your B2B and B2C payments including ACH, check, virtual card

• Seamlessly integrates with your ERP

• Reduces costs, errors and risk”

“It’s easy to focus on the inefficiencies and risks within accounts payable, but what if AP automation allowed you to see AP in a new light. This two-minute video reveals how Bottomline’s automation solution can help your company:

* Digitize and accelerate the entire invoice-to-pay process

* Capture early payment discounts and earn rebates on your AP spend

* Alleviate the burden on IT

With Bottomline as your strategic partner, you can transform your AP department from a cost center to a profit center. “

California’s new groundbreaking law, Prop 24, is the first US government watchdog law targeting data protection and privacy. This law will become effective in 2023 and protect nearly 40 million people. California Prop 24 is just the start of potential federal privacy regulations. Use this piece to future-proof your company for a National Privacy Law.

How can CPO’s ensure an inclusive approach to their supply chain?In this piece learn how to implement supplier diversity and why “procurement with purpose” is important for your business.