Sam Altman’s recent employment shifts between OpenAI and Microsoft triggered a remarkable $100-billion surge in the Cloud Wars Cloud Confidence Index.

Search Results: customer success (1580)

At Celosphere 2023, Mark Klein of ERGO Group explains how the insurer has applied Celonis process mining software over the past year in the insurance business.

AI Index Ep 17: Announcements from OpenAI’s DevDay; Lidl Invests in startup Aleph Alpha; and Carmax integrates a new AI feature.

Establishing a strong working relationship between the CISO and the CIO is crucial for the overall success and security of a company, writes Kenny Mullican.

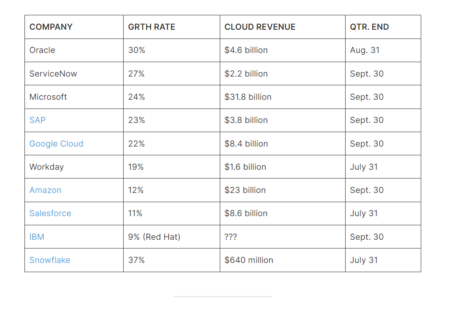

In the Cloud Wars landscape, Oracle leads with a remarkable 30% growth rate, closely followed by ServiceNow and Microsoft at 27% and 24%, respectively, with Microsoft’s FY24 Q1 standing out as an extraordinary quarter, contributing $6.1 billion in incremental cloud revenue.

At its DevDay developer conference, OpenAI made major announcements regarding new products and changes, particularly advancements with GPTs

Oracle’s Larry Ellison and Microsoft’s Satya Nadella are redefining competition and collaboration norms

With its NorthPole chip optimized for AI inferencing, IBM builds on its history in hardware and chip design, and advances one of the key foundational elements of AI apps.

Actionable data is necessary to drive marketing and sales success. Steps including validation, enrichment, and standardization are needed to ensure data is actionable.

Q3 results show Microsoft, Google Cloud, and AWS have unique responses to evolving market dynamics, along with insight into the potential disruptor, Oracle.

A look at AWS’s Q3 2023 revenue growth, highlighting its 12% rate and raising questions about its ability to adapt to changing customer needs.

At its annual customer conference, UiPath unveils generative AI-driven ‘Autopilot,’ trust and governance functionality, as well as an expanding alliance with SAP.

With its new copilot, SAP helps customers of its wide range of applications access contextually relevant data in their regular workflows.

SAP is enhancing its RISE go-to-market offering with new pricing and product tiers to convince its 25,000 on-premises customers to migrate to the cloud.

Oracle’s chairman, Larry Ellison, predicts that billion-dollar deals in the GenAI infrastructure market will become the norm.

SAP CTO Juergen Mueller discusses the GenAI revolution and the future of cloud innovation.

Oracle’s top executives commit to not raising prices for GenAI features in contrast to their competitors.

A conversation on the partnership between Automation Anywhere and Cognizant, focusing on transforming industries through Intelligent Automation.

At its Imagine 2023 customer event, Automation Anywhere unveiled its expanded generative AI-powered automation tools, adding greater speed and efficiency to its automation platform.

Oracle and Microsoft are embarking on a transformative cloud partnership with potential to reshape the tech industry’s approach to collaboration for improved customer outcomes.