Supply chain leaders have been under the gun for the past 2+ years – facing massive disruptions from a variety of sources while they simultaneously deal with pressure from customers, regulators, and boards of directors to drive sustainability increases.

They’re so under the gun on sustainability, in fact, that more than half of Chief Supply Chain Officers (CSCOs) recently surveyed said that they’re prepared to sacrifice some amount of profit to achieve sustainability gains.

The research report, called the Resilient Digital Supply Chain, was fielded in the first quarter of 2022 by IBM’s Institute for Business Value (IBV) in partnership with Celonis, a provider of execution management software.

“Even though recent IBV research has shown sustainability can positively affect revenue growth, 51% of CSCOs are willing to – perhaps unnecessarily – sacrifice profit to improve sustainability outcomes,” the report says. It even quantifies the tradeoff they’re willing to make: on average, 5%, which the report notes would equate to $22 billion in lost profit for Fortune 500 companies in a single year.

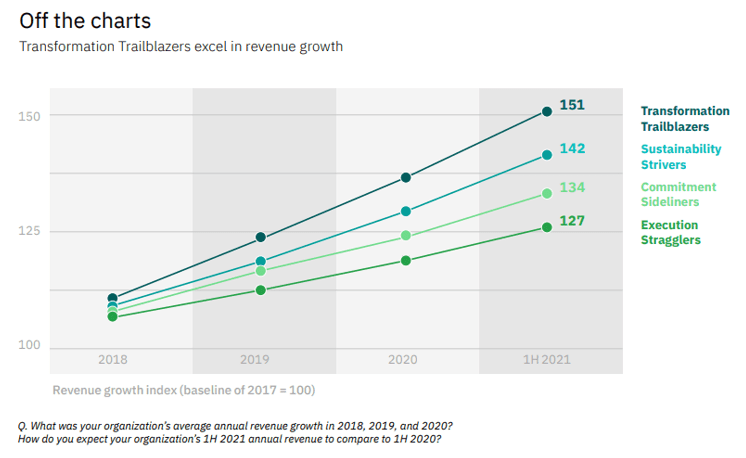

Yet research that IBM conducted in late 2021 supports what I consider an important counterpoint to this thinking. Namely, that positioning sustainability at odds with growth and profitability sets up a false dichotomy (and some major cloud vendors seem to agree). That earlier IBM research found that sustainability leaders – “trailblazers” who approach sustainability as a business opportunity — grew revenue at 51% over the time period measured — 21% higher than the next closest category, which grew at 42% over the same period.

The key differentiator will be how execs approach the sustainability challenge: problem or opportunity, the study indicates: “CSCOs who advance higher-value, forward-looking strategic initiatives can distinguish themselves from peers who struggle just to manage the present…envisioning the supply chains of tomorrow is essential to succeeding today.”

Stated differently, which CSCOs will approach sustainability as a compliance/regulatory issue, and which ones will approach it as a means to develop better products that appeal more to customers and command premium prices? Winners and losers in the race to sustainability could be determined by how that question is answered.

What’s the problem?

Virtually every business-to-business and business-to-consumer buyer has directly experienced supply chain disruptions in recent times: products out of stock due to labor and materials shortages, soaring transportation and logistics costs that increased product and delivery prices, unexpected demand spikes, and more. The most frequently cited cause of supply chain disruptions in the Resilient Supply Chains survey is demand volatility, cited by 80% of respondents. A sampling of other responses: 74%, employee wage inflation; 64%, supply base inventory availability.

The situation has resulted in a number of tactics being employed to ease the supply chain pain: 52% of CSCOs have sought alternate types of transportation and logistics capabilities and 41% have worked with alternate suppliers.

Some others are also taking a strategic approach, re-evaluating their tech infrastructure to make their supply chains more resilient and leveraging data for competitive advantage: 67% are using data to enhance sustainability initiatives, 64% are using data to uncover new business opportunities, and 51% are applying AI to reveal new insights.

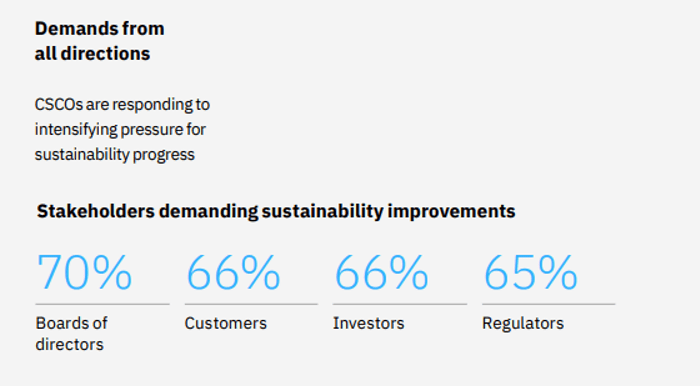

Against these supply chain disruptions, the pressure to increase sustainability is coming from above (boards of directors) as well as customers, investors, and regulators – all of whom are demanding sustainability progress.

While CSCOs say sacrificing profitability is on the table as a potential sustainability tradeoff, there isn’t universal agreement that’s needed. But that finding “underlines the commitment companies are making and saying we take this so seriously that we would sacrifice profit,” says Janina Nakladal, global director of sustainability at Celonis. But that sacrifice may not even be necessary.

Learn practical ways to optimize your supply chain, at Cloud Wars Expo June 28-30 in San Francisco. You’ll learn from real-world CXOs who’ve built supply chains that deliver great results.

“Sustainability doesn’t kill profit. That’s the thing we’re seeing more and more,” Nakladal says. “It might not be that every sustainable action immediately increases revenue or decreases cost.” But it can increase customer satisfaction and attract great talent, she notes. And recall the finding above: “trailblazers” who excel at sustainability execution also excel at revenue growth. Note that just 13% of those in IBM’s research meet the standards of a trailblazer, so there’s much more work to be done.

“Sustainability doesn’t kill profit. That’s the thing we’re seeing more and more,” Nakladal says. “It might not be that every sustainable action immediately increases revenue or decreases cost.” But it can increase customer satisfaction and attract great talent.

Janina Nakladal, Celonis

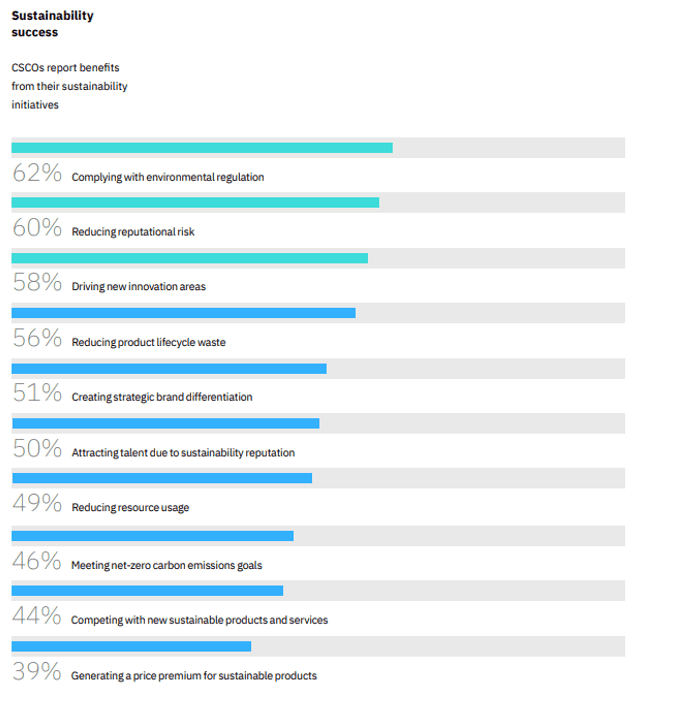

Strategic benefits reported from sustainability initiatives include creating brand differentiation (51% of respondents), attracting talent due to sustainability reputation (50%), and even generating a price premium for sustainable products (39%). But those benefits are reported by smaller percentages of CSCOs than benefits such as complying with environmental regulation (62%) and reducing reputational risk (60%). Nakladal said she expects to see companies report more of those strategic benefits in higher numbers in the future. That, of course, would be a welcome development.

Getting Proactive with Technology

While the level of sustainability priorities and focus varies, CSCOs are moving to deploy technology that should make their supply chains more robust and resilient, contributing to the strength of their sustainability efforts:

- By 2025, 83% plan to introduce AI-enabled real-time inventory management

- 81% are looking to AI-enabled processes and workflows for real-time “demand sensing” to get a better handle on their customers’ needs

- 74% say hybrid clouds – a combination of public cloud and, typically, a closed-end system that is operated by companies within a vertical industry – are critical to digitally transform supply chains.

- 87% are implementing execution management, and 77% are implementing process and task mining

Closing thoughts

While some CSCOs gave provocative responses about their willingness to make tradeoffs in favor of greater sustainability performance, a more likely scenario is that they continue to expand their use of advanced technology platforms (execution management or industry cloud systems that contribute to sustainability initiatives, AI, hybrid clouds) that will allow them to kill two birds with one stone: improving their supply chains and their sustainability results. Anything less feels shortsighted.

For more in-depth insights on the categories that matter from top experts, register now for the Cloud Wars Expo.