As the rush to digital business accelerates in 2019, the Cloud Wars’ most intense battles will be waged around applications as CRM leader Salesforce.com rolls out a slew of new products and programs and megavendors SAP and Oracle race to keep up in the massive market for customer-engagement solutions.

For Salesforce, 2019 will be all about pushing its Customer Success Platform—a topic that dominated its recent upbeat quarterly earnings call—and continuing to expand and raise the profile of its fast-growing partner organization to extend the business impact of its CRM suite.

For Salesforce, 2019 will be all about pushing its Customer Success Platform—a topic that dominated its recent upbeat quarterly earnings call—and continuing to expand and raise the profile of its fast-growing partner organization to extend the business impact of its CRM suite.

At SAP, CEO Bill McDermott is looking to do nothing short of redefining the enterprise-apps space by interconnecting the formerly disparate and mostly fragmented categories of CRM, ERP and HCM.

And Oracle recently noted that for the trailing 12 months, its total applications business—both on-premises and cloud, and including annual maintenance fees—now exceeds $11 billion, with its internally developed Fusion Cloud ERP business growing at 44%.

But for all their successes in the booming world of SaaS, both SAP and Oracle remain far behind Salesforce, and as evidenced by their commentary during their FY19 Q3 earnings call, co-CEOs Marc Benioff and Keith Block are dead-set on aggressively extending Salesforce’s lead in CRM in the coming year.

That mission is anchored by Salesforce’s belief that digital transformation begins and ends with the customer—and that since Salesforce is the leading provider of customer-focused applications, it is perfectly positioned to lead the way into the nascent global digital economy.

Salesforce Earnings Call Highlights

“Every company in the world has a mandate to digitally transform its business,” Block said in his opening remarks on that recent Q3 earnings call.

“I’ve traveled around the world meeting with more than 100 CEOs and world leaders, and the conversation is consistent everywhere I go: it’s about digital transformation.”

A few minutes later on the call, co-CEO Benioff tied that global phenomenon to Salesforce’s idealized positioning around the customer.

“When it gets right down to digital transformations, well, every digital transformation starts and ends for all of our customers with their customers,” Benioff said.

“And CRM has never been more strategic and you can see that in the growth rates for the CRM marketplace—it remains the fastest-growing market segment in enterprise software” because “it’s all about the customer.” Benioff then made a number of compelling claims about his company, its current position, and its future potential:

“And CRM has never been more strategic and you can see that in the growth rates for the CRM marketplace—it remains the fastest-growing market segment in enterprise software” because “it’s all about the customer.” Benioff then made a number of compelling claims about his company, its current position, and its future potential:

- “We’re obviously the largest player already and we have these incredible growth rates that we’re putting up.”

- “We continue to take share and outpace the market, and you can see that in our results as we’re moving to $16 billion [the company’s target in its guidance for FY2020, ending Jan. 31, 2020].”

- “This is because we’re the only company that is dedicated 100% to CRM at this size and scale.”

- And then came Benioff’s big pitch for what is likely to be the company’s top priority for calendar 2019: “We’re the only company with a complete Customer Success Platform for both B2B companies as well as B2C companies.”

A Continued Focus on Customers

That Customer Success Platform is Salesforce’s mast plan to strategically fuse its SaaS and PaaS capabilites into a truly 360-degree set of customer-management and customer-experience solutions, Benioff said.

“This is how we’re helping out customers connect all of our clouds [Marketing, Sales, Commerce, Service, etc.] together, giving our customers a single 360-degree view of their customers across every touch-point,” Benioff said.

Salesforce president Bret Taylor, one of the company’s top product leaders, added this perspective.

“With Customer 360, you have a single view of your customer through all of those touchpoints so that our strategic advantage relative to our competitors—and they’re all trying to catch up with us by acquiring the second-place product in each of these spaces—is that unlike them, we’re a fully integrated solution,” Taylor said.

“At a strategic level, our customers are looking for fully integrated solutions to their business problems—they’re not just looking for pieces of technology.”

On the partner front, Block said Salesforce is investing significant resources into the continued expansion of a wide range of partnerships that deliver new skills and capabilities to customers around the world looking to move rapidly and capably into the realm of digital business.

“Partners are so critical to our growth and so we’re continuing to expand our ecosystem, which in turn extends the power of our core offerings,” Block said. “In this quarter, our SI partners were engaged in 64% of our new business globally and continue to invest in their Salesforce practices.”

Benioff also hit on the power of Salesforce’s extended partnership efforts: “We’re strengthening our relationships with amazing companies in the cloud world including Apple and Amazon and Google and IBM, and our customers are just loving the incredible amount of innovation that’s happening in our industry, especially as the cloud becomes mainstream.”

Mainstream indeed.

Game on.

Disclosure: At the time of this writing, SAP and Oracle are clients of Evans Strategic Consulting LLC.

*******************

RECOMMENDED READING FROM CLOUD WARS:

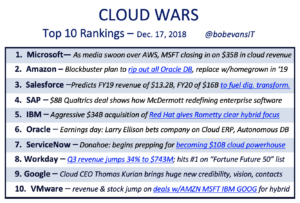

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************