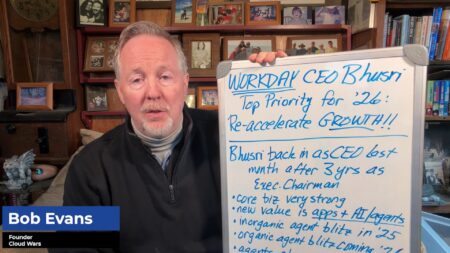

Coming off a strong Q4, Workday CEO Carl Eschenbach believes the DOGE impact on federal-government tech spending represents a “tremendous opportunity” as agencies realize they can no longer put off the inevitable and much-needed move from on-premises systems to the cloud.

If that scenario plays out the way Eschenbach expects, Workday could be a big winner via its expertise in equipping large organizations with cloud applications for both financials and HCM, along with a growing portfolio of AI-powered agents and other solutions.

Before sharing Eschenbach’s thinking on the DOGE impact on federal agencies, I want to point out some highlights from Workday’s Q4 and full-year results:

Q4 ended Jan. 31:

Subscription revenue up 15.9% to $2.04 billion, marking the company’s first $2-billion quarter for subscriptions;

Total revenue up 15.0% to $2.21 billion;

Current RPO up 15% to $7.63 billion

AI Agent & Copilot Summit is an AI-first event to define opportunities, impact, and outcomes with Microsoft Copilot and agents. Building on its 2025 success, the 2026 event takes place March 17-19 in San Diego. Get more details.

Full fiscal year 2025:

Subscription revenue up 16.9% to $7.72 billion;

Total revenue up 16.4% to $8.45 billion;

Of total revenue: U.S. up 16% to $6.33 billion, international up 17% to $2.11 billion

Total RPO up 20% to $25.1 billion

FY26 Guidance: subscription revenue up 14% to $8.8 billion. “We continue to expect a slightly faster pace of year-over-year subscription revenue growth in the second half of FY ’26 relative to the first half.” — CFO Zane Rowe

DOGE and Workday’s ‘Tremendous Opportunity‘

During the Q&A portion of Workday’s Q4 earnings call, Eschenbach was asked how the DOGE cost-control measures for federal agencies would affect Workday’s public-sector business.

“Over the past 18 months, we’ve started to lean into the federal business and opportunity more aggressively than we’ve historically done,” Eschenbach said in reply.

“And the reason for that is if you look at the federal government, while they spend a tremendous amount of money on technology, the systems they have, specifically ERP, HCM, or financial systems, are very antiquated. In fact, the majority of them are still on-premise, which means they’re inefficient.

“And as we think about DOGE and what that could potentially do going forward, if you want to drive efficiency in the government, you have to upgrade your systems,” he said.

“And we find that as a really rich opportunity — in the last year, we’ve laid the groundwork with a couple of significant wins at the Department of Energy and the Defense Intelligence Agency to allow us to springboard our momentum in the federal market moving forward.

“So, yes, there’s some uncertainty, but there’s still tremendous opportunity,” Eschenbach said.

“And if you want to drive efficiencies across the government, there is a starting point called on-premises solutions and getting them to the cloud. As we speak to the customers, all of them are looking to leverage Workday and what we have in our best-of-breed platform and applications to better service them more efficiently.”

One trend supporting Eschenbach’s view is that in Q4, 30% of Workday’s net-new wins included both Financials and HCM. “And if you look at our focus industries of SLED [State, Local, and Education] and healthcare, that number climbs to 50%.”

Workday now has 6,100 customers using its core Financials and/or core HCM, he said, with 2,000 of those using both.

Ask Cloud Wars AI Agent about this analysis