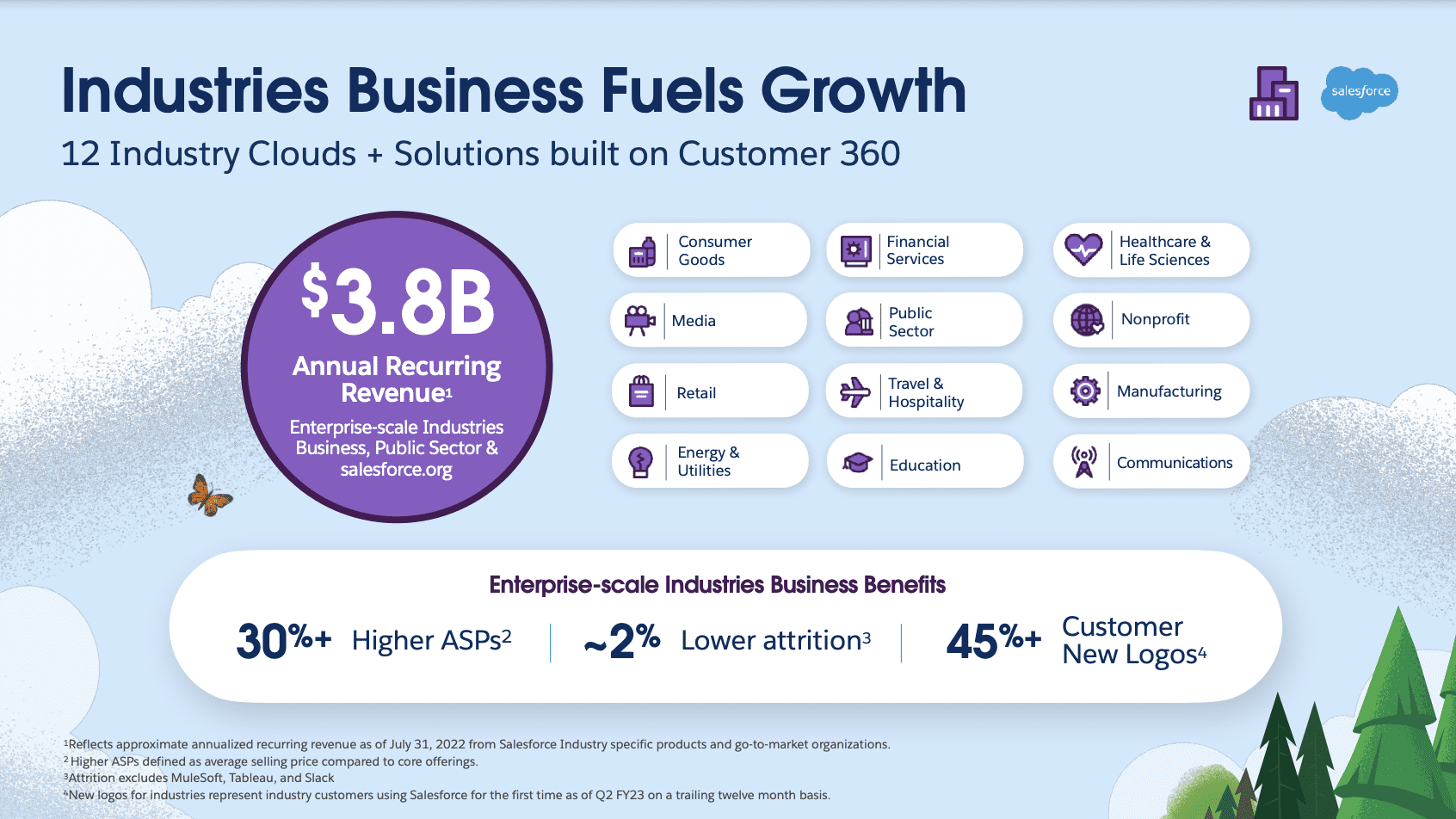

In its quest to reach $50 billion in annual revenue, Salesforce has designated industry clouds as one of the company’s three primary growth drivers because industry customers are willing to try out Salesforce for the first time, pay higher prices, and remain more loyal to Salesforce.

After reporting industries revenue of $2 billion two years ago, Salesforce is no doubt sweet on the category because since then, that business has grown much faster than Salesforce’s core business: about 40% a year ago and 33% this year to $3.8 billion.

At Dreamforce last week, Salesforce President and CFO Amy Weaver used part of her session during the Investors Day forum to share some insights into why Salesforce chose Industries as one of its three strategic growth pillars along with Customer 360 and geographic expansion.

Here are the key details and then I’ll share Weaver’s brief comments in her own words.

- Industries revenue of $3.8 billion for the 12 months ended July 31, 2022

- 30% higher average selling price for Industries solutions over “core” solutions

- 45% of Industries customers are brand-new to Salesforce

- Industries customers are stickier than “core” customers, with an attrition rate 2% lower than that for core customers

- 33% revenue growth rate for Industries for the 12 months ended July 31 versus about 24% for the company overall

In her Investors Day session, Weaver spoke of a “New Day” for Salesforce as it moves into new markets and drives toward $50 billion, and it is clear that she views industry clouds as a key component of that growth engine.

“When you look at our 12 Industry Solutions, plus public sector and Salesforce.org, which caters to nonprofits and higher education, it’s driving $3.8 billion of revenue, up from just $2.9 billion when I was talking to you last year,” Weaver told the audience of financial analysts, investors, and Salesforce’s board of directors.

“Industries have really never been more important. And when we talk about industries projects, what these are is really out-of-the-box solutions tailored to particular industries. [Co-CEO Bret Taylor] loves to say this helps these customers start on third base: easy to install, shorter installment time, and quicker time to value,” Weaver said

“But there’s something for us as well. And the reason I love this: our industry sales generate 30% higher ASPs [average selling price compared to Salesforce’s “core” clouds], 2% lower attrition when compared to core, and 45% of the customers are new logos to Salesforce, beautifully balancing out our opportunities in our installed base while continuing to bring in a steady flow of new customers to Salesforce.”

So, clearly, the #1 company on our Industry Cloud Top 10 list is fully committed to retaining that lofty spot by continuing to make Industries a highly differentiated element of the Salesforce portfolio.

But, as is always the case in the Cloud Wars, hot markets draw ferocious competition — and Oracle, following its acquisition of Cerner, is breathing down the neck of Salesforce in industry-cloud revenue.

We’ll keep a close eye on that intriguing front in the Cloud Wars, where the ultimate victor is always the customer.