After 23 years of being the world’s leading purveyor of CRM—the acronym that flat-out declares that sellers manage the relationships with customers—Salesforce has just made a huge investment in a young company built on the premise that it is the buyers, rather than the sellers, who are in charge.

As the headline on the press release says, Vivun Raises $75M Series C to Transform B2B Selling as We Know it. And Vivun’s “buyer experience” value proposition flies right in the teeth of the definition of CRM—customer relationship management—that Salesforce has dominated for the past decade.

From the press release:

“Buyer Experience is a new category of enterprise software that has emerged in response to the way B2B buyers enter into sales cycles. Buyers have become sales-proof. They no longer buy from salespeople themselves, trusting the relationship and the person to deliver the desired outcome. Instead, they demand value at every step, total transparency, and the ability to run the sales process their way. Many of them are digital natives, and are used to getting everything they need via self-directed research and free trials. When they do engage with vendors, they want targeted conversations with product experts.”

CRM Meets the Anti-CRM

Now, I’m no Paul Greenberg, but that sure-as-heckles doesn’t sound like CRM to me! Look at the Vivun strategic insight: “Buyers have become sales-proof” and they “demand” to have “the ability to run the sales process their way.”

So, why is the world’s leading provider of solutions to help businesses manage and control the relationships they have with their customers making a big investment in a fast-growing three-year-old company pushing an idea that’s totally out of phase with the CRM model?

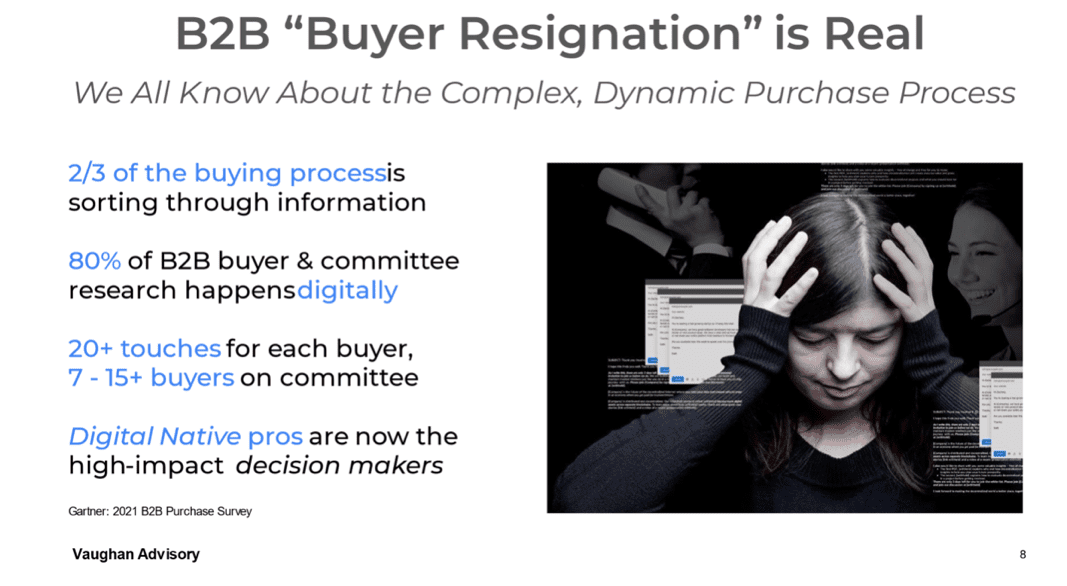

To gain some perspective on this puzzling situation, I reached out to my longtime friend and fellow Acceleration Economy analyst Scott Vaughan, a three-time CMO who now advises CMOs and CEOs on marketing strategy. Scott shared a couple of slides that he’s used recently to help B2B businesses reimagine and then rebuild their sales and marketing programs to align with the very different reality that pervades today’s market.

A Very Different Attitude Toward Traditional Sales Process

As you’ll see in the first slide below, Scott has corralled some rather jarring findings that show just how out of phase sellers are with buyers’ expectations and mindsets. And Scott issued an unmistakable warning call to many B2B companies by saying, “The market is waking up to this but many revenue and CXO leaders are not.”

So just how bad is it out there?

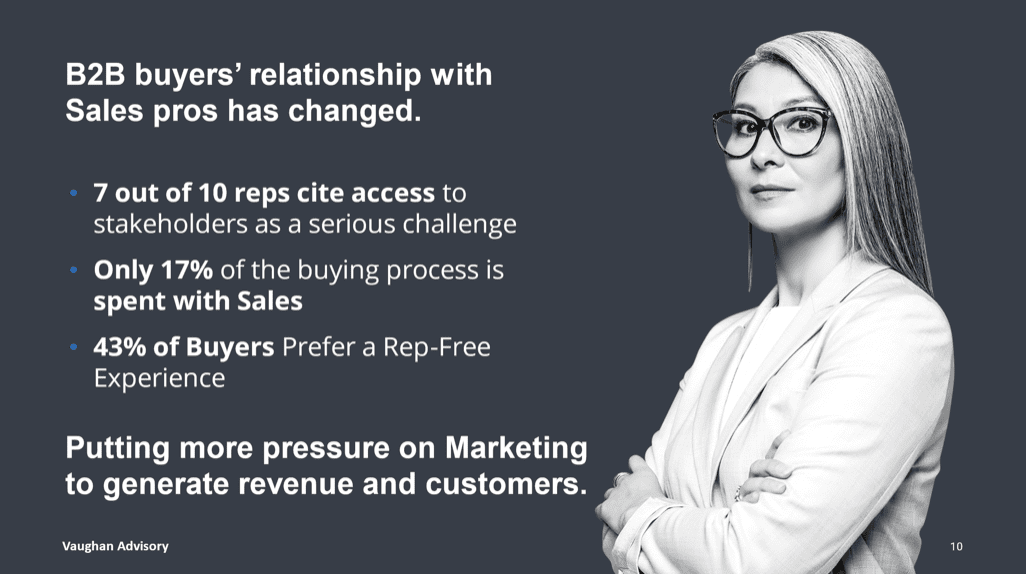

And in this second slide, Scott points out some new buyer imperatives, including a couple of findings that made my head spin: “43% of buyers prefer a rep-free experience,” and “only 17% of the buying process is spent with Sales”!

Now, in no way am I trying to “blame” Salesforce (or anyone else) for this profoundly different reality from what existed just a few years ago. But, what I am saying is that this stunning trend toward environments that are increasingly rep-free and even sales-free does not mesh so well with a company that has achieved iconic status by enabling sales organizations to use a variety of applications to manage customer relationships.

Plus, the investment was made by Salesforce Ventures, the company’s VC that bears responsibility for identifying and investing in high-potential startups. So for Salesforce, Vivun is, above all, part of a diversified investment strategy aimed at staying close to disruptive innovations in the broad marketplace Salesforce serves.

At the same time, it is certainly possible that at some point Marc Benioff and Bret Taylor might look at Vivun and determine that it just might be high time to bring on board a new organization with a value proposition radically different than the one Salesforce has championed for 23 years.

Final Thoughts

Benioff and Taylor have made it very clear that they’re totally unafraid of making significant changes in the company, and I have no doubt that they and other Salesforce execs could create a compelling position for how the Vivun story fits in perfectly with the Customer 360 strategy and portfolio—new tools for new times.

And at least for now, that’s all speculation for some time in the future as Vivun has landed a big chunk of investment funding from Salesforce Ventures. Other firms that contributed to the $75 million Series C round include storied VC firms Menlo Ventures and Accel.

But if I had to bet on what’s going to happen with Vivun two years from now, I would put my chips on Benioff and Taylor acquiring this “buyer experience” category creator.

Because that’s an appealingly disruptive new category, and Salesforce needs to keep displaying its disruptive self—and if the new business reality indicates that it’s time to bust out beyond CRM, then I’m betting Benioff and Taylor will do just that.

Want to gain more insights from Cloud Wars Expo?

Starting on July 20th, more than 40 hours of on-demand cloud education content will be available for free to Acceleration Economy Subscribers.