Koen Cuypers of SignUp Software shares how AI can optimize business processes and ERP functions, and details the company’s roadmap for 2026.

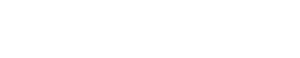

Legacy tactics are fading as companies like Google Cloud and Palantir redefine what cloud leadership means in 2026.

AI agents can eliminate mundane, repetitive tasks—like documentation and customer data lookup—freeing professionals to focus on higher-value, growth-oriented work.

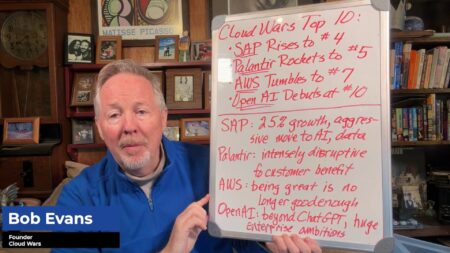

After four years of Microsoft dominance, the Cloud Wars rankings now feature Google Cloud at the top, showcasing a new leader in cloud innovation and enterprise transformation.

GPT-5.2 is now live in Microsoft Foundry, empowering developers with smarter, more reliable AI agents and scalable outputs.

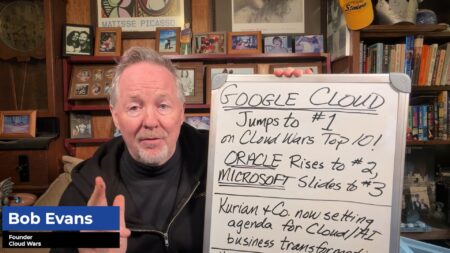

AI is no longer just a buzzword, it’s a new economic paradigm. With AI reshaping retail, automotive, and energy, leaders must choose between innovation or obsolescence.

Columbus VP, Michael Simms, joins the AI Agent & Copilot Podcast to share what went into selecting the sessions for the 2026 event, and what’s required to successfully adopt AI.

The speakers and sessions for the 2026 AI Agent & Copilot Summit have been announced by event producers, Dynamic Communities and Cloud Wars.

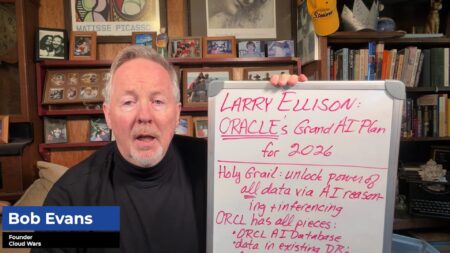

Oracle is merging its legacy databases, apps, and infrastructure into an all-inclusive AI stack to dominate the fast-growing AI economy, according to Larry Ellison’s recent earnings call.

St. Jude Children’s Hospital leader explains how AI tools enhance donor engagement, while authentic relationships remain at the core of fundraising.

IBM and Pearson have partnered to build AI-powered personalized learning tools using watsonx Orchestrate and watsonx Governance to serve businesses, governments, and educators.

Microsoft adds new insight into the user interface for Agent 365 and how it integrates previously dispersed functions in a unified format so stakeholders can monitor and act on their AI estates.

Grant Dess reflects on last year’s AI Agent & Copilot Summit and shares what attendees can look forward to at the 2026 event.

ServiceNow is reportedly in talks to acquire cybersecurity firm Armis for up to $7B. This move could significantly enhance its AI-driven security and cyber exposure management capabilities, giving customers a powerful edge in digital protection.

Insight Works’ Mark Hamblin shares how AI and agents are impacting the companies processes and products, and gives thoughts on the advancement of AI advancement in recent months and how this impacts adoption.

Microsoft’s Frontier Firm strategy shows how large-scale Copilot adoption is reshaping enterprise operations and accelerating customer AI adoption.

A cheerful end-of-year Cloud Wars Minute filled with gratitude, humor, and holiday spirit.

BNY Mellon partners with Google Cloud to bring AI capabilities to all employees, aiming to deliver faster, richer insights.

AJ Ansari joins John Siefert to examine how leaders can cut through AI hype, choose the right problems to solve, and bring home measurable value from the AI Agent & Copilot Summit.

Google Cloud’s deal with NATO marks a significant move into the defense sector, long dominated by AWS and Microsoft.