Unless you’ve been living under a rock, you know that technology markets are booming. This year, the global tech market is expected to reach $5 trillion, with the North American technology market projected to hit $1.6 trillion. Businesses aren’t slowing down their investments anytime soon, either, as forecasts show the business technology market will continue to grow at double-digit rates. What is changing, however, are the drivers of why technology is being adopted, how technology decisions are made, and who is involved in the decision process. And these customer-driven changes are leaving many technology providers flat-footed in how best to respond.

For the last 30 years, the main drivers of technology adoption have been efficiency and basic productivity. We made individual business functions more efficient with technology and increased personal productivity through new technology tools. The reality is while the increases in efficiency and productivity have been significant in industries where automation has an outsized impact, most of the gains have been incremental. While worthwhile, for the most part, the benefits have had little to no effect on every business’ ultimate goal: revenue growth and scale.

Over the last several years as hybrid, multi-, and industry cloud technologies, platforms and solutions have been introduced, businesses have started to shift their view of technology from efficiency to growth. Today’s technology decision-maker is living in a digital-first world, looking to harness the power of technology to dazzle customers, differentiate products and services, create new business models, and grow revenues. These growth drivers are not motivated by small, incremental efficiency gains. This simple, yet profound shift from efficiency to growth has also changed how the technology buying process works today.

Why? How? Who?

In the previous era, technology decisions started and ended with “What,” as in what are we going to buy? Technology information, analysis, and value propositions were all focused on what technology to buy. Today, technology decision-making has changed, reflecting a much more business-driven viewpoint that involves three key stages:

- Why? Why can this technology serve as a growth driver for our business?

- How? How do we adopt, integrate, and operationalize technology into our business processes to fuel ongoing growth and scale?

- Who? Who should make up our short list of vendors, providers, and integrators?

The New Technology Buyer

Given the role that technology now plays in business growth and scale, new buyers are getting involved in decision-making. Business leaders, who own P&L’s, realize that the key to growth and competitive leadership is how they harness the power of technology. These buyers are working closely with information technology (IT) with a primary focus on why and how technology can be used to unlock growth and scale.

This is a demographic as well as a mindset shift, and it’s reflected in the rapidly changing purchasing demographics. In 2021, 59% of technology investments were driven by the need to replace end-of-life technology, while 41% were driven by growth initiatives. This is a huge shift towards growth as the key driver in tech investments and one that is growing rapidly. The rise of the industry cloud and industry platform models is also a reflection of this shift and will only accelerate as buyers look to partner with technology providers to drive growth and co-create value for their businesses and industries.

Selling in a Digital-First World

The market transitions described here should be fantastic news for technology vendors and the related ecosystem, right? Well, they certainly will be, even if we will need to work through some significant cultural and organizational shifts on the vendor side before they fully realize the benefits. Here at Acceleration Economy, we’ve been analyzing the changing nature of sales in a digital-first world. Buyers today are more than 70% of the way through their purchase process before they engage with a sales rep. This means that technology vendors need to be visible, helpful, and top of mind as buyers work through the Why, How, and Who of their purchase process.

They also need to understand When and How to have sales reps engage with buyers. Whether we want to admit it or not, we have shifted from a sales and marketing world to a marketing and sales world. In this new model, sales still play a critical role, but it’s one of providing customer-centric intelligence and industry and market knowledge that supports a growth-driven purchase process. Not trying to create a purchase process. Simply put, the buyer of technology is in the driver’s seat today, and vendors who aren’t putting customers at the center of their go-to-market strategies will ultimately fail.

Good News, Bad News

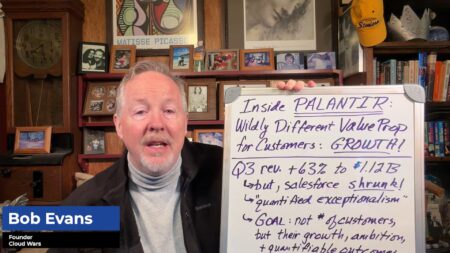

The good news is that as Acceleration Economy and Cloud Wars founder and chief content officer Bob Evans regularly notes, “Cloud technologies represent the greatest growth market the world has ever known.” We’re witnessing unprecedented growth rates, scale, and valuation levels for technology vendors. The bad news is history teaches us that market transitions can quickly and irrevocably change the fortunes of companies that fail to understand and adapt to them.

This market transition is tricky for technology providers in more ways than one. Most technology executives are used to dealing with technology transitions, where new technology is introduced by a competitor, and they need to respond. This transition is being driven by customers and as such it requires a deeper understanding and set of responses that many technology companies aren’t yet prepared to deal with. The key, as always, is to stay myopically focused on solving customer needs. And today that starts and ends with helping drive growth.

Want more tech insights for the top execs? Visit the Leadership channel: