Even post-pandemic, chief procurement officers (CPOs) are still dealing with shortages, long lead times, and inflation. At the same time, businesses are mandating cost reductions (or at minimum, cost containment). Suppliers are having similar challenges. So, if you can’t ask suppliers to reduce the price for incoming goods and services, what can you do?

Transforming business processes is the next frontier of savings opportunities for CPOs. Process mining is a great enabler to provide insights needed to transform processes. It can identify opportunities faster, more accurately, and more comprehensively than tools used in the past. I’ll go into more detail on how process mining works below, but first its important to understand the difference between process mapping and process mining.

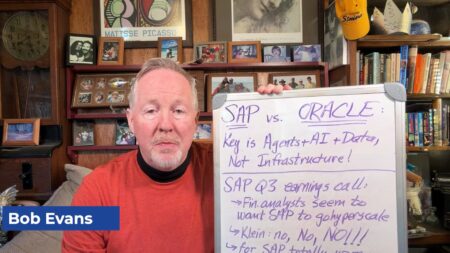

See how process mining pioneer Celonis made the Cloud Wars Horizon list by accessing the Acceleration Economy Cloud Wars Top 10 Course. Cloud Wars Founder Bob Evans and Acceleration Economy Editor-in-Chief Tom Smith outline the criteria and innovations that earned Celonis a spot on the horizon of the biggest cloud platform companies on the planet.

How Process Mapping Works

Until recently, when there was a perceived need to improve a process, a business would usually go through a process mapping event. That’s a very people-driven exercise where someone is responsible for documenting a process from start to finish. They talk to the individuals involved in the process, identify the technology used, and create a visual workflow of how something gets done.

Then this map can be analyzed for breaks in the chain, redundant steps, bottlenecks, or other problems. Because it relies on input from humans, it’s the best representation of what people believe to be true. But it will never be completely accurate because it’s based on people’s interpretations of how things work. It’s qualitative, not quantitative.

What Is Process Mining?

Process mining is the digital sibling of process mapping. Where process mapping is all about perceptions, process mining is all about data. In process mining, software containing data-mining algorithms is applied to the event logs of IT systems used by a company. The algorithm creates a workflow model based on the trends it sees in the event log’s data.

By harvesting data, process mining can create a more accurate map of what’s happening because it is quantitative, not qualitative. Whereas process mapping paints a picture of what the organization believes to be true, process mining reveals what is actually happening.

How Process Mining Helps Procurement

Research by Celonis, a process mining software provider and member of Acceleration Economy’s Top 10 AI/Hyperautomation Short List, identifies some great process mining use cases for procurement. These include:

- Identifying rogue spending by using process mining to identify spending outside of the approved processes and tag any requisitioners using unapproved suppliers.

- Understanding true delivery times by identifying any consistent deviations between planned and actual deliveries from suppliers.

- Improving cash management by identifying actual time to pay suppliers and making adjustments if the actual time is too low (reduces working capital) or too high (may trigger late payment fees).

- Identifying the extent that the organization is using free-text requisitions requiring manual intervention.

One of my favorite use cases is identifying process automation opportunities based on repetitive tasks where the same kind of input or query is done over and over. Invoice entry is a task that comes to mind; process mining can dig deeper and identify similar opportunities that may not be evident.

Final Thoughts

Process mining isn’t for every business. It relies on data-mining algorithms, which need data to function. The more manual the business, the less reliable process mining results are. But for large or complex organizations, process mining is an opportunity to see what is truly happening and identify opportunities to transform processes.