Of all the buzzwords I’ve covered, Web3 is by far the most obscure. The analogy going from Web1 to Web3, from a bottom-up, user-generated internet to a corporate-controlled collection of platforms, sounds good as an elevator pitch but crumbles under even an ounce of critical thinking. Why did we move from Web1 to Web2? What are the major advantages of centralized platforms that will sustain their dominance? How could a nascent technology like blockchain uproot the powerful network effects of Web2 constituents? And what would a blockchain-based internet even look like, from social media to online shopping to search engines?

So, instead of telling a story with just words, I’d like to dive into the numbers. This will help us understand where we stand today. It will give insight into the trends that have been unfolding in the past few years, as well as allow us to extrapolate from those trends.

My hope is that this article will give the idea of “Web3” a little backbone, something you can work with to make better decisions and contextualize other opinions you hear. Of course, the world of Web3 is about more than just technology: It’s about politics, leadership, economics, media, and our daily lives. Although it doesn’t seem like a divisive topic, there are tensions and motives behind parties unknown to the general public — knowing a few numbers is a useful addition to your toolbelt to make sure you aren’t fooled.

Cryptocurrency: The First Pillar of the Web3 Revolution

Web3 is really a three-pronged revolution. First, it’s a new asset class and currency. Second, it’s a new kind of decentralized database. Third, it’s a new set of decentralized platforms with built-in composability that gives rise to an application layer very different from the one we see with the current web.

First — the currency. The total market cap of all cryptocurrencies currently hovers around $1 trillion, of which just under 40% is Bitcoin and 20% is Ethereum. You can spin this statistic in two ways. On one hand, a $1 trillion market cap is larger than the annual GDP of all countries in the world except the richest 19. On the other hand, it’s also only about 40% of the market cap of a single American company, Apple Inc., and only a fraction of the total value in the traditional finance world.

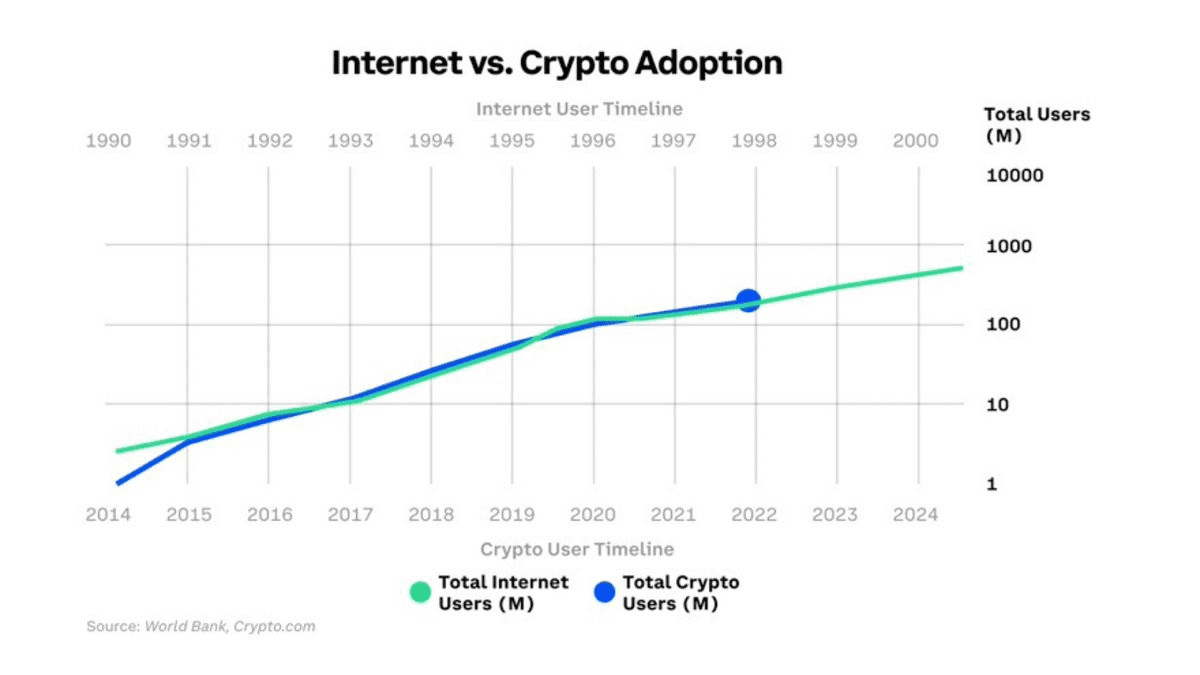

What about users? A Crypto.com report pointed out that the crypto population (those owning or using cryptocurrencies, one of the cornerstones of Web3) increased by 178% in 2021, with more than 300 million by the start of 2022. India is the country with the most cryptocurrency users, an interesting statistic that reveals the financial inclusivity of Web3 that traditional finance could never reach.

At such a growth rate, we can expect to have one billion users by the end of 2022. This means there are more people using crypto than almost every type of traditional fiat currency, with exception of the currencies of the world’s largest economies. Even if the monetary volume isn’t there, crypto is more inclusive for consumers than any fiat currency.

A Forbes article mentions that mass-market applications, like the Internet and mobile computing, typically get major traction once the underlying technology stack reaches one billion users. In the case of the internet, this stack consists of protocols like transmission control protocol/internet protocol (TCP/IP), hypertext transfer protocol secure (HTTPS), browser-compatible devices, and more. In Web3, this stack is the underlying Ethereum blockchain, and its adoption can be measured by the number of addresses on it. Currently, there are 180 million such addresses; so, at current growth rates, it will take another five years to reach one billion users.

The internet reached one billion years in 2006-2007, about 14 years since the start of the consumer web — if we reach one billion users by 2026, it’ll be 15 years since the start of Bitcoin and only 11 since Ethereum’s founding.

VC Funding and Web3

That line of thinking has fuelled the largest burst in VC (venture capitalist) funding since the early days of the Internet, with more than $30 billion deployed in crypto startups in 2021 alone. This burst in 2021 has created over 40 additional crypto unicorns, putting the total past the 65 mark. Andreessen Horowitz recently announced another Web3 fund of $4.5 billion, the largest of its kind, even amidst a market crash of cryptocurrencies.

Thinkers like Stephen Diehl argue that Web3 is just a marketing term used by VCs to euphemize their continued investment into crypto and continue boosting further investment in the space to keep their portfolios strong. Indeed, the term was popularized by VCs without much consideration for how economics and blockchain technology actually works. While there’s nothing wrong with being enthusiastic about new technology, VCs and others tend to spin Web3 as a political movement as well, painting utopian images of the users conquering the mega-corporations currently enslaving us. Guess who allowed those corporations to rise and currently sits on their boards? The same VCs behind Web3.

“Web3 is a deeply polarizing topic for technologists because it’s designed to be that way. It’s a rhetorical trick to set up a false dichotomy between the legacy internet world of popup ads and Zuckerbergs — which legitimately does suck — and a fantasy world built on technologically incoherent pipe dreams and phony crypto-populism,” writes Diehl.

The Expanding Ecosystem of Decentralized Technologies

Blockchain won’t solve the world’s problems — at least not alone. But that doesn’t mean it can’t provide value. The influx of capital, combined with the migration of developers to the field and the possibilities afforded by having a new technology primitive, will lead to an explosion of innovation that will likely resemble the early internet days. What’s really happening here, aside from buzzwords and catchy headlines, is an expanding ecosystem of use cases for technology with unique strengths.

One of these use cases is decentralized finance (DeFi). This field has grown at unprecedented speeds, jumping from $700 million in locked-up value in late 2019 to more than $200 billion in early 2022. Another use case is to recognize ownership of digital assets in the form of nonfungible tokens (NFTs), which themselves can be used in a variety of ways beyond digital art. My favorite application, however, is DeSci which involves using NFTs and DAOs to streamline the process of turning research into real-world value.

The bottom line is this: Web3 is just a term. It’s an attempt to spin blockchain and crypto as a political movement, falsely claiming that, this time around, a tech revolution won’t spawn an oligopoly of mega-corporations and new billionaires pulling the strings. Of course, it will. It already has. But regardless of your view on the term and the political ideas behind it, the underlying trends it was originally ascribed to remain true.

Want to compete in the Metaverse? Subscribe to the My Metaverse Minute Channel: