In mid-September, I attended the Digital Asset Summit (DAS) in New York City, organized by blockchain media company Blockworks. In short, the two-day event was a confluence of New York’s top finance players and blockchain technology. It was inspiring to see such influential figures and big-name corporations all discussing a topic that was niche only a few years ago. What was once in the realm of developer forums and oddball enthusiasts is now being taken seriously by a lot of serious people.

The DeFi Revolution

The enthusiasm at the conference revolved around the realization that blockchain totally changes how finance can be done. Before, industry innovations were limited to the application layer, marginally increasing settlement speeds and other incremental improvements. Blockchain, being a new kind of database and scripting mechanism, targets the back and middle office as well.

This realization is the core of DeFi (decentralized finance). DeFi is a revolution targeting the bottom of the financial stack, at the infrastructural level, and the rest of the stack is being rebuilt because of it. DeFi, a sub-movement of Web3, has seen explosive growth in recent years, with the total value locked in DeFi applications jumping from $700 million in late 2019 to more than $200 billion in early 2022. A few years ago, DeFi was not on the minds of traditional finance, or TradFi. Now, we have events like the DAS, where the rooms were overfilled with folks trying to understand it. When you see esteemed financial executives sitting on the floor to listen to a panel, you know something’s up.

Interestingly, the conversations at the event were more about scaling trajectories and the hurdles of adoption. A few years ago, it was about whether blockchain would even be around in the future or if it was just a fad. It was a debate about whether or not the train would leave the station —now, it’s about which tracks to take and who is boarding at what stop.

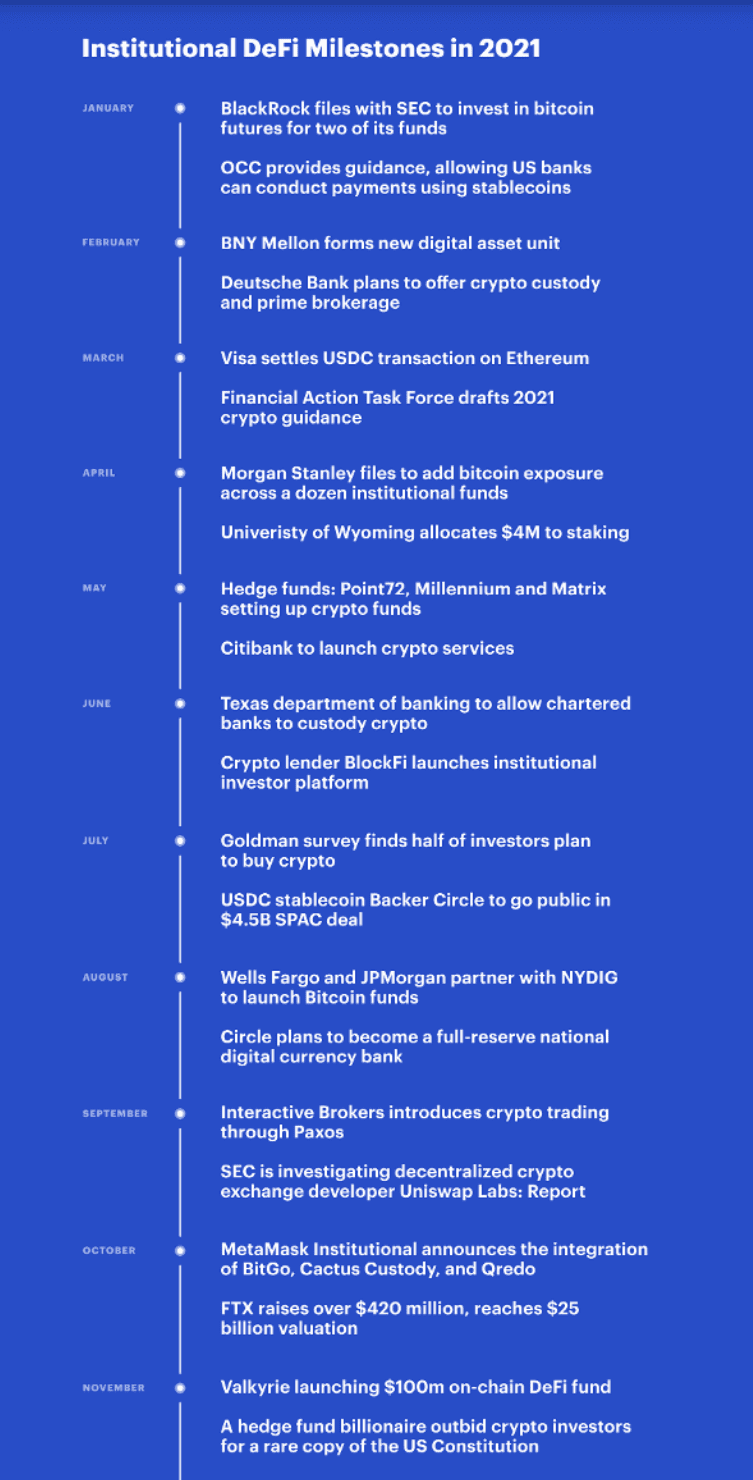

Institutional Adoption and Regulation

One of Web3’s main drivers is institutional adoption. Without organizations coming on board, blockchain will never be able to benefit the end customer effectively. This applies to firms in all industries, but in the DeFi context, this means funds, banks, regulators, asset managers, fintechs, and others must start considering Web3 technologies — native Web3 teams can only do so much. It took Coinbase six years to reach 60 million users. If Chase began offering crypto services on its app, it would reach that number in a matter of months, effectively pouring jet fuel on the fire that is Web3’s growth rate.

Of course, all is easier said than done. Not only do firms need to provide value to their customers, whether that’s banks ensuring swift transactions or funds providing returns to their investors, but they also need to comply with a mountain of regulations created to ensure security, stability, and fairness. Many businesses at the event were created to fulfill that exact purpose, from legal teams ensuring legal compliance to data scientists monitoring transaction flows to spot money laundering.

One point almost everyone seemed to agree on was the need for proper regulation to drive innovation in this space, but there is already almost a century of a precedent set in finance and plenty of regulators that organizations need to tiptoe around — the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA); Commodity Futures Trading Commission (CFTC); Financial Stability Board (FSB); and the Internal Revenue Service (IRS), etc. Some of that needs to be redefined, and it’s important that officials are educated on blockchain as much as businesspeople are.

Smaller Versus Larger Organizations

On the bright side, compliance is easier for smaller organizations. One DAS panelist mentioned that agile teams complaining about “regulatory uncertainty” just had their hand caught in the cookie jar. Regulation is a double-sided coin: When there’s a rug pull, everyone wants to be bailed out, but when markets are booming the room gets oddly silent.

Unlike startups and individual early adopters, large organizations also face a host of other considerations before jumping into Web3 (or “apeing in” as they say on Twitter or Discord). Funds need to protect the downside before maximizing potential upside — compliance with regulation is vital for staying in business; education for the whole team is necessary; and there are also environmental, social, and governance (ESG) goals to keep in mind.

As blockchain matures, it’ll be easier to jump these hurdles. For example, the Ethereum merge, the first phase of which took place during the conference, transitions the blockchain onto a proof-of-stake consensus mechanism that doesn’t require as much electricity as traditional proof-of-work miners were consuming.

Entering DeFi

So, what were some of the actions that financial teams were taking to enter DeFi? Besides the low-hanging fruit, such as direct investment in crypto assets like Bitcoin or Ether, many people at the event were discussing staking, yield farming, offering NFTs, using NFTs as collateral for loans, participating in industry-specific DAOs, developing custom layer 2s and smart contracts on top of other chains like Ethereum, and replacing fiat currencies with stablecoins in payment rails.

There are real advantages to using blockchain. “TradFi institutions spend about $20 billion in trade processing annually, according to an estimate by the Bank of England. TradFi can save up to 80 percent of post-trade settlement expenses by leveraging distributed-ledger technology (DLT),” according to a report by MetaMask Institutional, which offers an institution-compliant version of the MetaMask DeFi wallet and had a booth at the event.

While there are too many advantages to explain in detail, DeFi generally decreases the cost of creating and distributing assets, as the internet did with media. This is because the backend of blockchain is controlled by streamlined code rather than by people filing documents. Stay tuned for Part 2 of my DAS coverage, and make sure to check out my video coverage from the event by clicking below.

Related:

Why Tokenization Was a Big Hit at the Digital Asset Summit (cloudwars.com)

Why the Digital Asset Summit Emphasized Scaling and Regulatory Clarity

Want to compete in the Metaverse? Subscribe to the My Metaverse Minute Channel: