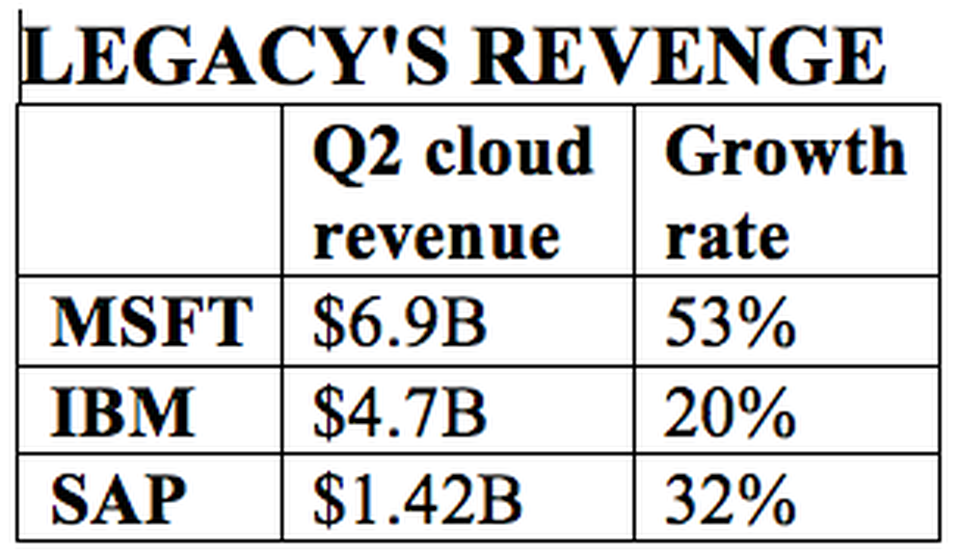

Three of the world’s iconic tech vendors continue their striking transformations to end-to-end cloud powerhouses as enterprise bluebloods Microsoft, IBM and SAP posted a combined $13 billion in calendar-Q2 cloud revenue, led by Microsoft’s breathtaking commercial-cloud growth rate of 53% to $6.9 billion.

As shown in the the table above, all three vendors this week reported impressive growth rates for their cloud businesses and each continued to emphasize their advantage of incumbency over cloud-native vendors: by being able to span the worlds of cloud and on-premises, Microsoft and IBMand SAP feel they can meet the wide-ranging needs of business customers whose journeys to the cloud will require a blend of on-premises and cloud environments for at least the next decade.

As shown in the the table above, all three vendors this week reported impressive growth rates for their cloud businesses and each continued to emphasize their advantage of incumbency over cloud-native vendors: by being able to span the worlds of cloud and on-premises, Microsoft and IBMand SAP feel they can meet the wide-ranging needs of business customers whose journeys to the cloud will require a blend of on-premises and cloud environments for at least the next decade.

This continued high-scale cloud growth from massive tech companies with deeply rooted products, services, relationships and experiences within the corporate world will provide increasingly stiff challenges to cloud-native companies that have performed brilliantly to date but have little or no expertise in dealing with the pervasive on-premises IT environments that will be around for many years to come.

And the ongoing contentions between the cloud natives and the “cloud immigrants” will no doubt continue to provide some of the most-compelling chapters in the Cloud Wars over the next few years.

For Microsoft, with total quarterly revenue of $30.1 billion, its $6.9 billion in commercial-cloud revenue now makes up 23% of that total. And CEO Satya Nadella said the company has every intention of driving both numbers much higher. (For Microsoft, the just-ended quarter is its fiscal Q4.) I recently predicted that Microsoft would reach $7.0 billion in commercial-cloud revenue in its FY Q4, and the impressive numbers Microsoft reported triggered a surge in the company’s stock price the following morning.

In his prepared remarks during Microsoft’s earnings call with analysts, Nadella said, “I shared our vision for the intelligent cloud and intelligent edge a little over a year ago, a vision that is now quickly becoming reality and impacting every customer in every industry. Everything we have accomplished this year has been about accelerating our lead in this new era and the tremendous opportunity ahead.”

In particular, Nadella pointed to the recent overhaul of the enterprise sales organization to add more technological expertise and deeper industry expertise, while also reshaping the engineering teams to drive more customer-centric innovation.

One number that jumped out at me was the 89% year-over-year revenue growth rate for Azure. And while it is true that that number is down very slightly from the last few quarters, which were in the 90s, the ability to grow 89% on what is becoming a very large base shows that customers across all industries are buying into Nadella’s vision.

While part of that vision is a bit of a stretch—specifically, Nadella’s catchy but over-the-top claim that Azure is becoming “the world’s computer”—there’s no doubt that some of the world’s largest companies are moving some of their largest and most-complex workloads to Azure, a point that Nadella underscored on the call.

Over at IBM, the company says it has become “the go-to destination” for big businesses whose cloud journey includes shifting big, complex and highly strategic workloads—databases and applications—to the cloud.

In his prepared remarks to open IBM’s Q2 earnings call this week, CFO and senior vice president Jim Kavanaugh said, “The IBM Cloud enables clients to migrate, modernize and build new cloud apps, is AI ready, and secure to the core. This quarter we completed the migration of Westpac’s core banking applications to the IBM Cloud; it’s just one example of how we’re becoming the go-to destination for mission-critical workloads on the cloud.”

For Q2, IBM’s $4.7 billion in cloud revenue includes $2.75 billion in “as a Service” offerings; the remaining $2 billion comes from helping large business convert their legacy on-premises systems into private-cloud environments, a specialized capability I haven’t seen any other major cloud vendor talk about.

At SAP, CEO Bill McDermott told investors that Q2 cloud revenue as measured in constant currency “soared 40%,” and made a special point of laying out the company’s plans for challenging Salesforce in the huge market for CRM.

It’s a compelling argument for the overall rise of the cloud industry: enabling businesses to move away from rigid and fragmented systems and applications to a seamless architecture that allows them to manage, analyze and fully leverage all of their data—an accomplishment that was simply impossible in the on-premises world.

“CEOs understand that serving their customers must be the unifying business priority,” McDermott said in his prepared remarks on the earnings call.

“They know this can’t be done when the sales department doesn’t work with the finance department, or when the marketing department doesn’t share data with their supply chain, or when the human resources team doesn’t know how to engage the fast-growing contract workforce.

“Unfortunately we have seen too many business revert to the silo practices of failed enterprises—so it is no coincidence that many were actually disrupted by innovative competitors,” McDermott continued. Those disrupters built the entire company as a single integrated machine to serve that customer from demand chain to supply chain.”

With that imperative in mind, McDermott said, “Every asset in our portfolio has been carefully assembled to deliver the intelligent enterprise.”

From all three companies, powerful numbers and compelling customer stories—and all of that adds further evidence to my belief that for each of those “legacy” companies, the best years are still to come.

*******************

RECOMMENDED READING FROM CLOUD WARS:

The World’s Top 5 Cloud-Computing Suppliers: #1 Microsoft, #2 Amazon, #3 Salesforce, #4 SAP, #5 IBM

Amazon Versus Oracle: The Battle for Cloud Database Leadership

As Amazon Battles with Retailers, Microsoft Leads Them into the Cloud

Why Microsoft Is #1 in the Cloud: 10 Key Insights

SAP’s Stunning Transformation: Qualtrics Already “Crown Jewel of Company”

Watch Out, Microsoft and Amazon: Google Cloud CEO Thomas Kurian Plans To Be #1

The Coming Hybrid Wave: Where Do Microsoft, IBM and Amazon Stand? (Part 1 of 2)

Oracle, SAP and Workday Driving Red-Hot Cloud ERP Growth Into 2019

*********************

Subscribe to the Cloud Wars Newsletter for twice-monthly in-depth analysis of the major cloud vendors from the perspective of business customers. It’s free, it’s exclusive, and it’s great!