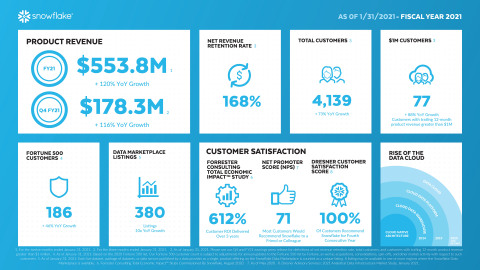

Despite having annual revenue of well under $600 million, high-growth superstar Snowflake has forced its way into the Cloud Wars Top 10 by seizing the data-cloud position that all the major cloud players missed and are now eager to claim.

Snowflake replaces #10 Adobe on my weekly Cloud Wars Top 10 rankings. While Adobe’s Digital Experience enterprise business generates more revenue in a quarter than Snowflake has in its past 12 months, Adobe has failed to become a disruptive or force in the CRM/DX space whereas Snowflake has turned its market upside-down.

For its fiscal Q4 ended Jan. 31, Snowflake’s product revenue jumped 117% to $178.3 million, and it finished the quarter with RPO (remaining performance obligations) of $1.3 billion.

Clearly, Snowflake’s quarterly revenue is tiny relative to every other player on the Cloud Wars Top 10. Snowflake aside, the smallest quarterly revenue figures are #8 Workday at $1.01 billion and #7 ServiceNow at $1.2 billion.

But the company’s disruptive impact, surging growth rates and strategic leapfrogging of far larger and more deeply entrenched competitors give Snowflake full credibility for inclusion among the world’s most-influential cloud providers.

I’ll share a couple high-vision comments from CEO Frank Slootman in a moment, but I’d first like to point out a couple of superb references for anyone looking to understand the cloud database market that Snowflake has rocked:

- The Cloud Database Report by my colleague John Foley is a world-class overview of this fast-changing and highly strategic battleground in the Cloud Wars.

- John’s analysis of Snowflake’s latest earnings breaks down four major steps the company is taking on its road to $1 billion and beyond.

- And of course, I’d be terribly remiss if I didn’t mention that one of my excellent monthly guests on the Cloud Wars Live podcast, Sean Ammirati, predicted late last year that Snowflake would force its way into the Cloud Wars Top 10 this year. Sean, as always, you’re ahead of your time!

Now that Snowflake’s a part of the Cloud Wars Top 10, I’ll be adding my own ongoing analyses of the company on a regular basis, and I plan to offer the first of those overviews in the next week or two.

For now, though, anyone attempting to understand more fully the extraordinary impact this company is having should take a close look at these comments made by Slootman on Snowflake’s March 3 earnings call:

- “Our growth is driven by long-term secular trends in data science and analytics, and enabled by cloud scale computing and Snowflake’s cloud-native software architecture.”

- “With the onslaught of digital transformation, data operations become the beating heart of the modern enterprise.”

- “The Snowflake Data Cloud enables breakthrough data strategies.”

- “Capacity limitations are a thing of the past.”

- “There are virtually no constraints anymore on the number of workloads that can execute at the same time against the same data.”

- “The performance of individual workloads has increased by orders of magnitude.”

- “The Snowflake Data Cloud also breaks new ground in terms of data access, which is increasingly critical for data science, artificial intelligence, and machine-learning workloads.”

One of the key criteria for being on the Cloud Wars Top 10 is ambition: dreaming big dreams, seeing what others don’t see and turning those visions into reality.

And as you can tell, what Snowflake (at least for now) might lack in relative revenue volume, it more than makes up for in bold and customer-centric ambition.

So welcome, Snowflake, to the Cloud Wars Top 10!

RECOMMENDED READING

Google Cloud CEO Thomas Kurian: “Where the Cloud Needs to Go”

Are You Funding #1 Competitor: Amazon? | Ammirati on Innovation

10 Reasons Salesforce Expects to Rule Booming Industry-Cloud Market

Amazon Shocker: CEO Jassy Says Cloud Less than 5% of All IT Spending

10 Questions for Amazon Web Services CEO Adam Selipsky

SAP, Oracle, and Workday Reviewed by Customers: Who’s #1?

Fastest-Growing Major Cloud Vendors: Google #1, Oracle #2, Microsoft and ServiceNow #3

Workday Co-CEO: Liberating CFOs from ERP Limitations

Has Salesforce Beaten Microsoft, Oracle & SAP to #1 in Industry Clouds?

New from Cloud Wars: Subscribe to the Industry Cloud Newsletter, a free biweekly news and commentary update on the booming demand from business leaders for industry-specific cloud applications.