Deliverable from partners will enable task automation and personalized support as well as deliver data-driven insights that leverage Salesforce’s Einstein AI.

Workday

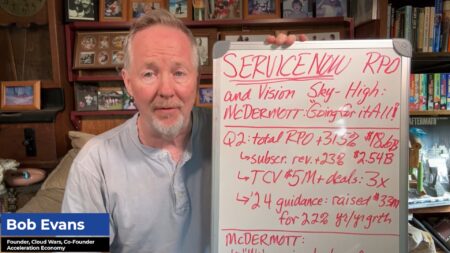

ServiceNow’s impressive Q2 results are a reflection of CEO Bill McDermott’s ambitious vision for industry-wide transformation through AI and digitization platforms.

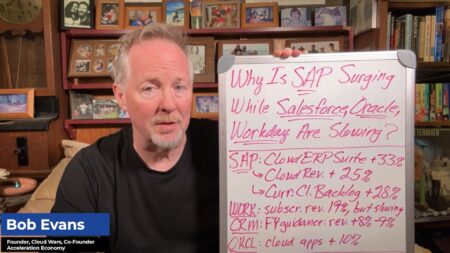

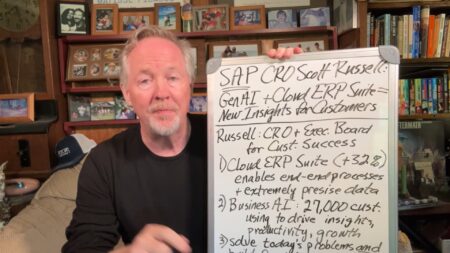

SAP reports strong Q2 growth driven by high demand for Business AI solutions and cloud migrations, significantly outperforming competitors

SAP’s strong Q2 performance stands out as it maintains robust growth while competitors face a slowdown in demand.

A look into Workday’s expanding partner ecosystem and AI Marketplace that showcases the importance of understanding partner roles, evaluating options carefully, and balancing the trade-offs between rapid and thorough software implementations for successful outcomes.

There have been changes in the Cloud Wars Cloud & AI Confidence Index; where the major cloud companies stand and what’s driving them to new heights.

The Cloud and AI Confidence Index shows a 12.5% increase, with notable gains for Microsoft, Google, Oracle, and Amazon, while others face declines.

Partners ecosystem leader shares Workday’s latest thinking on co-creation vs. co-selling, working with hyperscalers, AI trust and how partners help customers drive results.

Insights cover the evolving landscape of cloud-native applications and their transformative potential in driving digital transformation agendas.

Highlights from an in-depth interview with Workday partners leader Matthew Brandt, who emphasized customer outcomes and trusted AI solutions.

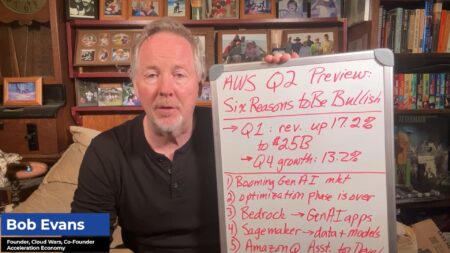

AWS is expected to achieve or exceed a 17.2% growth rate in Q2, driven by robust demand for GenAI and its other AI services including Bedrock and SageMaker.

AWS anticipates steady Q2 revenue growth driven by AI advancements and increased customer spending, according to Amazon CEO Andy Jassy.

Google Cloud partners and ISVs exec Stephen Orban discusses the ecosystem’s evolution in the AI era, how the company’s Partner Advantage increases deal sizes, and how AI is impacting cybersecurity.

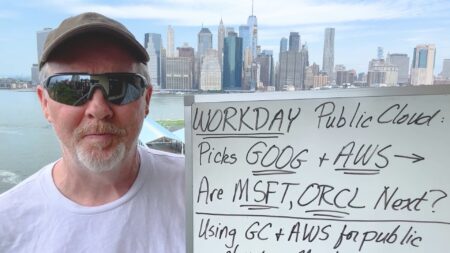

Workday explores new avenues for cloud partnerships, emphasizing innovation and customer-centric solutions in the enterprise sector.

Examining the potential — and potential benefits — of Workday striking public cloud deals with Microsoft and Oracle, despite intense rivalries in SaaS applications.

In a market facing delayed purchases, SAP’s Cloud ERP Suite excelled with 31% growth in Q1, the highest among major enterprise-apps vendors.

Although Workday saw impressive subscription and revenue growth, heightened customer caution prompted a reduction in its FY25 revenue guidance.

Workday’s quarterly report reveals varied results, prompting discussions on market dynamics, customer behavior, and revenue flow.

SAP’s innovative integration of Cloud ERP Suite and Business AI aims to enhance customer value and facilitate their transition to digital business powered by AI.

Q1 saw growth rate acceleration among the Cloud Wars Top 10 companies, with Google Cloud leading the charge followed by Oracle and ServiceNow each growing at 25%.