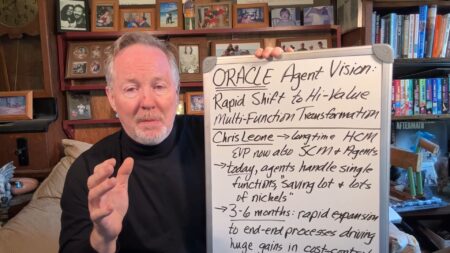

Oracle EVP Chris Leone shares how tightly integrated AI agents and enterprise applications are transforming HR, supply chain, and operational workflows into autonomous, highly productive systems

Oracle

A bold move toward AI-driven, end-to-end business processes is underway at Oracle.

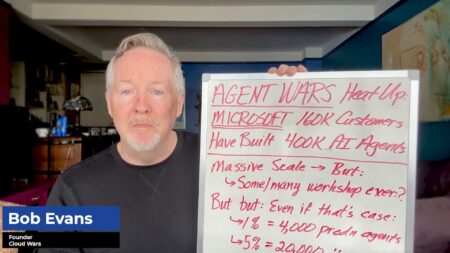

Microsoft is leading the rapid rise of AI agents, driving a cultural and business shift as companies increasingly build their own digital agents.

AI agents are reshaping enterprise software, but success hinges on thoughtful adoption—aligning technology with business needs, readiness, and strategic goals, not just chasing hype.

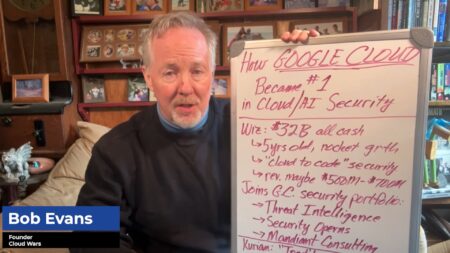

Google Cloud’s $32B acquisition of Wiz signals a bold move to lead in AI and multicloud cybersecurity by offering next-gen, preventive security solutions that outpace traditional approaches.

Google Cloud’s acquisition of Wiz positions it as the new leader in cloud and AI security, outpacing Microsoft despite the latter’s higher revenue.

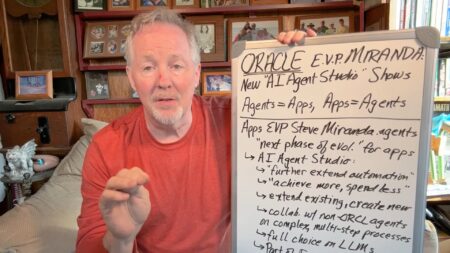

Oracle’s new AI Agent Studio empowers businesses to build, customize, and orchestrate AI agents for advanced enterprise automation.

Oracle’s AI Agent Studio is reshaping the fusion of apps and AI agents for business growth.

Oracle’s new AI tools improve fraud detection by identifying complex patterns and generating investigative reports.

Oracle aims to surpass competitors by offering more cloud regions globally, enhancing flexibility and AI capabilities for customers.

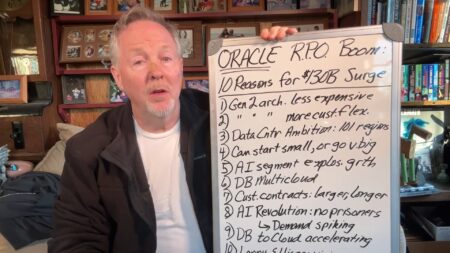

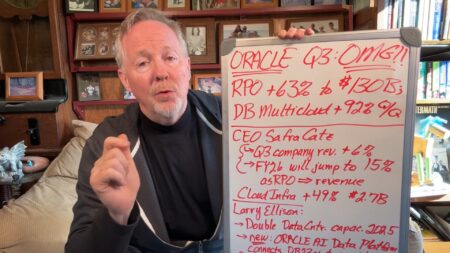

Oracle has achieved significant growth in its cloud infrastructure business, with a 63% increase in its Remaining Performance Obligation (RPO) to $130 billion.

Oracle is rapidly scaling its cloud and AI business, marked by a 63% RPO surge and major investments in data center capacity and AI solutions.

Oracle’s Q3 results showed a 63% surge in remaining performance obligations (RPO) to $130 billion, driven by strong cloud infrastructure growth and major contract signings.

Salesforce is transforming business growth through AI agents, data-driven innovation, and industry-specific solutions, as discussed by David Schmaier at TDX 25.

Bonnie Tinder discusses how AI-driven enterprise software is transforming businesses by enhancing automation, decision-making, and customer insights.

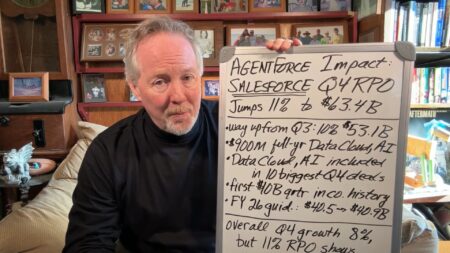

Salesforce’s Q4 results highlight significant growth in its AI-driven products, with strong future potential as indicated by an 11% increase in Remaining Performance Obligation (RPO), driven by its Data Cloud and Agentforce solutions.

IBM’s Sustainability Accelerator partners with global organizations to develop AI-driven solutions to increase environmental and urban resilience.

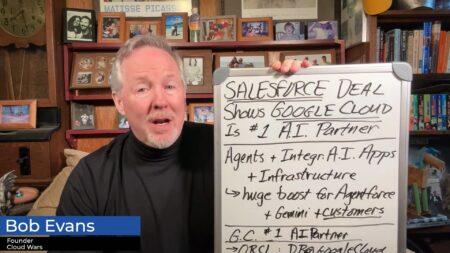

Google Cloud and Salesforce have expanded their partnership to deliver AI-driven offerings, reflecting a strategic trend among top cloud vendors to accelerate business transformation through collaboration.

Salesforce and Google Cloud have expanded their partnership to include integrated AI applications and infrastructure, significantly enhancing their offerings for customers.

ServiceNow is transforming enterprise operations by leveraging its integrated platform and AI-driven solutions to enhance workflow efficiency and deliver customer-centric innovations.