AWS tumbles to #7 as SAP climbs and Palantir rockets up the Cloud Wars rankings, reflecting shifting dynamics in the enterprise AI race.

Oracle

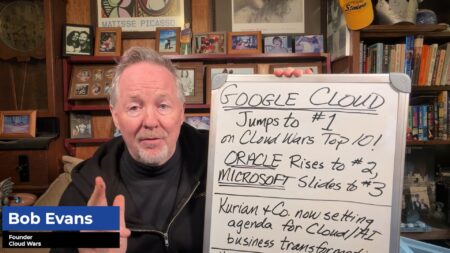

Google Cloud is now the top-ranked cloud and AI provider, surpassing Microsoft and Oracle, thanks to bold leadership from CEO Thomas Kurian and a relentless focus on customer success in the AI economy.

Major shifts at the top of cloud rankings reflect customer focus, ecosystem strength, and future readiness rather than raw financial performance.

After four years of Microsoft dominance, the Cloud Wars rankings now feature Google Cloud at the top, showcasing a new leader in cloud innovation and enterprise transformation.

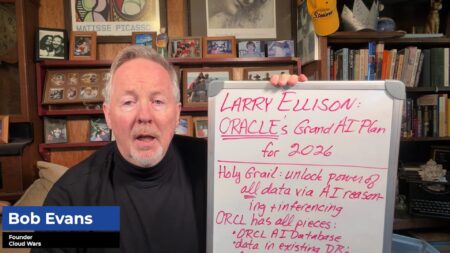

Oracle aims to outpace competitors with a platform that makes enterprise data accessible to top AI models like ChatGPT and Gemini.

Oracle is merging its legacy databases, apps, and infrastructure into an all-inclusive AI stack to dominate the fast-growing AI economy, according to Larry Ellison’s recent earnings call.

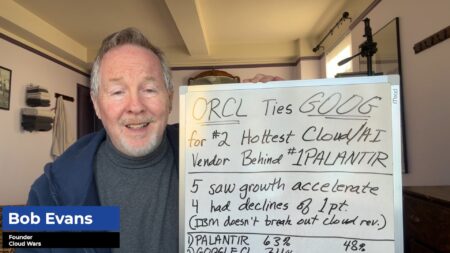

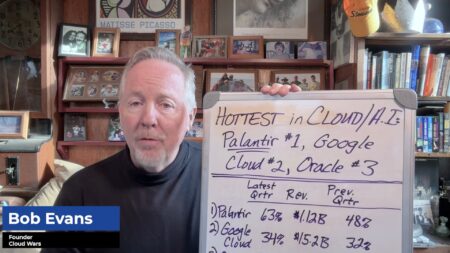

Palantir, Oracle, and Google Cloud dominate the Cloud Wars Growth Chart amid the AI Economy boom.

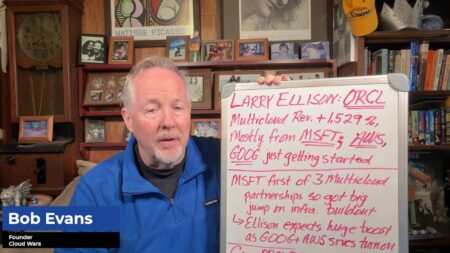

Oracle and Google Cloud surge into a tie for #2 among the fastest-growing cloud vendors, as Cloud Wars earnings reveal sustained momentum, accelerating growth, and strong AI-driven demand across the market.

Oracle’s Q2 FY2026 shows explosive cloud and AI growth, with RPO rising 433% to $523.3B, signaling unprecedented future demand.

AWS is investing $50 billion to expand AI and supercomputing infrastructure for U.S. government agencies, accelerating cloud innovation.

Leaders unpack why later-generation cloud platforms, bare-metal architectures, and multi-cloud strategies can cut costs by up to 70% and fuel enterprise AI adoption.

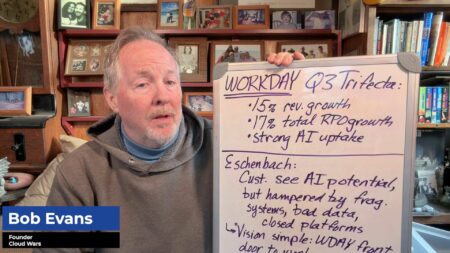

Strategic federal wins and healthcare momentum underscore Workday’s strong Q3, with AI adoption driving customer expansions and renewed 10-year commitments.

CEO Carl Eschenbach says Workday is becoming the “new front door to work” by addressing fragmented systems with AI.

Palantir’s AI-fueled cloud surge in Q3 sets a new precedent, forcing the industry to rethink what hypergrowth looks like at scale.

Palantir surges to the top of the Cloud Wars Growth Chart with 63% growth.

Oracle’s AI Data Platform empowers organizations to drive AI transformation by unifying and leveraging their business data, enabling industry-specific intelligence and automation across Oracle’s extensive application ecosystem.

Mahesh Thiagarajan, Executive Vice President of Oracle Cloud Infrastructure (OCI), discusses Oracle’s vision for fulfilling customer expectations and ambitions in the AI Era.

SAP and Snowflake have teamed up to create a unified platform that simplifies access to AI-ready business data for enterprise innovation.

Oracle is using its multicloud partnerships with Microsoft, Google and AWS to reignite its core database business. It aims to reach $20 billion in revenue within five years by riding the AI inference wave and offering flexible multicloud deployment.

The Microsoft‑Oracle database partnership is generating nearly all of Oracle’s multi‑cloud database growth so far, with Larry Ellison believing AWS and Google Cloud will ramp up soon and drive the next wave of revenue.