Many signs points to the likelihood of Microsoft and Oracle extending their flourishing partnership to the use of Oracle’s Cloud for AI inferencing.

Earnings Call

SAP’s Christian Klein and Microsoft’s Satya Nadella are hashing out an expanded data agremeent with wide-ranging implications for customers’ generative AI initiatives.

Q3 results show Microsoft, Google Cloud, and AWS have unique responses to evolving market dynamics, along with insight into the potential disruptor, Oracle.

Is AWS losing its dominance in the cloud market? Discover what its growth rate stabilization — at a rate well below its main competitors — means for its future.

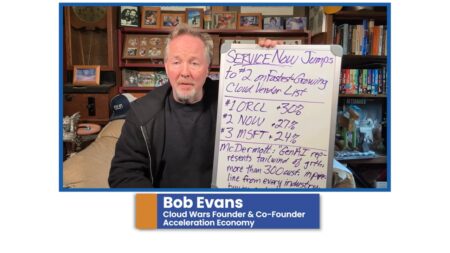

ServiceNow’s Q3 performance showcases its ascent in the Cloud Wars, transforming the future of business technology.

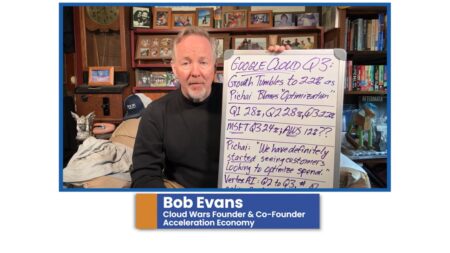

Google Cloud’s Q3 performance – a 22% growth rate – represents a decline from the previous quarters, specifically from 28% in Q2.

SAP is partnering with AWS to enhance its HANA Cloud database, signaling SAP’s increased focus on the cloud-native database market.

SAP and AWS are collaborating to enhance the HANA Cloud database, potentially aiming to challenge Oracle’s dominance in the database market.

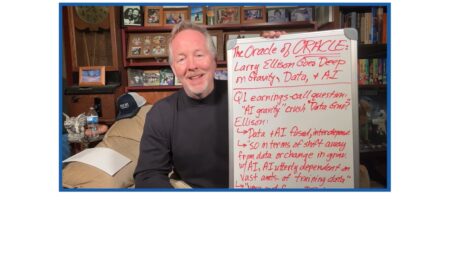

Larry Ellison discussed the interplay between data gravity and artificial intelligence (AI) during Oracle’s fiscal-Q1 earnings call.

Larry Ellison had an interesting response to a question about the relationship between data gravity and AI during an Oracle earnings call.

Oracle’s cloud infrastructure business is poised to outgrow its cloud applications business by the end of 2024. Artificial intelligence (AI) companies are embracing its platform.

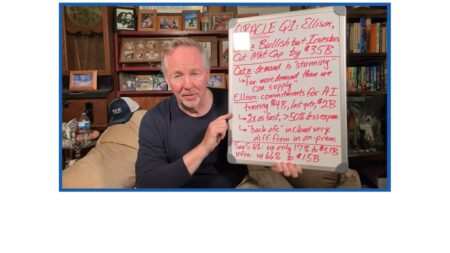

Despite a significant drop in market capitalization, Oracle’s cloud business continues to thrive, with strong customer confidence and robust Q1 cloud revenue growth.

Oracle’s Q1 results show conflicting perspectives, with the company’s leaders optimistic about its future and strong customer demand in its cloud business, while investors are displeased.

Oracle remains fast-growing with an anticipated Q1 cloud revenue growth of at least 29%, even without the boost from its Cerner acquisition.

Oracle is expected to announce strong Q1 earnings results with significant cloud growth, distinguishing itself from other top cloud providers.

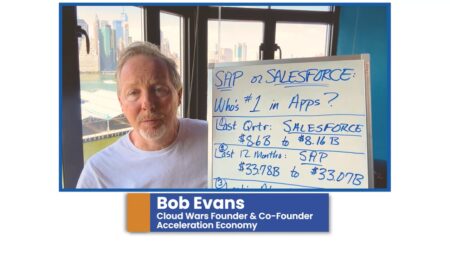

Here’s a look into the intense competition between SAP and Salesforce to become the world’s largest applications vendor, highlighting their quarterly, trailing-12-month, and long-term revenue comparisons and the significance of this competition in the evolving cloud market.

Snowflake CEO Frank Slootman notes that business customers have shifted from extreme cost-cutting measures to a more confident outlook, resulting in improved spending on data technologies and cloud-based services.

Workday’s Q2 results reflect the transformative “Eschenbach Effect.” The co-CEO is boosting growth through AI integration, expanded offerings, and accelerated customer commitments.

Intel’s visionary approach to AI spans devices and power levels, promoting an open ecosystem, offering opportunities for diverse product differentiation and innovation.

Its growth rate has declined over 18 months, but AWS remains a dominant cloud infrastructure force and customers benefit from its scale, focus on innovation, and generative AI strategy.